Private equity activity in the first half of the year has been relatively subdued as the economic environment remains persistently uncertain.

However, a deeper look paints a much more complex picture.

For example, recent data from Europe suggests fundraising could be back on pace. Certain private market subsegments as well are showing levels of robustness, such as secondaries, while some industry experts believe that private credit is even having a “golden moment”.

Below, we present our five takeaways from the first six months of the year, as well as the opportunities that lie ahead.

European fundraising surprises on the upside

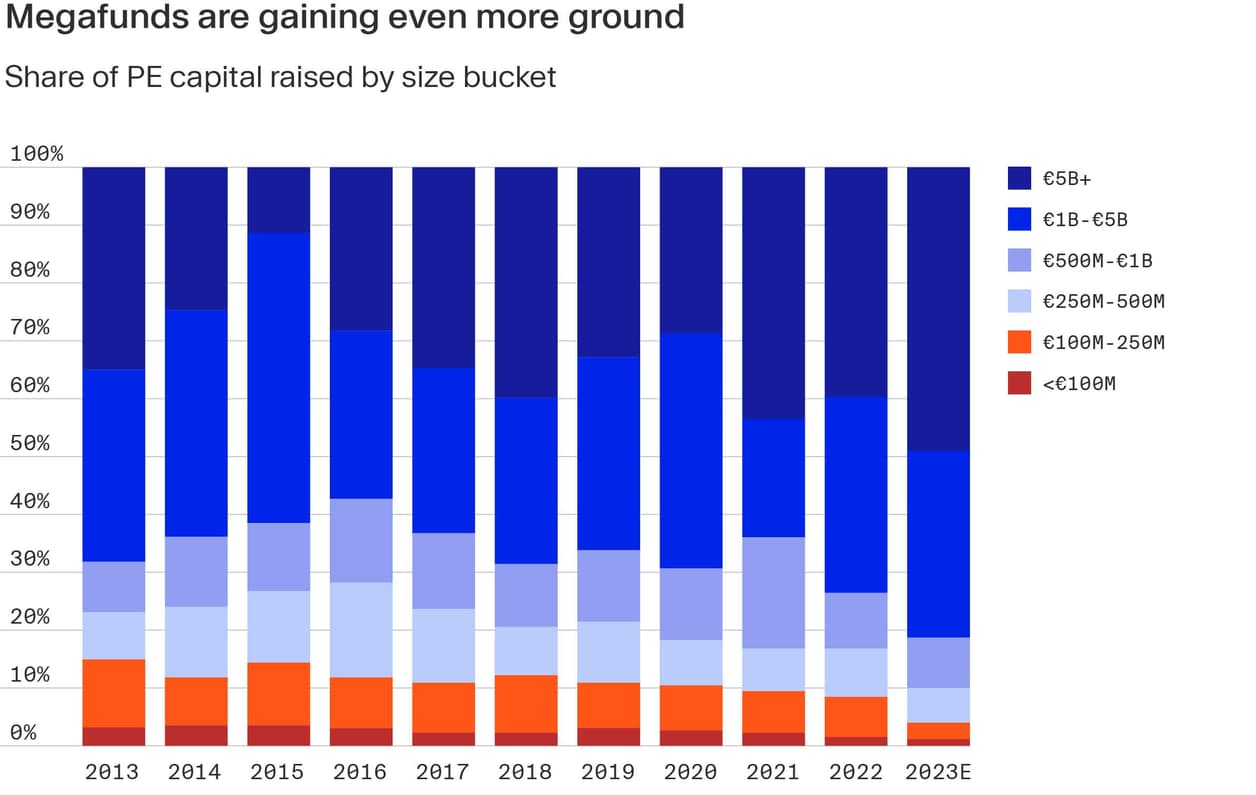

European private equity firms raised €49 billion in the first half of the year, a significant amount when contrasted with the €68 billion raised throughout the entire 2022, according to PitchBook’s Q2 2023 European PE Breakdown.¹

This near-record fundraising tear is being driven by the growing prominence of megafunds with over $5 billion of raised capital as investors flock to more established managers with stronger track records.

