Key takeaways:

- Although secondary transaction volumes dipped in the first half of 2023, industry experts expect a strong rebound until the end of the year as pricing stabilises further.

- Secondaries offer investors a path to early liquidity and sponsors a mechanism to own high-quality assets beyond typical holding periods—both attractive attributes in volatile times.

- Fundraising for secondaries funds is on track to surpass both 2022 and 2021, a welcoming outlier in an otherwise muted fundraising environment for private markets.

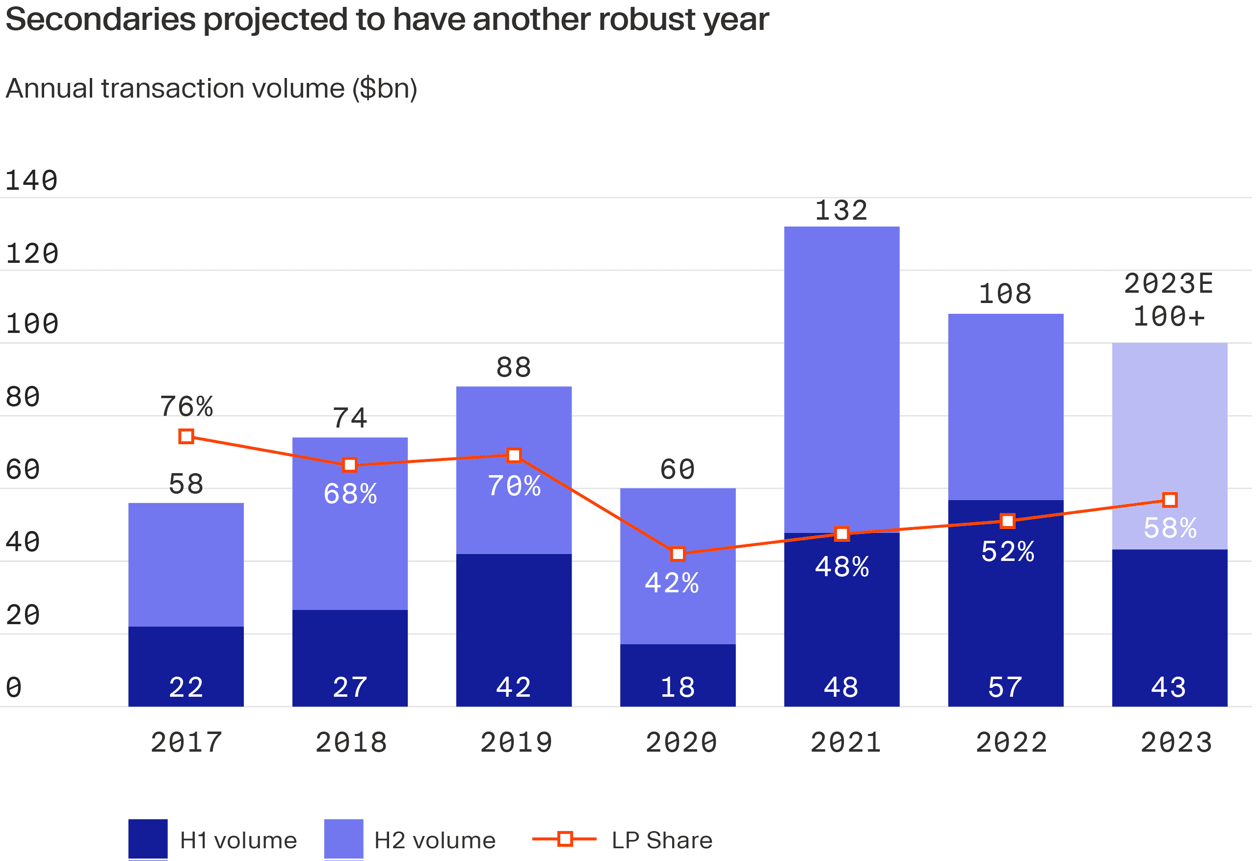

In the first six months of the year, the global secondary transaction volume totalled $43 billion, according to investment bank Jefferies.¹ Although this represents a 25% year-on-year decline, annualised figures predict a much smaller, 8% drop—markedly more optimistic compared to estimates for the entire private capital market, which is on course to drop 28% this year.²

The growing appeal of secondaries is even more evident when 2023 volumes are viewed through a longer term lens; compared to the 2017-2020 average, for instance, current figures are 60% higher.

Looking ahead, it seems secondaries could be poised for sustained growth, but what underlying forces are shaping this space and where lie the opportunities?

