Key takeaways

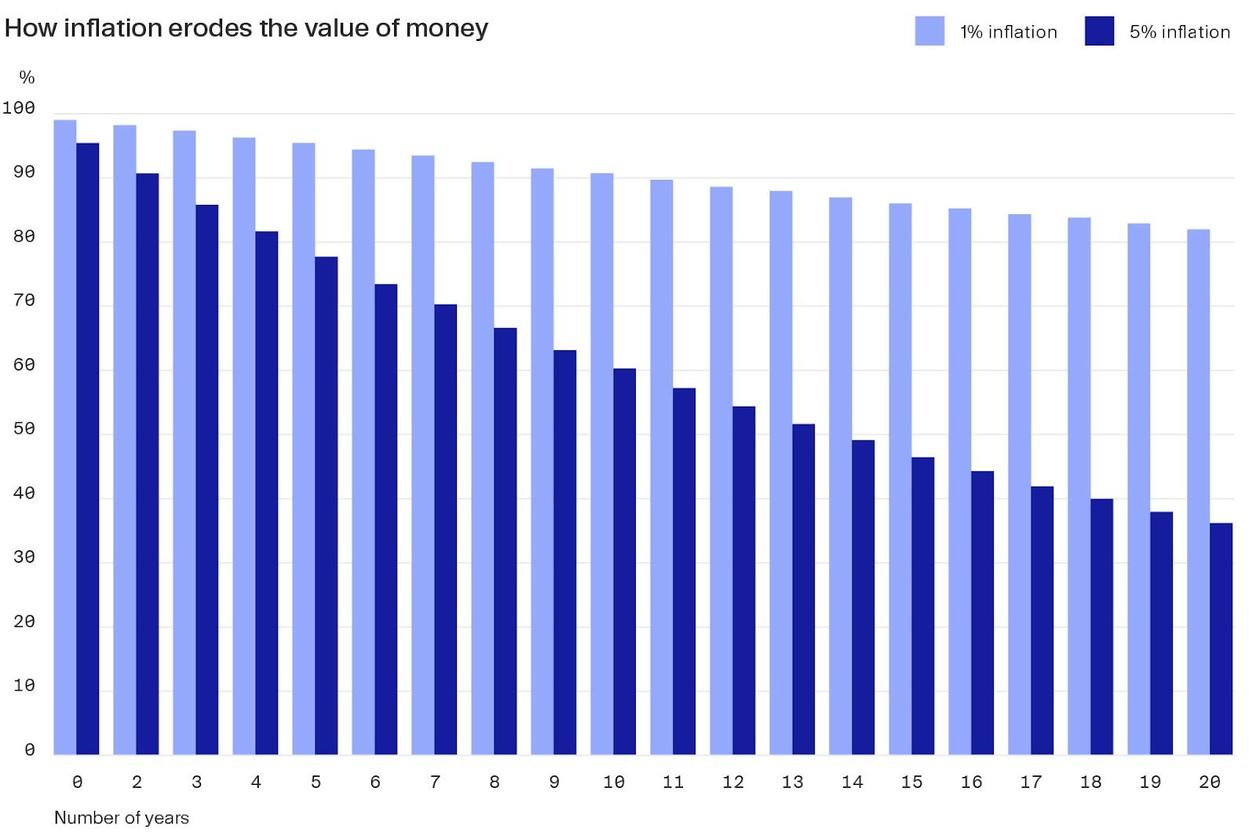

- The fear of losing capital in today’s volatile and uncertain world is leading many investors to hold cash reserves. Yet rising inflation means they are realising that fear – they are in fact losing money in real terms as the value of their capital declines.

- As part of a diversified portfolio, private equity can help investors generate returns over the long term as fund managers can act to protect and enhance value in their portfolio.

- Best private equity fund managers have the tools that allow them to perform well in an inflationary environment. These strategies include buy and build, targeting companies that can pass on costs to customers, and pursuing long-term investment themes.

Investors today are confronted with a confluence of factors that make it very difficult to decide where best to put their money. The war in Ukraine is causing uncertainty and has led to an energy shock, while other geopolitical tensions, such as that between the US and China, plus Covid-induced supply chain disruptions, have added to the trend of deglobalisation.

