Infrastructure assets are the backbone of society. They provide services from distributing energy and managing waste, to enabling mobility through roads and airports.

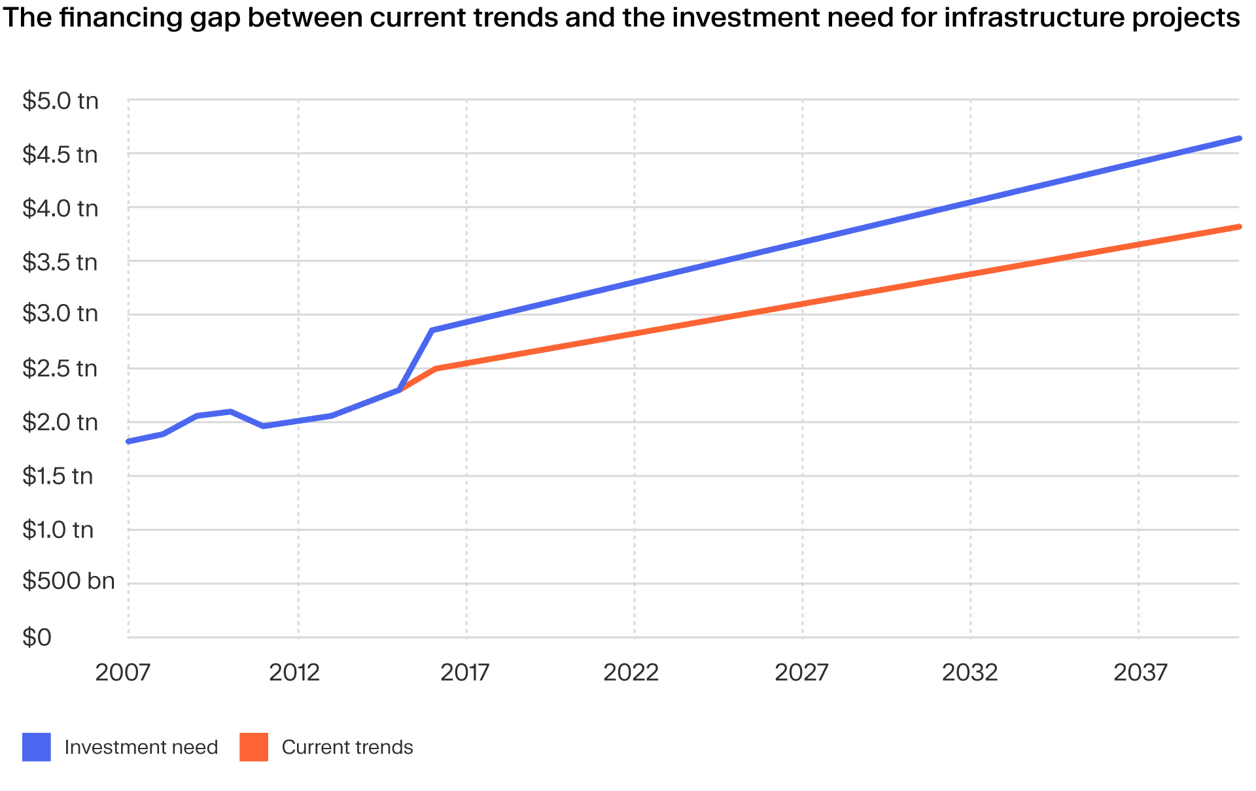

Yet despite their essential nature, the world faces an infrastructure financing gap of $15 trillion by 2040.¹ Public funding that has traditionally supported infrastructure development and operation in developed economies has become constrained. This means private capital needs to step in.

The rapid rise of infrastructure as an investment

Recognising this, governments have developed structures for private finance, such as well established public-private partnerships. This has created a market for investors to become involved in long-term strategic projects at both the development and operational stages.