This trend is epitomised by two massive fundraises in 2023 — Permira's eighth flagship fund that secured €16.7 billion in commitments², and CVC Capital Partners closing its ninth flagship fund on €26 billion, setting a new milestone as the largest buyout fundraise in history.³

Appetite for add-ons is growing

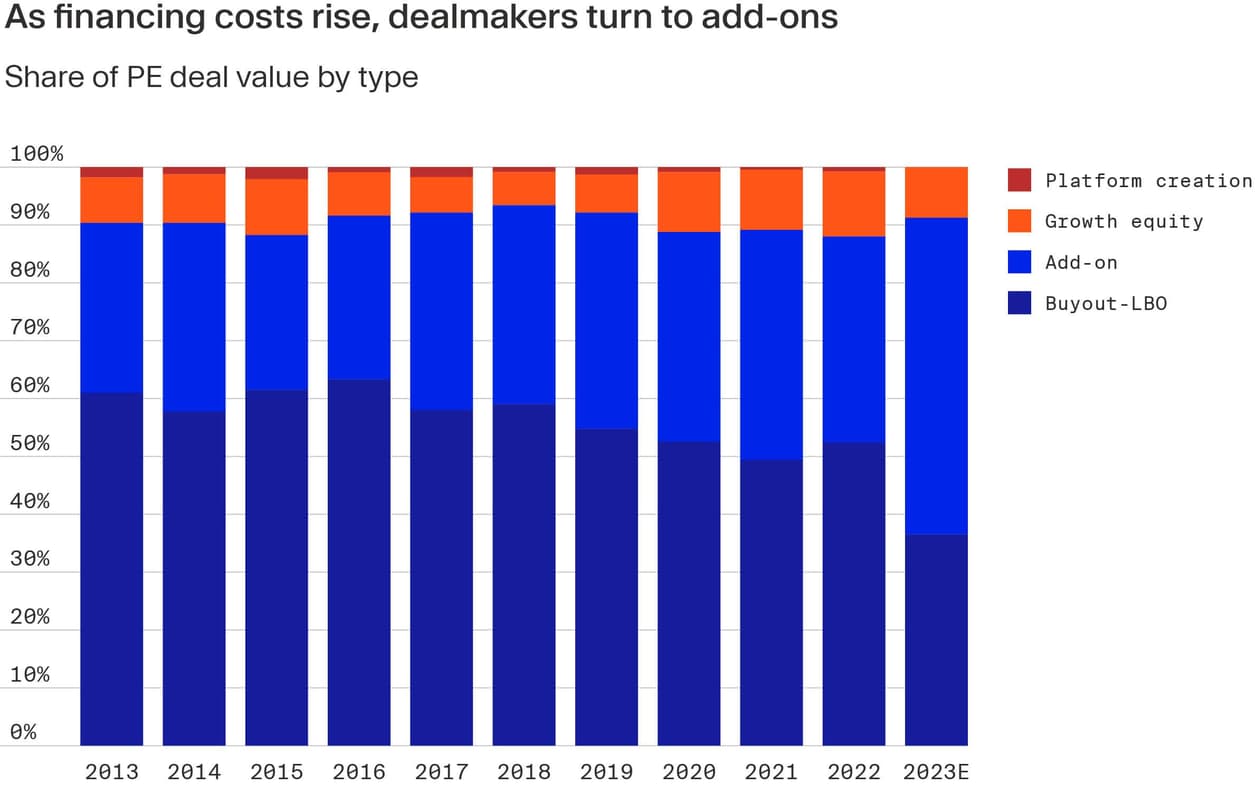

Dealmakers in private equity are still largely sitting on the sidelines. Managers at buyout funds closed 864 deals globally in the first half, signalling a 29% year-on-year decline, according to Bain & Company.⁴ Measured in US dollar value, the drop is even steeper at 58% compared to the same period last year. This dwindling activity largely stems from the current price expectation mismatch between buyers and sellers, coupled with tougher financing conditions.

Yet, today's appetite — or lack thereof — doesn’t permeate all corners of the industry. While megadeals may be languishing, there is significant interest in add-on acquisitions in the mid-market space.

These deals see private equity funds purchase smaller-sized businesses, typically without using leverage, and fold them into one of their existing portfolio companies to extend product lines or capture market share. According to PitchBook, add-ons made up almost 55% of all deal value in Europe in the first half of the year, while in the US, this share is even greater.⁵

Breaking things down by sector also highlights how a broad-brush approach doesn’t tell the whole story. Financial services in the European market, for example, stood out as the “only sector on track to pace above its 2022 levels of €48.4 billion”.⁶ One of such deals was KKR’s $215 million investment in Swedish wealth management company Söderberg & partners.⁷ Conversely, the healthcare sector trails both in Europe and in the US.

