2024 has been a momentous year politically and it will set in train a range of profound technological and macroeconomic changes next year — amongst those could be a spur for private equity activity, currency volatility and a contested geopolitical scene. We look ahead to the main themes we expect to see materialise in 2025.

Private assets catalysed, at last

The election of Donald Trump as president for the second time has had a major impact on crypto and stocks.¹ ² What is much less perceptible is the impact on private assets (though the share prices of private equity firms have risen³). Our sense, which in many ways echoes views from GPs and other stakeholders, is that after a two year lull, the election result could catalyse a restart of private deal making and unblocking of the dealflow and distribution pipelines.

Monetary policy will help this process.

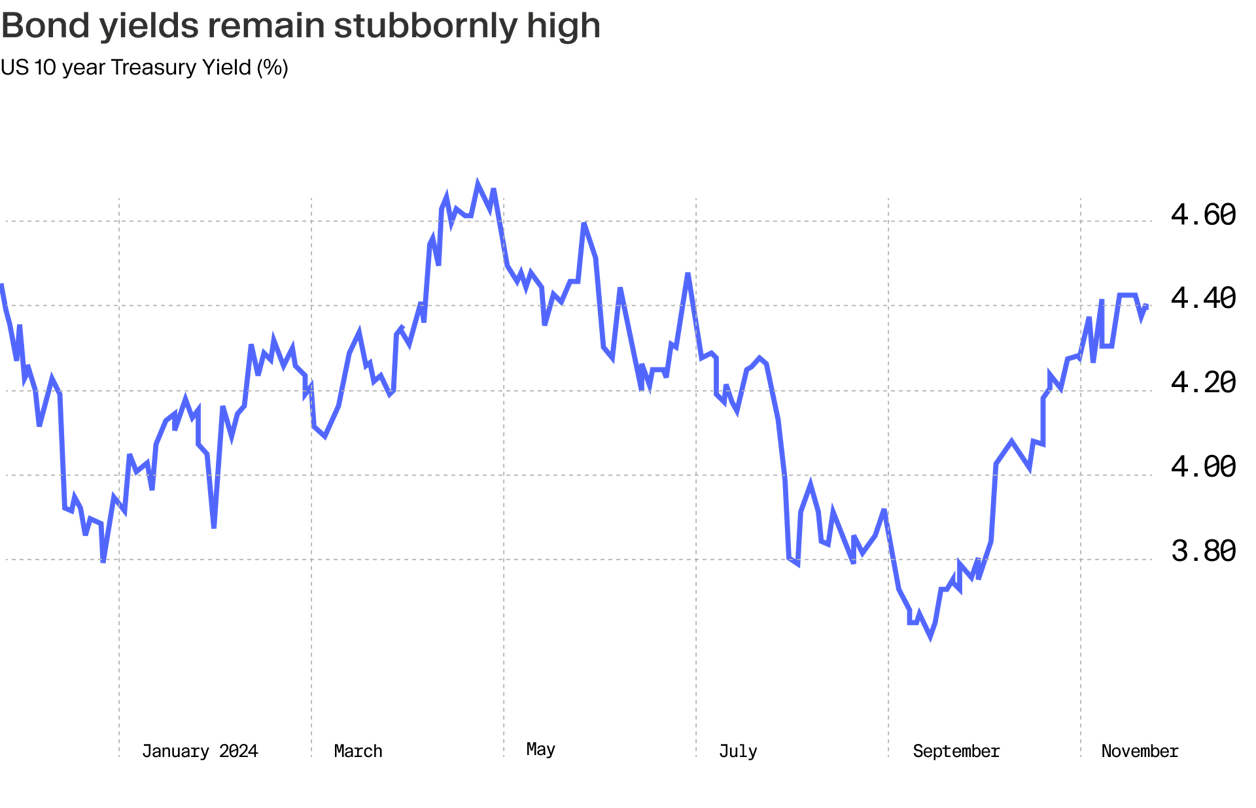

In September twenty-four central banks worldwide cut interest rates,⁴ a scale of easing only previously seen in the COVID and global financial crises. While the subsequent rise in long-term bond yields called into question the wisdom of such aggressive cuts, messaging from central banks — as we head into the end of the year — hints at further cuts.⁵ Indeed, the Fed cut rates again in November.⁶ We suspect that of the major central banks, the ECB has room to cut further.

