Key takeaways:

- Family offices are embracing direct investments which offer them more control, customisation and potential for outsized returns.

- Many family offices invest in sectors they know well, but others branch into entirely new industries, using networks and long-term vision to create value in unexpected places.

- While sourcing, structuring and managing direct deals comes with challenges, family offices can potentially reduce risk and maximise returns by taking a blended approach that includes fund investing.

Family offices largely exist because someone, somewhere, once built a great business from the ground up. It’s fitting then that the same family offices are actively diversifying their strategies between PE fund allocations and something their clients know well: investing directly inprivate businesses.

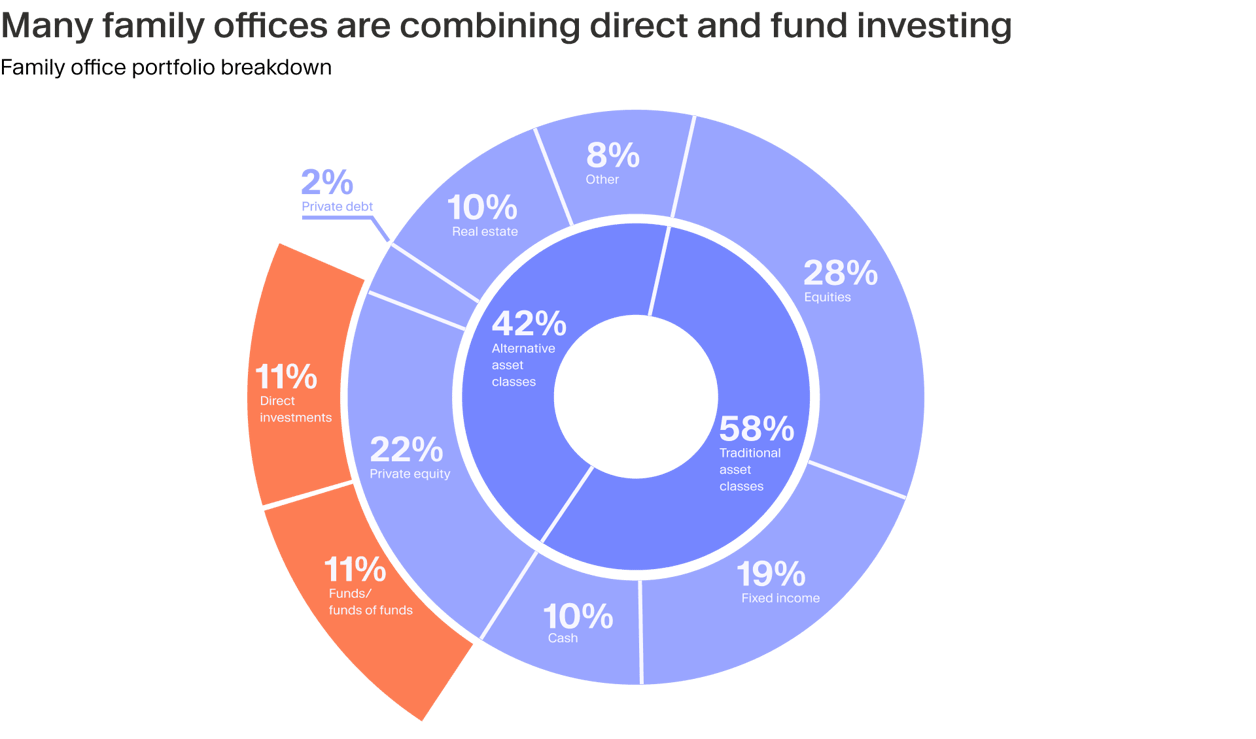

This is reflected in a wealth of recent data. A survey from Citi Private Bank shows that 77% of family offices are now engaged in direct private equity investments. What’s more, average allocations are almost evenly split between directs (8%) and PE funds plus funds of funds combined (9%).¹ ² Even this is a conservative estimate. Separate research, courtesy of Deloitte, indicates that 10% of family office portfolios comprise PE funds and as much as 17% is represented by directs while in last year’s UBS survey this share is evenly split at 11%.³

Clearly family offices come in all shapes and sizes and it’s the latter that plays a big role here.

Perhaps counter-intuitively, offices with more than $1 billion in assets under management are twice as likely to invest in funds than direct deals compared with their smaller counterparts, per Deloitte.⁴ The reason is thought to be a straightforward scaling issue — managing a larger capital pool does not necessarily mean having commensurate in-house resources to source and oversee direct investments.

The bottom line, though, is that many family offices have an affinity for going direct in their PE investment programmes — for good reason.

Direct advantages

The appeal of direct investing among this cohort of investors is clear. Those who choose this route gain greater control over their investments and portfolio risk exposure, while allowing them to negotiate entry and exit terms, tailor deal structures to their needs, actively manage companies and apply their family domain expertise.⁵ Unlike traditional fund investing, which requires committing capital to a blind pool fund with limited influence over individual deals, direct investing enables family offices to allocate capital more selectively.⁶ Cost efficiency is another key motivator. By managing their own deals family offices can reduce the standard fee structures of private equity funds. In principle, these cost savings can potentially lead to higher net returns, making direct investing an attractive proposition for those with the experience and expertise to execute deals effectively. Definitive data on this performance edge is patchy at best. However, one widely cited academic study by Fang, Ivashina and Lerner shows that during the period 1991-2010, “solo” deals delivered an IRR of 22%.⁷ This is equivalent to a nearly 6.8 percentage point IRR outperformance versus various fund benchmarks over the same period.⁸ Note, however, that past performance is not indicative of future returns.