PE-sponsored exits show first signs of life

Exit activity remained subdued in the first six months, as private equity firms shied away from selling their investments into a perceived weaker market. Global buyout-backed exits reached just $131 billion in that period, a 65% drop year-on-year.⁸

Despite the challenging immediate outlook, the second quarter brought encouraging increases in both deal count and value within the US market, suggesting sellers have slowly started to adjust to lower valuations. Indeed, PitchBook noted a 67% jump in US exit value quarter over quarter, reaching $87.3 billion from April to June. Sales to corporates accounted for the largest share by exit type, representing nearly 65% of the US total PE exit value.⁹

The two of largest PE exits to date this year included a $10.6 billion sale of Oak Street Health, an operator of primary care centres, and Nasdaq’s acquisition of Adenza, a risk software developer, which Thomas Bravo sold for $10.5 billion.¹⁰¹¹

Meanwhile, IPOs are still few and far between. Notable exceptions include Cava, a VC-backed Mediterranean restaurant chain, that notched a valuation of $4.7 billion in its market debut in June.¹²

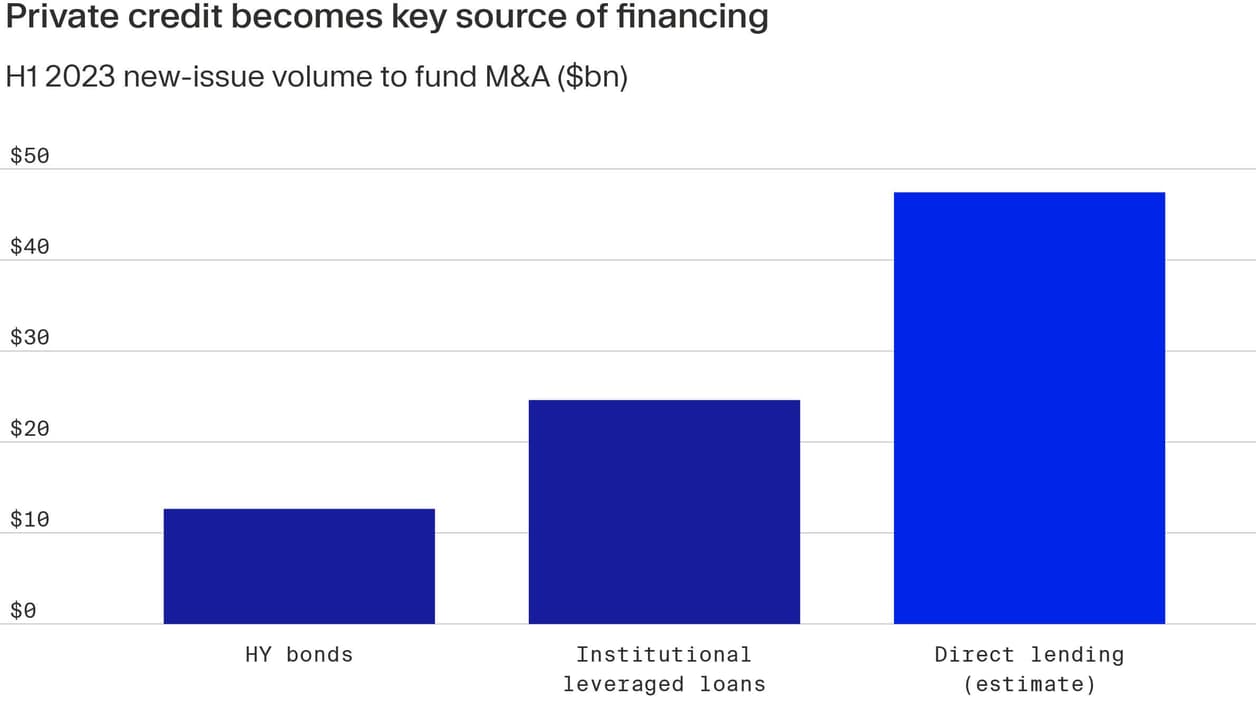

The rise and rise of private credit

With monetary conditions tightening over the past 18 months, traditional lending institutions have curtailed much of their lending activity. This retreat has paved the way for private credit providers to fill the financing void, often emerging as the sole alternative for capital-deprived businesses.

The asset class’ growth bears this out. Private credit now represents a significant segment within the broader credit landscape, facilitating loans for a diverse range of purposes. This includes supporting corporations in refinancing their existing obligations or helping private equity sponsors secure funding for leveraged transactions. PitchBook estimates that more than $40 billion-worth of direct loans have been issued in the first half of the year in the US alone to finance acquisitions, surpassing publicly traded leveraged loans and high-yield bonds.¹³

The balance of power additionally has also shifted firmly into the hands of lenders, given the context of current market volatility and the relative scarcity of available debt.