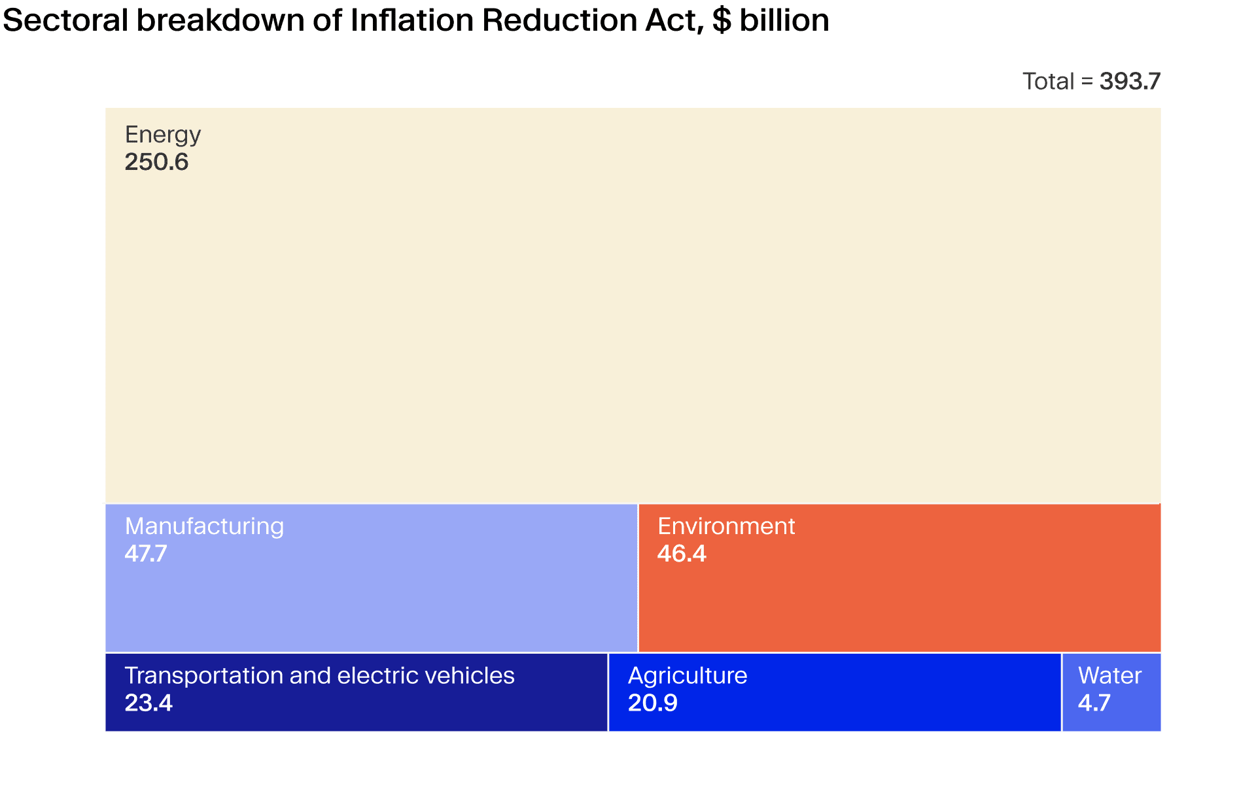

Indeed, plans to upgrade existing infrastructure and build new assets span the globe. In the US, President Biden’s Inflation Reduction Act, CHIPS & Science Act and the Bipartisan Infrastructure Law will bring $2 trillion of federal spending over the next decade, largely in infrastructure.² Meanwhile, the European Union is aiming to mobilise up to €300 million of infrastructure investments by 2027 through its Global Gateway Strategy.