What secondaries can offer to investors in volatile times

For many limited partners (LPs), secondaries can serve as a tool to actively manage or rebalance their portfolios, but can also be used to prematurely lock in gains from high-quality investments. In either case, a secondary transaction would involve selling an asset to a secondary buyer who then assumes all the rights and obligations of the original LP.

The opportunity to sell stakes before the end of the fund's lifecycle can be hugely convenient considering that common holding periods in buyouts last up to ten years and can be even longer for venture capital funds. For some investors, a decade-long hold can understandably challenge their ability to maintain sufficient liquidity.

Secondary sales among LPs gain even more significance when economic conditions deteriorate and liquidity needs surge. Some allocators may struggle to weather the storm and are compelled to sell stakes quicker than they would have to under normal conditions. During the 2023 private market correction, for instance, the share of LP-led transactions swelled to 58% of the entire secondary market volume, up 10 percentage points compared to the considerably more buoyant conditions in 2021.³

The so-called denominator effect has also contributed to the heightened secondary activity among LPs. It occurs when prices of public equities and bonds decrease but, since private alternatives adjust to market conditions with a months-long delay, investors' portfolios may suddenly become over-allocated to private markets. To correct this imbalance that institutional investors, in particular, have faced during the past 18 months, LPs frequently have turned to secondary markets to exit selected positions.

Fundraising for secondaries on track for near-record year

The increase in transaction volume has also led to an expansion of capital raised for funds targeting secondary deals. In the first half of 2023, these vehicles raised almost $35 billion globally, per PitchBook, which puts them on track to surpass both 2022 and 2021 volumes and only lag behind the record-setting 2020.⁴ As a result, secondaries stand out as the only fund group that has been defying the overall downward trend in private markets fundraising this year.⁵

However, it should be noted that recent substantial fundraising is primarily driven by a handful of massive closes. Goldman Sachs, for instance, secured more than $15 billion to buy existing stakes in private equity funds.⁶ French private equity group Ardian collected over $20 billion, while Blackstone raised $22 billion,⁷ well above its initial target of $13.5 billion, marking the largest fundraise in the secondaries space to date.⁸