While this makes financing for borrowers more expensive, for investors, this becomes an attractive opportunity to generate income at a higher yield. As we've noted in our recent white paper on private credit, income-based returns across private credit reached 6.2% in 3Q 2022, higher than high-yield bonds, which stood at 4.2%.¹⁴

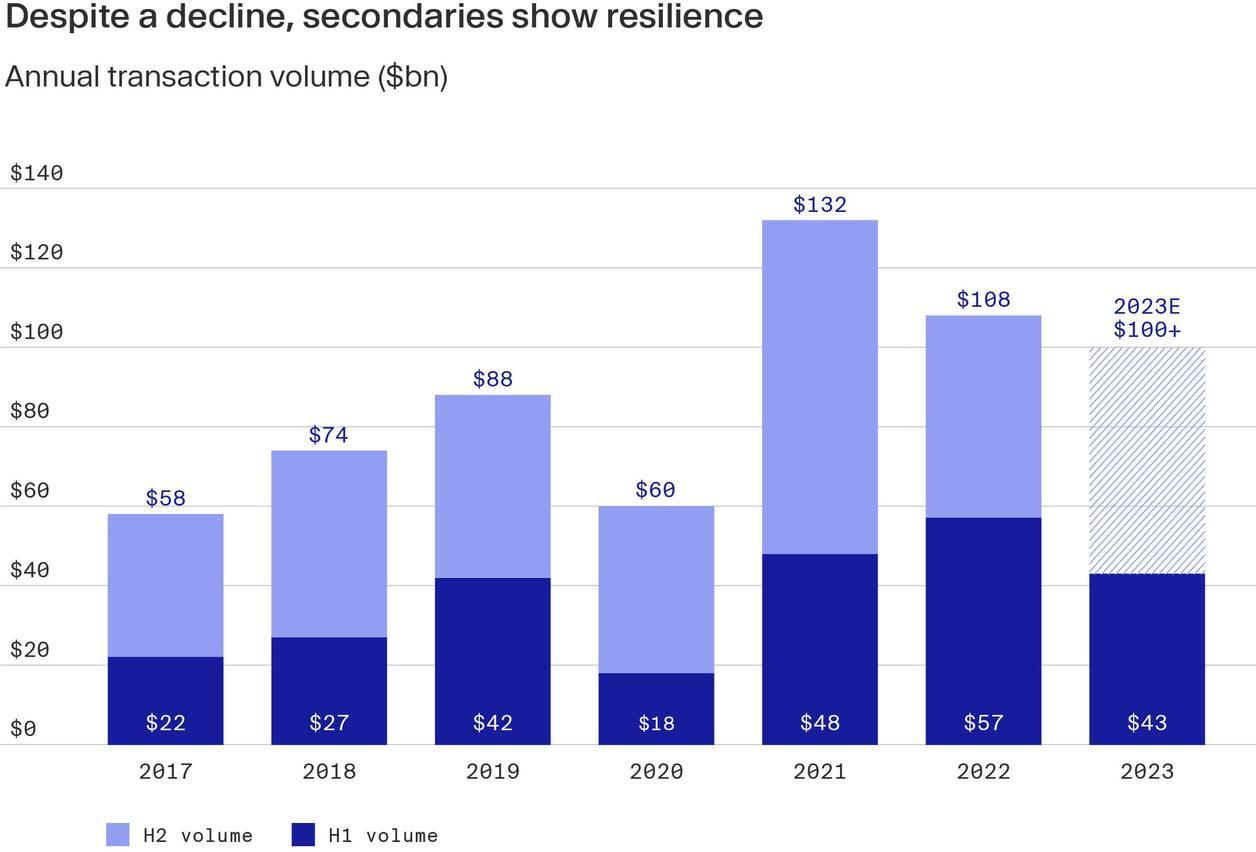

Secondary market holds steady

Despite depression elsewhere, the secondary market is showcasing a certain resilience given increasing demand for liquidity. Private equity secondaries deals reached $43 billion in H1, per investment bank Jefferies. While this represents a 25% decrease from the same period in 2022, it's important to note that H1 of last year was a record-setting period of six months, with $57 billion raised. Analysts at Jefferies estimate that secondaries will surpass the $100 billion mark in 2023, a third highest amount ever, underscoring the appeal they have for limited partners (LPs) and general partners (GPs) alike — despite the downturn.¹⁵

With slower M&A and virtually closed IPO markets, secondaries may continue to offer a vital liquidity route for investors to divest their interests before the end of a fund's lifecycle. At the same time, fund managers are increasingly looking towards secondary sales as a means to satisfy immediate capital requirements and to avoid becoming forced sellers in an unattractive exit market.