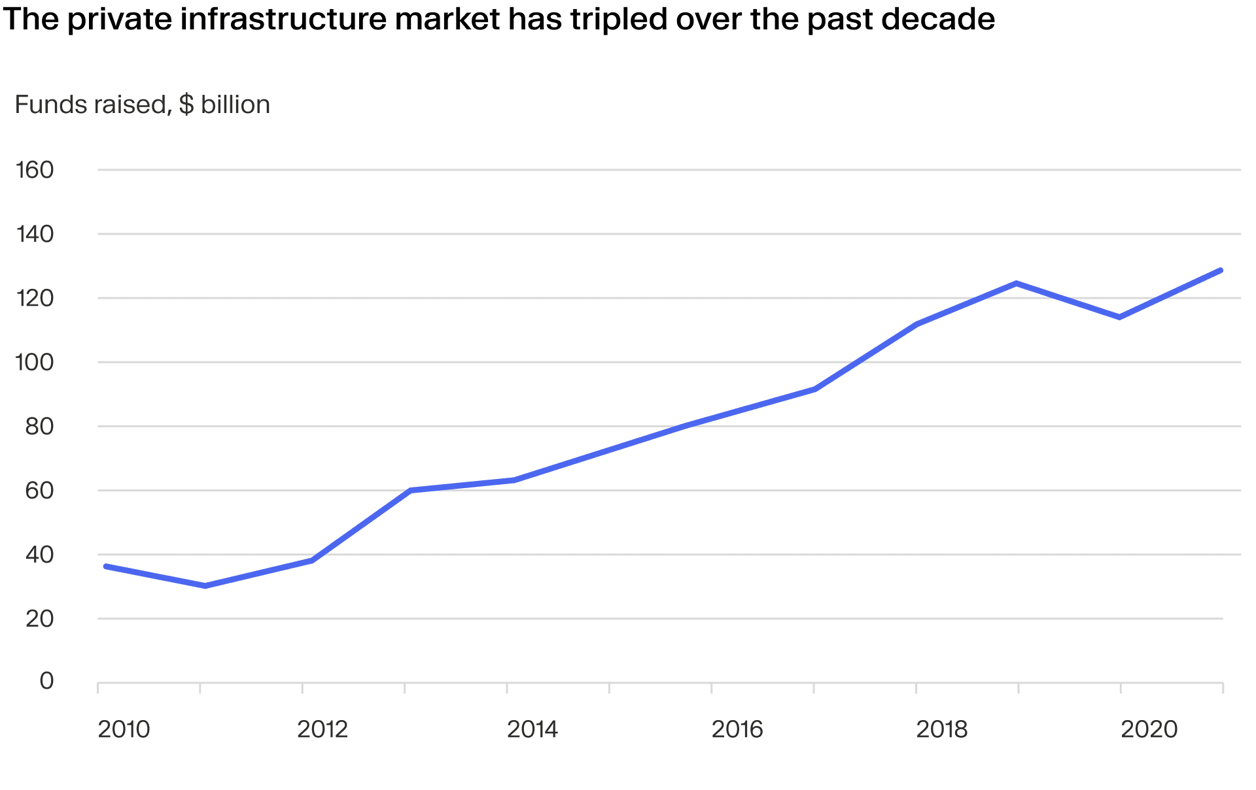

These tailwinds are supporting a marked growth in private infrastructure funds. Despite a challenging economic backdrop in 2022, infrastructure funds had a record-breaking year for fundraising, with $139 billion raised by 67 funds by the end of the third quarter.

Infrastructure is predicted to be the second-fastest growing private capital asset class with an expected compound annual growth rate in assets under management of 13.3% up to 2027.⁴

Why now is the time to invest in infrastructure

Infrastructure is generally a long-term investment that can offer a range of benefits through economic cycles. Indeed, there are several features that are particularly attractive during times of economic turbulence:

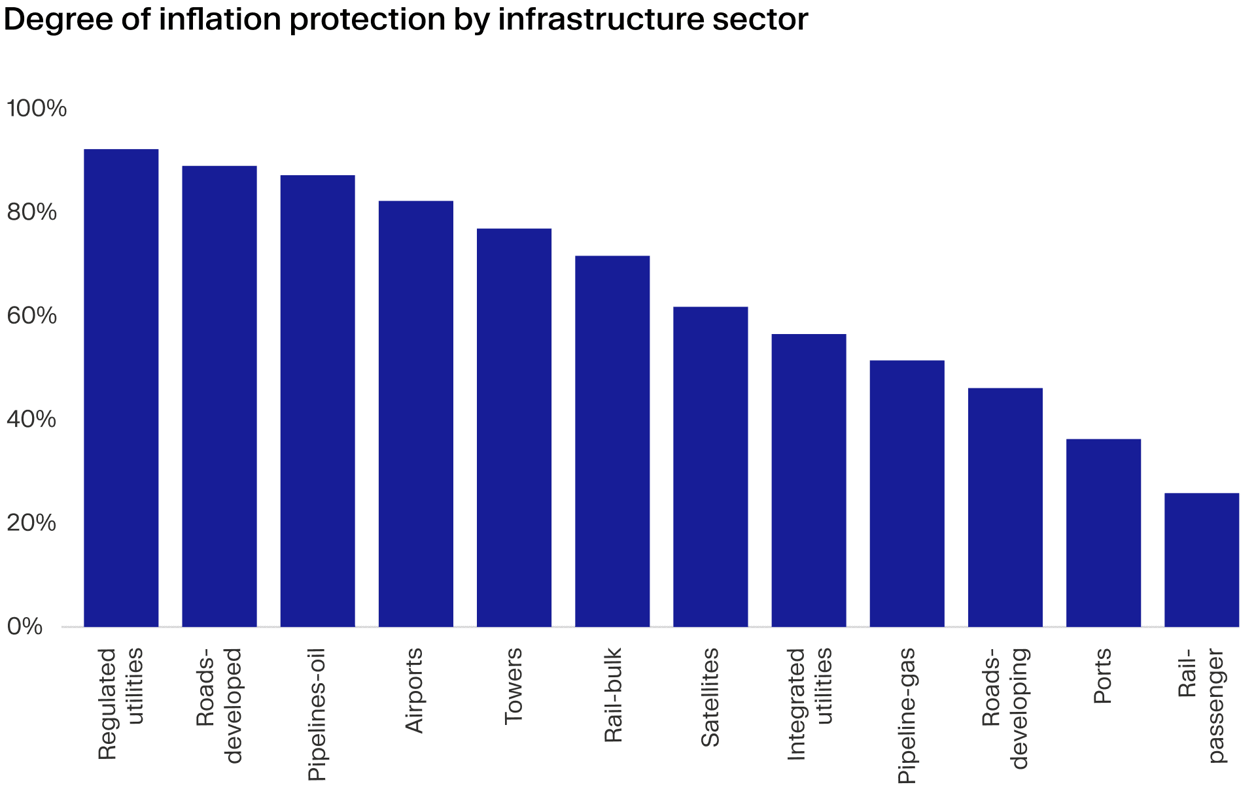

Potential inflation hedge. Various infrastructure assets can help offset rising prices through different methods. Some offer contractual protection with automatic price increases factored in, while others can set pricing because they are monopolies. Common examples include:

- Transport assets, such as toll roads, often have revenue models that are linked to inflation.

- Water and other utilities usually feature regulated pricing that has an explicit link to inflation, although there can be a time lag between inflation and price rises.

- Mobile towers and fibre networks have either annual set price increases or rises linked to inflation.

Residual value and resilience during downturns. Infrastructure investments are made – with few exceptions – in tangible assets which have residual value (meaning the amount you can salvage from selling the land, property or equipment in an adverse event). This is quite unlike those in areas such as cryptocurrency, which have no underlying value, and can offer some comfort to investors in more difficult economic periods.

In addition, many infrastructure assets provide essential services, which means that demand is largely unaffected by downturns. Good examples include waste management and other areas connected with municipalities and local authorities.