Investors eye attractive discounts in the VC secondary markets

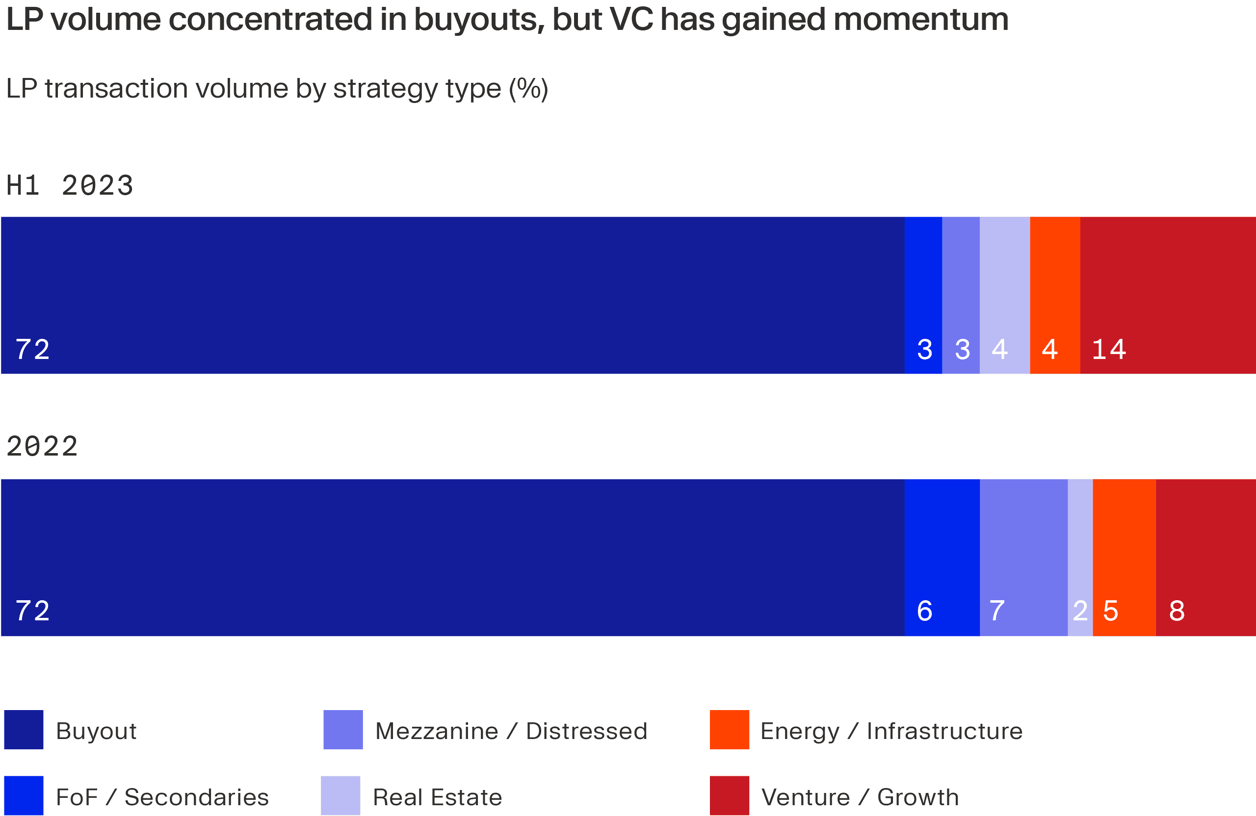

While buyouts have traditionally been in the crosshairs of secondary investors, venture and growth strategies have made a substantial leap in 2023. In the first half of the year, these transactions grew to 14% of total volume, almost doubling their share from 2022, according to Jefferies.⁹ Pent-up supply of VC-backed assets, coupled with falling valuations, have forced many investors to sell these investments at substantial discounts — an average secondary deal in the VC space transacted at 69% of net asset value (NAV).¹⁰

Meanwhile, VC-oriented secondaries funds are sprouting to capitalise on this relatively underserved market segment. Industries Ventures, for example, has raised $1,5 billion for its latest vehicle. Pinegrow Capital Partners is reportedly targeting a $2 billion fundraise and StepStone Group is seeking to raise $2.6 billion.¹¹

With exit paths blocked, GPs turn to continuation funds

LPs usually enter secondary markets to access additional liquidity by selling stakes, but private equity sponsors or general partners (GPs) typically have opposite goals — to retain hold of their best assets or generate distributions when more traditional exit routes are subdued, as is the case currently.

With this in mind, many GPs are turning to continuation funds, which allow them to circumvent underwhelming exits and potentially realise higher returns when market conditions improve. In these transactions, assets are transferred to a new fund vehicle, enabling additional follow-on investments. Existing investors, meanwhile, have two options — they can either roll into the continuation vehicle or sell their stakes to new LPs and effectively exit the investment.

Continuation funds currently represent around 80% of the total volume of the GP-led market, which reached $18 billion in the first half of 2023, per Jefferies. On an annualised basis, GP-leds are projected to accelerate until the end of the year, surpassing $45 billion, only slightly below 2022 figures. A growing investor pool, a robust single-asset continuation vehicles’ segment, and near-par pricing are the driving forces behind this growth, according to analysts at Jeffries.