Given this context, activity within the secondaries space will likely remain robust near term. Jefferies predicts a transaction volume exceeding $60 billion in the second half of the year, driven by “favourable macro conditions, ample dedicated capital and strong pricing." They also forecast narrower bid-ask spreads — the gap between a seller’s asking price and what buyers are willing to pay —, with expected average pricing of around 85% of net asset value (NAV) for LP portfolio offerings.¹⁶

2023 investor playbook: Four considerations to look out for

In our 2023 outlook, released at the beginning of the year, we put forward four considerations private equity investors need to be aware of to successfully navigate this year’s volatile environment. As we’ve passed the midyear point, we believe it’s worth reinforcing the key points:

Focus on value creation. Monetary tightening and uncertain inflationary and geopolitical outlooks will favour strategies with an active approach to value creation. Buyouts and turnarounds, for example, could generate higher returns than more passive investment models that rely on multiple expansion, market timing, and financial engineering.

Prepare for lower distributions. A more muted exit environment may bring longer holding periods and lower distributions. However, these returns on investments are more likely in today’s context to come from secondary buyouts, M&A transactions and GP-led secondary deals.

Choose funds carefully. In private markets, return disparities widen during downturns.³¹ The best fund managers take action to protect existing investments and can take advantage of market dislocations; lesser managers, however, may not be equipped well enough to do this.

Investors should take time to evaluate a fund manager’s strategy, team, and performance, to form a view on whether they believe the GP can deliver the risk-return profile they are seeking.

Keep a long-term mindset. During a typical eight-to-twelve-year lifespan of a private markets fund, there are likely to be periods of economic turbulence. With this in mind, investors need to keep a long-term perspective and avoid timing the market. They should remain disciplined in their annual commitment plan and diversify by vintage year, manager and asset class to help protect against volatility and provide downside protection through market cycles.

¹ https://files.pitchbook.com/website/files/pdf/Q2_2023_European_PE_Breakdown.pdf ² https://www.privateequitywire.co.uk/2023/03/08/319742/permira-closes-buyout-fund-eu167bn ³ https://citywire.com/selector/news/cvc-raises-26bn-for-largest-private-equity-fund-ever/a2422126 ⁴ https://www.bain.com/insights/stuck-in-place-private-equity-midyear-report-2023/ ⁵ https://files.pitchbook.com/website/files/pdf/Q2_2023_European_PE_Breakdown.pdf ⁶ https://files.pitchbook.com/website/files/pdf/Q2_2023_European_PE_Breakdown.pdf ⁷ https://www.pehubeurope.com/kkr-to-aid-soderberg-expansion-with-growth-investment/ ⁸ https://www.bain.com/insights/stuck-in-place-private-equity-midyear-report-2023/ ⁹ https://files.pitchbook.com/website/files/pdf/Q2_2023_US_PE_Breakdown.pdf ¹⁰ https://pe-insights.com/news/2023/06/12/thoma-bravo-exits-financial-risk-software-company-adenza-to-nasdaq-for-10-5bn/ ¹¹ https://www.pehub.com/cvs-health-to-acquire-oak-street-health-for-10-6bn/ ¹² https://www.reuters.com/markets/deals/restaurant-chain-cava-valued-47-bln-shares-pop-debut-2023-06-15/ ¹³ https://files.pitchbook.com/website/files/pdf/2023_US_Private_Equity_Outlook_H1_Follow-Up.pdf ¹⁴ https://www.im.natixis.com/en-institutional/insights/why-does-private-credit-remain-a-compelling-investment-opportunity-vs-high-yield-bonds-in-the-current-economic-environment ¹⁵ https://media.licdn.com/dms/document/media/D4E1FAQEyCfGrG9vAhw/feedshare-document-pdf-analyzed/0/1690206229434?e=1691020800&v=beta&t=DUEa4vsoEUeA4bJdUdpybZVi-iNFYIb_rFBeLGUZRLc ¹⁶ https://media.licdn.com/dms/document/media/D4E1FAQEyCfGrG9vAhw/feedshare-document-pdf-analyzed/0/1690206229434?e=1691020800&v=beta&t=DUEa4vsoEUeA4bJdUdpybZVi-iNFYIb_rFBeLGUZRLc