Inflationary pressures

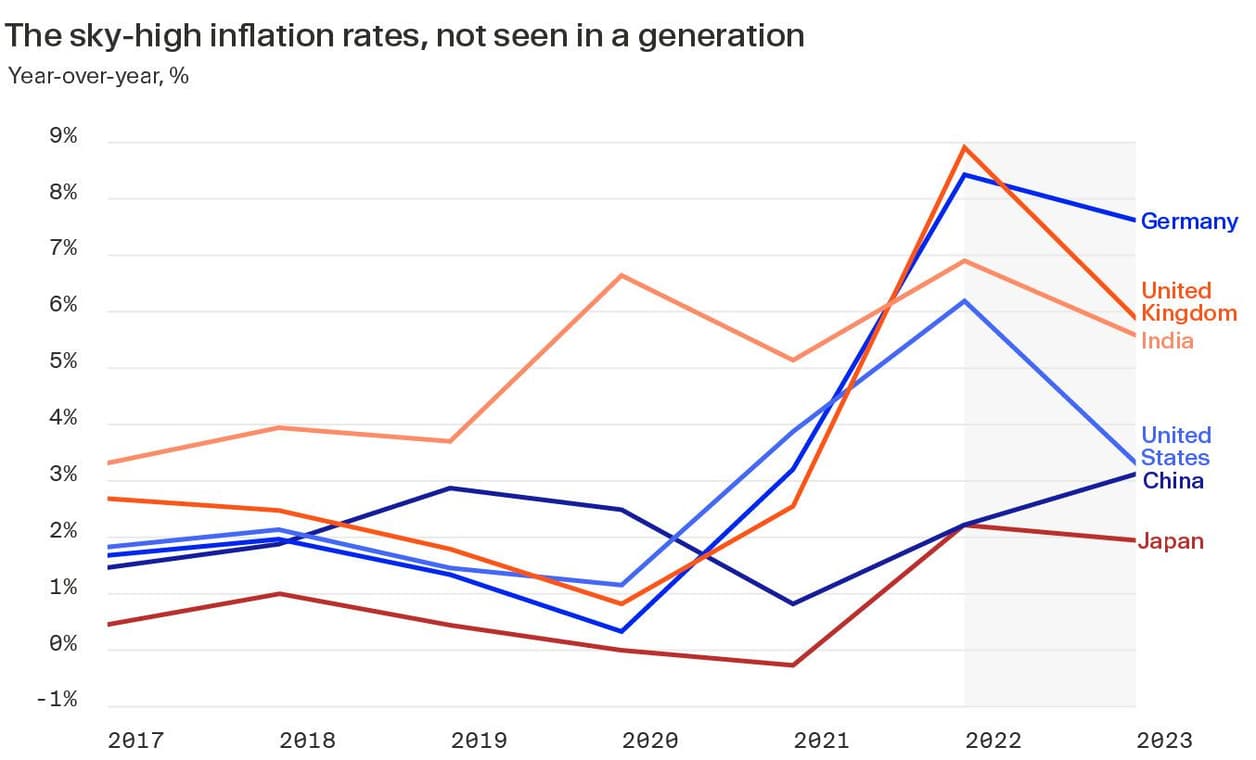

Many of these pressures are behind the sharp rises in inflation we’ve seen over the past year. In September, this reached an annual rate of 8.2 percent in the US¹ and 10.9 percent in EU countries², while in the UK, it soared to 11.1 percent in October.³ The response by central banks in the form of raising interest rates also risks pushing economies into recession and lowering stock market valuations still further.⁴

So where are investors deploying their hard-earned capital?

Public markets look challenging in the short run since they are highly sensitive to external shocks. Indeed, stock markets have been volatile this year, falling by as much as 20 percent year-on-year – meaning many officially reached “bear market” status at some points in 2022.⁶ Growth equities are particularly affected since their value is predicated more on future earnings than the here and now.⁷ And while fixed-income products, such as bonds, are often considered less risky, existing investments have fallen in value as newer instruments with higher interest rates have become more attractive, while overall, high inflation erodes the returns from fixed income over time.

These factors have led many investors to fall back on cash deposits as a straightforward and safe option while they wait and see what comes next. The pandemic led to a significant rise in savings rates among households as effectively closing the economy made it difficult to spend money. Yet the period since the restrictions eased but volatility has increased has seen savers largely keep their money in cash - in February 2021 US bank deposits totalled just under $16.5 trillion⁸; in October 2022, this stood at $17.7 trillion. And individual investors are not alone – Bank of America recently reported that fund managers increased their average cash balances in September to the highest level for more than 20 years.⁹

The cash conundrum

However, even as cash deposit interest rates have risen over recent times as a result of central bank rate hikes, investors will be hard pushed to find accounts that will pay much above (or even close to) three percent annually. Contrast that with double-digit inflation and it becomes clear that investors hiding in cash are seeing the value of their savings erode almost daily, as opposed to generating returns. It’s currently unclear how long high inflation will persist, but most economists predict that we may not yet have reached the peak and the Bank of England estimates that it may not reach its target two percent for another two years.¹⁰

Private equity in inflationary times

However, there are investments that can help protect investors against inflationary pressures – and as many investors are discovering, private equity is one of these. This does not mean that private equity portfolio companies are immune to rising prices, a higher cost of finance, or the other macro challenges the world faces today. However, private equity’s model and form of ownership may help fund managers navigate a smoother path than is possible in some other asset classes, while potentially also generating returns. The value private equity can create in the businesses it backs stands in contrast to the negative returns that confront cash savers today.

Protecting existing investments

Active, concentrated ownership means that fund managers can protect and grow the companies they back, including through restructuring, repositioning and refinancing businesses to build resilience. Yet there are also more specific actions private equity has in its toolkit to mitigate the effect of inflation on its portfolios.