Prices stabilising after deep discounts

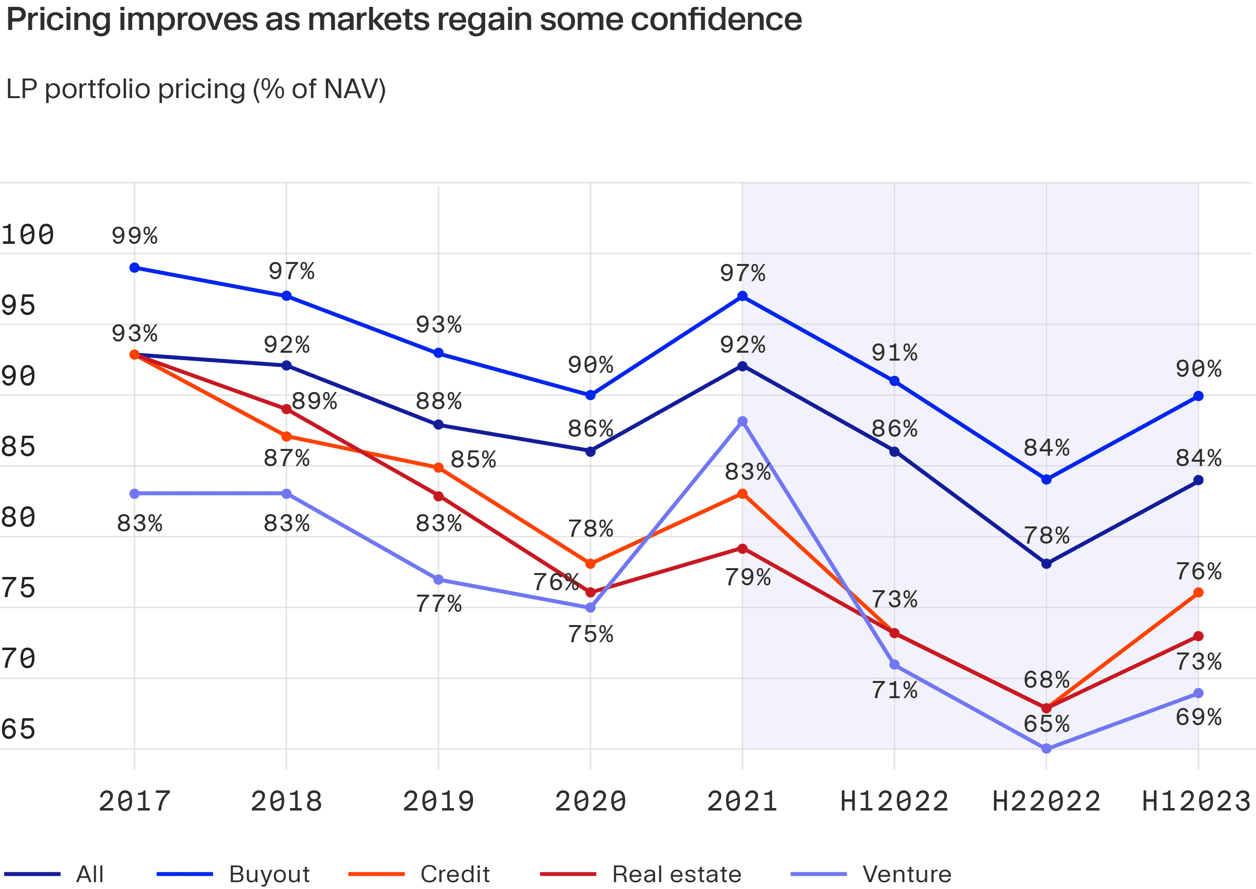

The secondary market so far in 2023 has been slanted towards buyers, but prices have risen. The average bid across all strategies in the LP-led market stood at 84% of NAV, a notable rebound of six percentage points compared to the same period last year.

This emerging recovery can be attributed to a somewhat clearer economic outlook, a revival in public markets and intensifying competition amongst buyers for high quality assets, particularly among GPs. According to asset manager firm Lazard, in the single asset GP-led market, 58% of transactions have been priced at or above NAV.¹²

Pricing is likely to continue stabilising further in the near future, with discounts expected to linger at around 15% of NAV for LP portfolio offerings.

In line with the overall bullish outlook, secondary managers remain proactive. More than 90% expressed intentions to fundraise in 2023, according to this year’s survey from a 2023 Investec survey. In addition, 76% and 50% expect to be more active in LP and GP-led sales, respectively, in the near future.¹³

Long-term forecasts imply that secondaries are poised for an even more significant upswing — estimated volumes range between $200 billion up to $500 billion by 2030.¹⁴¹⁵ This is a compelling indication that secondaries could soon become a staple and a primary investment strategy of mature private markets portfolios.

¹ https://www.jefferies.com/CMSFiles/Jefferies.com/Files/IBBlast/Jefferies_Global_Secondary_Market_Review_July_2023_.pdf ² https://www.bain.com/insights/stuck-in-place-private-equity-midyear-report-2023/ ³ https://www.jefferies.com/CMSFiles/Jefferies.com/Files/IBBlast/Jefferies_Global_Secondary_Market_Review_July_2023_.pdf ⁴ https://files.pitchbook.com/website/files/pdf/Q3_2023_US_PE_Breakdown.pdf ⁵ https://pitchbook.com/news/articles/private-markets-fundraising-q1-2023-secondaries ⁶ https://www.ft.com/content/d90c4edc-0385-4601-9ae5-b7f251462aea?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8 ⁷ https://www.reuters.com/markets/deals/frances-ardian-raises-20-billion-buy-stakes-buyout-funds-ft-2023-06-26/ ⁸ https://www.pionline.com/alternatives/blackstone-caps-worlds-largest-secondary-fund-22-billion ⁹ https://www.jefferies.com/CMSFiles/Jefferies.com/Files/IBBlast/Jefferies_Global_Secondary_Market_Review_July_2023_.pdf ¹⁰ https://www.jefferies.com/CMSFiles/Jefferies.com/Files/IBBlast/Jefferies_Global_Secondary_Market_Review_July_2023_.pdf ¹¹ https://www.venturecapitaljournal.com/lps-are-piling-into-vc-secondaries/ ¹² https://www.lazard.com/media/zwdfbtub/lazard-interim-2023-secondary-market-report.pdf ¹³ https://www.investec.com/content/dam/united-kingdom/cib/fundfinance/investec-secondaries-report-2023.pdf ¹⁴ https://www.institutionalinvestor.com/article/2bsjhx58tiizirnnelgcg/innovation/solid-opportunities-in-secondaries ¹⁵ https://www.ey.com/en_gl/podcasts/nextwave-private-equity/2023/03/episode-56-how-the-private-equity-secondaries-market-is-coming-of-age