Looking at the numbers, it’s been a tough time in the venture space so far this year as investors and startups alike have come to face the new economic reality.

According to PitchBook, for example, venture capital funds globally raised merely $70 billion, in the first half of 2023, way off the pace of the at least $260 billion they raised in each of the previous five years.Investments have also taken a similar turn, with recent data from EY and Crunchbase showing that in the US, the number of VC deals completed has fallen for the last five quarters straight.

And while larger deals such as the one for OpenAI have generated positive headlines, emanating uncertainty from the economic environment and the collapse of Silicon Valley Bank has meant many VCs have opted to focus on smaller deals. Indeed, according to EY, half of VC deals in Q2 2023 were in the Seed and Series A range, accounting for $7.2 billion.

Falling fundraising activity is understandable given the environment. However, this relative inertia could mean investors are missing out on a rare opportunity to back startups on their terms. According to PitchBook’s VC Dealmaking Indicator, venture capital is at its most investor-friendly phase for more than a decade.

Here are three key factors that are driving this change in the balance of power.

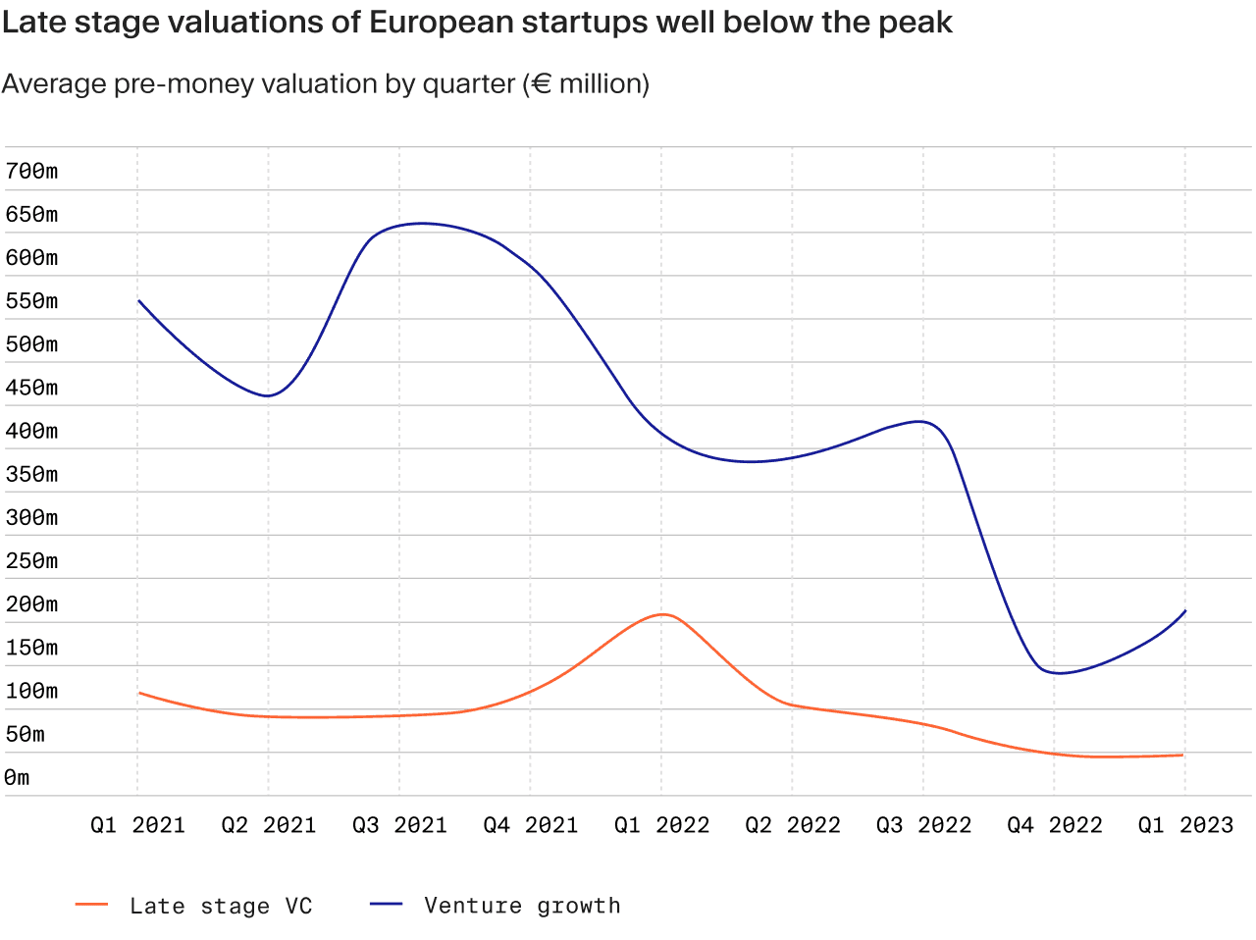

Valuations are falling from record highs

At a high level, there is one clear reason why the pendulum has swung back to investors; investing in startups has simply gotten cheaper.