Predictable and long-term cash flows. Revenues from infrastructure investments usually come from long-term projects or operational agreements — wind turbines, for example, have a shelf life of around thirty years. This means that future revenue streams are more predictable as costs can be controlled through long term operational contracts and the energy offtake can be agreed upfront for a predetermined price and contract length (known as a Power Purchase Agreement).

Managing potential risks in infrastructure

As with any investment, infrastructure can present some risks, although experienced investors are usually well placed to mitigate them. The three main risks are:

Regulatory risk. This mainly affects regulated assets and there is a possibility that legislative changes can affect partnerships and pricing structures. However, expert teams should have a solid understanding of regulatory frameworks in each market and have active, long-term relationships with regulators, which reduces the risk of surprise policy shifts. Investing in OECD countries with stable regulatory regimes can also minimise this risk.

Construction risk. Some projects can be susceptible to higher-than-expected costs and completion. This is particularly relevant to greenfield (new) projects, which can face higher barriers to entry and greater uncertainty. Yet there are mechanisms to mitigate this, such as through milestone payments that incentivise teams to complete project stages on time and deploying economies of scale to keep costs down.

Merchant risk. This can occur in unregulated assets where revenues are dependent on the sale price being higher than the production cost, such as in energy, meaning that high volatility can have an effect on revenues. However, this can be mitigated to a degree by hedging and employing long-term contracts directly agreed with users known as a Power Purchase Agreement between an energy producer and a corporate is an example of this.

The opportunities ahead in infrastructure

Yet the global need to attract investment to meet society’s current and future needs means that governments continue to create attractive structures allowing investors to take advantage of the opportunities and mitigate potential risks.

Demand for infrastructure investment looks set to grow considerably for the foreseeable future, with three converging trends driving this demand.

Dercabonisation and climate change. The shift to clean and more secure sources of power is creating significant opportunities in the renewable energy, grid networks, storage solutions and mobility sectors, including electric vehicle charging networks.

McKinsey, for example, estimates that annual capital spending to phase out fossil fuel-based power generation by 2050 will require an annual average of $1 trillion for power generation, $820 billion for power grids and $120 billion for energy storage.⁵ In addition, new investment will be necessary to make existing infrastructure assets more resilient to climate change.

Digitisation of everything. Increasing connectivity has been a trend for over a decade now, but it’s accelerating, especially since the pandemic tested remote working and communications. This presents opportunities in areas such as high-speed fibre network roll-outs and data centres that serve homes and businesses.

Yet there are further applications, including the infrastructure required to create smarter cities where sensors can detect optimal waste collection times, manage traffic (including using self-driving cars) and help run public transport networks. Digital technologies will also drive energy efficiency and other environmental goals.

Demographic changes. As life expectancy increases and income levels rise, the demand for social infrastructure, such as educational, health and housing assets, is on the up. In more developed economies in particular, there is a growing need to support and care for elderly people – in the UK, for example, the number of people aged over 85 will double over the next 25 years to 2.6 million, according to The Health Foundation.⁶ This trend offers private operators opportunities to provide facilities for long-term care, community housing and education.

Bottom line

There is a clear opportunity for discerning investors in infrastructure, both now and for decades ahead as demand for essential assets and services outstrips government budgets and as the world shifts to a decarbonised future.

Backed by real assets, stable demand and revenues typically linked to inflation, carefully selected infrastructure investments can generate steady returns through cycles, making this part of the private markets space particularly attractive during more uncertain times, such as we see today.

Endnotes:

¹ https://www.nb.com/en/global/insights/whitepaper-investing-in-infrastructure ² https://www.mckinsey.com/industries/public-and-social-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it ³ https://www.ft.com/content/610faad4-bacc-4a5e-ba9a-fbcb2a8208f4 ⁴ https://www.preqin.com/insights/research/reports/alternatives-in-2023/infrastructure ⁵ https://www.mckinsey.com/capabilities/operations/our-insights/global-infrastructure-initiative/voices/infrastructure-for-a-net-zero-economy-transformation-ahead ⁶ https://www.health.org.uk/publications/our-ageing-population