In this context the financial system is enjoying a bout of easy money, which in turn should help financial stocks and activity in private equity. It may also help to prepare the ground for the return of IPOs in 2025, with several large European fintechs set to come to market. Should this occur, it may breathe life into deal making in European fintech.⁷

Staying within the banking sector, the large European banks remain healthy lenders to households, but we feel that there is great scope for private credit to continue its growing role as a lender to firms.

An offshoot of the above theme is that there will be limited scope for governments to embark on large investment projects. The UK budget was a case in point where the Chancellor altered the UK’s fiscal rules to make it easier for the government to invest in greentech. However, the stated investment amount, £20 billion, is far lower than the requirements of the UK economy. In that respect we are carefully watching UK policy in particular for signs of greater involvement by private capital.

Technology: AI has dominated fundraising but what’s next?

Artificial intelligence (AI) has outstripped venture fundraising across other sectors this year. Pitchbook reported that in Q3 2024 alone, VC’s invested nearly $4 billion in some 209 AI startups (75% of that was in the US, not including a round for OpenAI).⁸ Indeed, in the first half of 2024, AI accounted for 40% of venture fundraising in the US.

In that context, an industry ecosystem is now beginning to form. A small number of large language model (LLM) projects are garnering funding, skilled labour and strategic partners. While this funding trend will continue into 2025, at least two questions are abegging. What parts of the AI sector will investors start to focus on and are there other industries that will be ‘hot’ in 2025?

On the first question, our sense is that datasets, especially private datasets in financial segments like options trade, payments and related transaction data will be more sought over. Secondly, we are likely to see a shift towards applied AI, or rather the use of AI in practical and specialised means — such as drug discovery or its use in the military theatre.

A second trend that may emerge is the notion of tech as a response to a broken world. If we consider that record obesity rates in many countries⁹ or severe global climate warming are now facts of life and very hard to reverse,¹⁰ we may see the advent of ‘moonshot’ technologies to combat the side-effects of these. Obesity drugs are an example here and we will likely see more radical new approaches to combating climate damage such as solar radiation management (SRM).

After a year of elections — the fiscal rectitude begins

2024 was a momentous year for democracy. France had a surprise election, Donald Trump became president of the US again and Labour won a resounding mandate in the UK, amongst the highlights. We still have a general election in Japan and the prospect of an election in Germany next February. In the cases of the US, UK and France, elections have seen bond yields rise in the context of near record indebtedness and very large deficits.

In that respect, with elections largely over, the fiscal hangover begins. Governments across regions will find themselves reined in by bond markets and under pressure to curb spending and in some cases to raise taxes. This pressure alone may eventually tilt economic policy more towards supply side changes and also change the kinds of issues that politicians focus on such as immigration and identity politics.

Fiscal rectitude may only come to reign after a few bond market tantrums. There are two countries in particular worth watching — France and the US. First, the French budget process has been very drawn out, and with France having to cut its deficit in half over the next three years, it is unlikely that France’s political class, not to mention its public, are ready for deeper austerity. In that way, higher French bond yields will be a fixture in markets and might periodically push much higher.

The other market to watch is the US bond market, which in 2025 may become the limiting factor for equity and other riskier assets. Since the Fed cut interest rates by 50 basis points in September, bond yields have risen and remain stubbornly high.¹¹ With growth in the US economy strong, and other economies steadying, the risk factor is that inflation rises (though lower oil prices and deflation from China can offset this), driving bond yields higher, or that the desire of the Trump administration to run the economy ‘hot’ provokes a rise in yields. In this sense, the bond market may become Trump’s nemesis.

Policy at a premium: trade wars and strategic autonomy shape the multipolar world

The election of Donald Trump leaves no ambiguity over the end of globalisation. The world is marching towards a multipolar form, which will be conditioned by the friction generated by tariffs — if the work of Robert Lighthizer, Trump’s Trade Representative (i.e. ‘No Trade is Free’), is anything to go by.

