Buy-and-build (roll-up) strategy

Key Takeaways

- Buy-and-build funds employ a buyout strategy where an initial target company is acquired with the intention of adding related businesses to create a larger enterprise.

- Buy-and-build funds seek exceptional returns, often through leverage, but can often take longer to execute than other forms of private equity.

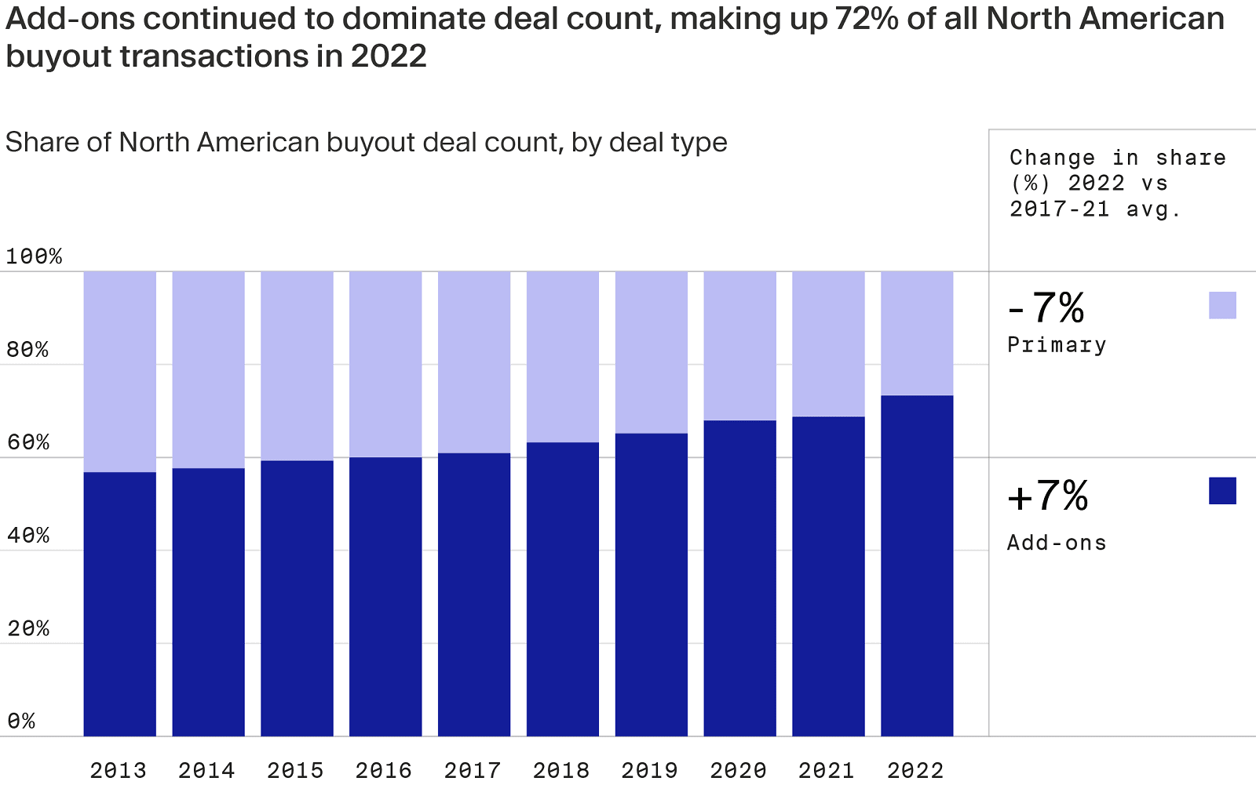

- These deals are growing in popularity. Nearly three out of four buyouts in North America are part of buy-and-build strategies.

Private equity investments are often categorised by the type of investment strategy they seek to profit from. Three of the most commonly implemented strategies are venture, growth and buyout.

Venture strategies seek to profit from the introduction of new technologies, business models or other innovations. Growth strategies look to capitalise on proven business concepts that need capital to expand their operations and markets.