Analysis of PitchBook European VC data by Sifted, for example, noted that late-stage valuations in the region have plummeted in Q1 2023; 23% year-on-year for Series A to C valuations, and an eye-watering 77% for companies on above Series C funding rounds.

One facet exemplifying this is the increasing number of down rounds, where startups raise capital at a valuation lower than their previous one. PitchBook, for instance, says that down rounds made up over 15% of all US VC deals in Q2 2023, a four-year high.

Notable down rounds this year includes that of US/Irish payments giant Stripe, whose $6.5 billion Series I fundraise valued the company at $50 billion — almost half the $95 billion it had been previously valued at.

Rising costs pressuring startups to relent on terms

One of the factors leading to a rise in the number of down rounds is that the turbulent economic environment is forcing venture-hunting companies to relent to less-friendly deal terms than before.

High interest rates and inflation are eating up cash reserves, leaving startups with a shorter capital runway. The reality this creates means that the balance of power has now swung to investors as founders grapple to secure funds at terms more onerous than they may have been previously.

The trends of the terms and conditions exemplify this. Law firm Fenwick and West’s analysis of venture capital deals in Silicon Valley found that the proportion of financing containing ‘pay-to-play’ provisions — stipulations forcing previous investors to participate in funding rounds or risk having their ownership diluted — spiked to 7% in Q2 2023, their highest level since at least Q1 2021.

VC focus shifting from hypergrowth to profitability

Startups aren’t just coming under pressure to acquiesce to stricter terms from their own bottom lines; a fundamental change in what VCs perceive as valuable is also having an effect.

From 2008 to 2022, unprecedented amounts of money flowed into venture from limited partners (LPs) such as pension funds and insurance companies. These LPs were becoming increasingly attracted to higher-return asset classes such as venture capital because interest rates were at historical lows, which limited the amount of return they could receive from traditional investments such as fixed income.

In turn, venture capital firms prioritised growth above many other metrics, with the idea of scaling first and turning a profit later. This made sense from an investor and LP perspective, who could look to achieve double-digit returns on exit either through acquisition or IPO. Take Uber, for example. The ridehailing giant was valued at $82.4 billion at the time of its IPO in 2019. From 2016 to 2018, it had made losses of over $3 billion, $4 billion and $3 billion each year respectively.

Now, however, elevated interest rates mean money is no longer cheap, and venture capital and wider private equity firms have changed their tune; it’s not what you might do in the future, it is what you are doing now that counts more.

As Jason Thomas, Head of Global Research at Carlyle, told us in our Deal Talk Macro Edition: “What we saw over the last couple of years was excessive focus on growth, because what was how you expanded your multiple—or of course prevented it from contracting…there was pressure to maintain top-line growth because that was what the market demanded in this period of extremely low interest rates.”

Now, this focus on profitability means that VCs are intensifying their due diligence, or as KPMG puts it, “putting a laser focus on profitability and the sustainability of startup business models when making investments.”

In turn, this could mean that the deals that are done this year are in companies that are built to last. The numbers seem to bear this out. According to a Journal of Venture Capital Study, the five years following the Global Financial Crisis saw VCs net an average return of 15.7%, while the preceding five years averaged only 7%.

Instead now, the focus on profitability means that there is an element of increased downside protection; companies that pass due diligence from VCs laser-focused on profitability and performance today will likely have more robust balance sheets and long-term business continuity plans.

- https://files.pitchbook.com/website/files/pdf/Q2_2023_Global_Private_Market_Fundraising_Report.pdf

- https://www.ey.com/en_us/growth/venture-capital/q2-2023-venture-capital-investment-trends

- https://www.ey.com/en_us/growth/venture-capital/q2-2023-venture-capital-investment-trends

- https://pitchbook.com/news/articles/the-pitchbook-vc-dealmaking-indicator

- https://sifted.eu/articles/startup-valuations-continue-to-fall#

- https://www.cnbc.com/2023/03/15/stripe-raises-series-i-billion-at-sharply-reduced-50-billion-valuation.html

- https://www.jdsupra.com/legalnews/silicon-valley-venture-capital-survey-9741730/

- https://news.crunchbase.com/venture/inside-the-uber-s-1-revenue-growth-and-losses/#:~:text=Uber%202016%20operating%20loss%3A%20%2D%24,34%20percent%20increase%20from%202016)

- https://www.moonfare.com/deal-talk/deal-talk-macro-edition-with-jason-thomas-carlyle

- https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2023/07/venture-pulse-q2-2023.pdf

- https://jcventurecap.com/venture-capital-investing-in-recessions/