Experience and expertise

On the point of experience and expertise, many family offices have a tacit advantage when investing directly. Given that they typically have origins in entrepreneurship, they tend to have deep industry knowledge, allowing them to potentially identify, assess and add value to businesses in sectors where they have an operational track record. Take Mousse Partners, a family office tied to the Chanel empire, and Téthys Invest, linked to L’Oréal’s fortune. In September, they teamed up to invest in The Row, the Olsen twins’ so-called “subtle” luxury brand.⁹ Their deep industry know-how helps them back brands that fit their legacy, using global networks to drive growth while preserving what makes these brands special in the first place. Family offices don’t always invest in alignment with how their fortunes were made. Welch Allyn, the office of the Welch family, who owned the eponymous global medical device company for over a century, recently became minority investors in Wrexham AFC.¹⁰ The deal, which follows the football club’s vault to international recognition following the hit Netflix series Welcome to Wrexham, reflects a broader trend of family offices using their capital and long-term vision to gain exposure to high-potential assets, even those outside their traditional field of expertise.¹¹

The challenges of going direct

Despite the advantages, direct investing comes with risks that family offices must account for. One of the primary concerns is deal sourcing. Unlike private equity firms, which have dedicated teams and extensive networks to find potentially high-quality opportunities, many family offices struggle to access proprietary deal flow. According to one study, only half of family offices making direct investments have trained private equity professionals on staff, raising concerns about their ability to identify and structure the best deals.¹²

Oversight and governance present another challenge. While private equity firms typically take board seats and actively engage in portfolio management, only 20% of family offices that invest directly do the same.¹³ Without proper oversight, they risk losing influence over key strategic decisions, which can ultimately impact investment performance.

Interestingly, an associated risk factor at play is distance. Fang et al’s research shows that solo direct investments made in companies located farther away from the investor tend to underperform relative to more local deals.¹⁴ The implication is that investors who pursue direct deals benefit from proximity to their targets, which likely reduces information asymmetry, improves oversight and strengthens operational engagement. This seems to support the case for investing closer to home.

Strategies for direct exposure

For family offices that want exposure to direct investing without taking on excessive risk, several strategies can help balance opportunity with caution.

One approach is to participate in syndication or club deals. Rather than taking on the full burden of sourcing, structuring and managing an investment, family offices can partner with other investors under pre-negotiated terms. Family offices prefer this model, with as much as 60% choosing club deals to gain exposure to private equity without shouldering the full operational workload.¹⁵

Co-investing alongside private equity firms offers another solution. In this model, family offices invest directly in a company but do so alongside an established private equity sponsor, leveraging the firm’s due diligence, structuring capabilities and operational nous. A third strategy, and one that is almost universally embraced, is blending direct investing with fund commitments. This benefits from the diversification effects of fund investing while maintaining control over select investments. Many family offices find that fund investing provides access to high-quality deals and professional management, while direct investing allows them to tailor their portfolios and reduce costs. Striking a balance between the two is almost always the preferred tactic.¹⁶ ¹⁷

Balancing risk and reward

We believe that the best path forward for family offices seems to be strategically engaging with both direct and fund investing. By incorporating direct investments and co-investments where they have strong industry knowledge while maintaining fund allocations for diversification, family offices can look to optimise their private equity exposure. This balanced strategy allows investors to potentially capture the best of both worlds while mitigating their respective risks, setting portfolios up for a potential long-term success.

¹ https://www.privatebank.citibank.com/doc/family-office/global-family-office-2024-survey-insights.pdf.coredownload.inline.pdf ² https://www.cnbc.com/2024/09/20/family-offices-most-bullish-in-years.html ³ https://www.deloitte.com/nl/en/services/deloitte-private/research/family-office-insights-serie.html ⁴ https://www.deloitte.com/nl/en/services/deloitte-private/research/family-office-insights-serie.html ⁵ https://caia.org/sites/default/files/direct_investments.pdf ⁶ https://caia.org/sites/default/files/direct_investments.pdf ⁷ https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2159229 ⁸ https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2159229 ⁹ https://www.bloomberg.com/news/articles/2024-09-12/chanel-owners-l-oreal-heir-said-to-invest-in-olsens-the-row ¹⁰ https://www.businesswire.com/news/home/20241030053048/en/Wrexham-AFC-Welcome-Allyn-Family-as-Minority-Investors ¹¹ https://www.pwc.com/gx/en/services/family-business/assets/global-family-office-deals-study-v4.pdf ¹² https://knowledge.wharton.upenn.edu/article/whats-behind-the-secret-walls-of-family-offices/ ¹³ https://www.cnbc.com/2024/12/16/family-offices-risks-direct-investments-private-companies.html ¹⁴ https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2159229 ¹⁵ https://www.pwc.com/gx/en/services/family-business/family-office/family-office-deals-study.html ¹⁶ https://www.barrons.com/articles/family-offices-bet-private-equity-how-that-will-reshape-the-market-a26a616c ¹⁷ https://www.ubs.com/content/dam/assets/wm/global/uhnw/doc/ubs-gfo-report-2024-single-pages.pdf