Buyout strategies, on the other hand, aim to improve or restructure existing businesses that can then grow, often through acquisitions into larger enterprises. This is known as a buy-and-built strategy, also referred to as “roll-up”, “add-on”, or “bolt-on” deals, which are predicated on identifying an initial acquisition target that can become the foundation for further acquisitions that will subsequently be folded into the base company. A typical approach would be to buy a core business in a particular geographic region and then add on similar companies from other regions to build a business with a nationwide footprint.

These add-on deals are gaining momentum. According to a Bain & Company report, add-ons made up 72% of all North American buyouts in 2022 by deal count and a growing share of them were used to further buy-and-build strategies.

Buy-and-build (roll-up) strategy explained

Buy-and-build strategies generally involve an initial investment in a business deemed to have significant potential as a ‘platform’ operation that can serve as the foundation upon which other businesses in the same industry can be added to create a larger enterprise. The newly created business, ultimately a product of multiple acquisitions, is then expected to reap the benefits of scale and value accorded its more dominant position in its industry.

The strategy involves the selection of a target company that can serve as the core investment for future anticipated acquisitions. The initial target could be a private company, a public company that can be taken private, or a division of a public company that can be privately spun off. The objective is to find a company that has strong underlying growth potential but which may be languishing due to bloated expenses, ineffective management or a lack of attention inside a larger enterprise.

The target also has to be able to support a business that will eventually include a number of additional acquisitions. Therefore, the general partner (GP) of a buy-and-build investment will look for characteristics in its initial target acquisition, such as a strong management team, current technology, excess capacity or good branding and reputation.

The industry sector can be a key factor, as the industry needs to be able to support the emergence of a new key player. An industry that already has several dominant competitors is less appealing than one that is fragmented and has no dominant player. In addition, there needs to be identifiable acquisitions in the industry with the potential to be accretive to the core business if merged with it.

Ultimately, the new enterprise that is created will likely be taken public or sold to provide an exit route for the investors.

How does the buy-and-build strategy create value?

Value creation in a buy-and-build strategy can occur in multiple ways:

- Operating efficiencies and other economies of scale should be achieved when acquiring add-on companies and merging them into the core business.

- Management enhancements should accrue from the experienced management pool available at the acquisitions.

- Multiple expansion may be realised when combining smaller players at lower multiples into a single, more powerful enterprise that can command a higher earnings multiple.

- Profit margin expansion should result from a stronger, more competitive company.

- In some situations, cross-selling opportunities may exist.

A real-life example

In 2014, private equity firm Ford Financial Fund made a tender offer to buy 51 per cent of Mechanics Bank for $265 million. Mechanics Bank in Richmond, CA was a public company that had been created in 1905 and was largely owned by a single family. The transaction effectively took Mechanics Bank private as part of a long-term buy-and-build strategy and provided family members with an opportunistic liquidity event that paid them a 62% premium over the price available at the time in the over-the-counter market.

It was openly disclosed that Ford intended to “roll up” other community and regional banks into the Mechanics Bank umbrella, with an eye toward selling the larger banking enterprise down the road. Ford had seen prior success with a similar strategy, having purchased and grown San Francisco’s Golden State Bancorp and selling it later to Citigroup for $6 billion in 2002. In 2012, Ford Financial sold Pacific Bancorp in Santa Barbara, which had been purchased for $500 million in 2010, to San Francisco’s Union Bank for $1.5 billion.

Within two years of its purchase by Ford, Mechanics Bank began merging with other West Coast banks. In 2016, it merged with the California Republic Bank of Irvine, CA. In 2018, it acquired Scott Valley Bank of Yreka, CA and in 2019, it merged with Rabobank's North American retail operations. The CEO confirmed that other acquisitions are in the works and that some considerations are in Nevada.

https://www.bain.com/insights/private-equity-outlook-global-private-equity-report-2023/

https://www.sfgate.com/business/article/Texas-billionaire-buys-Richmond-s-Mechanics-Bank-5792202.php