One of the consequences of rising inflation, combined with lower economic growth prospects, is a decline in company valuations. This clearly affects existing investments because valuation multiples may well have fallen since the original investment. Yet private equity fund managers have broadened their strategies over the years since the global financial crisis and have become adept at buying a platform company and adding on smaller businesses to accelerate growth. In 2021, more than 70 percent of US private equity deals were add-on acquisitions, according to PitchBook.¹² This clearly works well in good times, but it is also particularly well suited to times like today – the smaller companies tend to have lower valuations in any case, but the fall in valuations we’ve seen recently makes them even more attractive.

Executed well, buy and build strategies can average down the purchase price multiple, create larger businesses (which generally command higher multiples than smaller companies¹³), reduce costs through economies of scale, and therefore protect value while also generating growth. With high levels of dry powder (the amount of capital raised but not yet spent), private equity houses have ample firepower to pursue this strategy. Dry powder reserves stood at an all-time high of US$1.81 trillion in January 2022, according to Preqin.¹⁴

Targeting essential products and services

With private equity constantly refreshing its portfolio with new investments, there are further opportunities to respond proactively to inflationary pressures. Fund managers tend to actively target companies that provide goods and services that are essential to customers and/or are significant players in their industry. This allows them more leeway to pass on higher input, labour or supply costs. In a recent interview with Private Equity International magazine, Guy Weldon, chief investment officer at Bridgepoint, explained: “We target companies which enjoy market leadership and benefit from pricing power and therefore are well placed, in the event of longer-term inflation, to pass on prices.”¹⁵

This sentiment is echoed by Matt Smith, private equity partner at Foresight in an interview with RBS. “Our focus on responding to inflation is at the operational level within portfolio companies,” he said. “Can we demonstrate the pricing power that comes from great products or services, and stay ahead and hold our margins?”¹⁶

Going for the beneficiaries

The other target areas for new investments are companies that will benefit from some of the macro headwinds – in a tight labour market, headhunters, employment agencies and companies offering automated solutions would be clear winners, for instance. In addition, some private equity investors now pursue thematic strategies to complement private equity’s long-term investment horizons. This is, according to private equity fund manager The Riverside Company, an approach that “focuses on predicted long-term trends rather than specific companies or sector, enabling access to structural one-off shifts that can potentially change an entire industry”.¹⁷ Partners Group also has a thematic approach, focusing on digitisation and automation, new living and decarbonisation.¹⁸ These may not result in investments that are immune to inflation, but they are long-term trends that are not going away – when it comes to exiting an investment, companies that capture these themes should command higher valuations.

Performance in a difficult market

Overall, the active management and model of being able to buy at times of lower valuations, adding value and waiting for better economic conditions before selling has meant private equity has, historically, performed well during recessions. Yet performance tends to become more dispersed in downturns and we’d expect the same this time around. We have noted that some managers have relied heavily on rising multiples in a low inflation environment, yet we also know that others have the skills and capacity to carry out the more difficult hands-on work necessary to identify inflation-resistant businesses, to support companies in executing strategies that make them more resilient to inflationary pressures and then to exit at the right time.

When favourable market conditions can't lift all the boats, fund selection becomes even more important. Learn what are the traits and characteristics of top tier funds in private equity in our article.

Sources

¹ https://tradingeconomics.com/united-states/inflation-cpi ² https://ec.europa.eu/eurostat/documents/2995521/15131946/2-19102022-AP-EN.pdf/92861d37-0275-8970-a0c1-89526c25f392 ³ https://www.ft.com/content/1fcc250c-c1c5-4820-a5f4-4e48662a73aa ⁴ https://www.forbes.com/sites/qai/2022/09/20/do-higher-interest-rates-hurt-the-stock-market-how-do-smart-investors-adjust-as-rates-go-up/?sh=1930d34fb0fd ⁵ https://www.oecd.org/economic-outlook/september-2022/ ⁶ https://www.usbank.com/investing/financial-perspectives/market-news/is-a-market-correction-coming.html ⁷ https://www.cnbc.com/2021/05/13/heres-why-stock-investors-are-watching-inflation-so-closely.html ⁸ https://www.ceicdata.com/en/indicator/united-states/total-deposits ⁹ https://www.reuters.com/markets/europe/wall-st-week-ahead-markets-churn-investors-hide-cash-despite-surging-inflation-2022-09-16/ ¹⁰ https://www.bankofengland.co.uk/knowledgebank/will-inflation-in-the-uk-keep-rising ¹¹ https://www.schroders.com/en/insights/economics/inflation-on-the-rise-this-chart-shows-the-damage-it-could-do/ ¹² https://pitchbook.com/newsletter/why-pe-add-on-acquisitions-are-seeing-rise-in-popularity-DJt ¹³ https://www.cbinsights.com/research/report/how-to-value-a-company/ ¹⁴ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/another-pe-dry-powder-record-set-vc-rounds-in-us-fintech-surged-in-2021- 68838564 ¹⁵ https://www.privateequityinternational.com/how-the-worlds-biggest-pe-firms-are-planning-to-tackle-inflation/ ¹⁶ https://www.rbsinternational.com/insights/2021/09/inflation-the-private-equity-dilemma.html ¹⁷ https://www.riversidecompany.com/industries/thematic-investing ¹⁸ https://www.partnersgroup.com/en/about/transformational-investing/