One, gathering response to this is re-industrialisation and the advent of strategic autonomy as a policy goal. The new EU commission reflects this in terms of the roles and missions of the new commissioners in areas like trade, technology and finance. One example is the appointment of Europe’s first defence commissioner, whose first role will be to compile a report on the state of Europe’s military supply chains.

Whilst this news generates a sense of foreboding, it opens up a new vista for private equity and venture in the sense that in Europe in particular, this trend will be largely driven through private investment — from infrastructure funds to venture.¹² Segments we are focused on are space, quantum, military procurement and heavy equipment, aerospace and telecoms.

Risks — from war to China recession

Four years ago, the consensus was that we still lived in a globalised world — one new development to shatter that has been the outbreak of two bloody conflicts — invasion of Ukraine by Russia and the attack on Israel by Hamas and its response. It is possible that both conflicts will come to an end in 2025. In Ukraine there is growing talk of a negotiated end to the conflict¹³ ¹⁴ and in the Middle East there is greater attention on the post-conflict geopolitical landscape, mostly notably how the weakening of Iran will impact the balance of power.¹⁵ Our view is that an end to one or both conflicts is very welcome from a humanitarian point of view.

However, it is easy for headline writers to focus on war and although it is a significant risk, we think that a prolonged downturn in the Chinese economy is an even greater risk.

Despite a recent, aggressive financial stimulus, the Chinese economy is gripped by deflation — in house prices, activity and a fall in entrepreneurial activity. Underlying this is a generalised demand problem.

This year’s plenum on economic policy has not done much to repair the structural creaking of the economy and the worry is that internal ‘reform’ (i.e. a political crackdown) further saps the willingness of entrepreneurs to invest.

Equally, President Xi’s shaping of China in the form of a more closed state (which makes for a less open world) curbs the will of those inside, adopts a singularly selfish approach to those outside and relies on several great strides in technological industrialisation for the prolongation of the ‘China Dream’.

The contradiction here, and specifically between the three strands to emerge from the plenum, is that in its policy making (social infrastructure) and economy (high quality development) China needs innovation but is creating a socio-political system that smothers it.

In this respect, the third plenum and the recent liquidity boost missed a trick in not outlining a Keynesian style stimulus for the economy (or even longer-run structural one). The property market is slowing, entrepreneurs are very cautious and the risks associated with local government debt are rising.

While China has so far managed to duck a major recession, the government may have become too complacent about the deleveraging process, while possibly accelerating this process downwards.

A period of disruption

In summary, the unifying thread across the themes is disruption — of markets, technologies and the way states operate. It will surely throw up many private asset opportunities.

¹ https://www.reuters.com/markets/us/sp-500-futures-soar-record-high-after-trump-claims-victory-2024-11-06/ ² https://www.reuters.com/technology/crypto-market-capitalisation-hits-record-32-trillion-coingecko-says-2024-11-14/ ³ https://www.spglobal.com/spdji/en/indices/thematics/sp-listed-private-equity-index/#overview ⁴ https://tradingeconomics.com/country-list/interest-rate?continent=world ⁵ https://www.reuters.com/markets/rates-bonds/ecb-set-second-straight-rate-cut-economy-stagnates-2024-10-16/ ⁶ https://www.forbes.com/sites/jasonschenker/2024/11/07/the-fed-just-cut-interest-rates-and-more-rate-cuts-are-coming/ ⁷ https://www.bnnbloomberg.ca/business/2024/11/21/klarnas-planned-ipo-sets-the-stage-for-more-fintech-listings/ ⁸ https://techcrunch.com/2024/10/20/investments-in-generative-ai-startups-topped-3-9b-in-q3-2024 ⁹ https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight ¹⁰ https://earthobservatory.nasa.gov/world-of-change/global-temperatures ¹¹ https://markets.ft.com/data/bonds/tearsheet/summary?s=US10YT ¹² https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf ¹³ https://www.economist.com/graphic-detail/2024/11/20/most-ukrainians-now-want-an-end-to-the-war ¹⁴ https://carnegieendowment.org/europe/strategic-europe/2024/11/behind-the-scenes-preparations-for-russia-ukraine-negotiations?lang=en ¹⁵ https://www.bbc.com/news/articles/clylzx1xz2yo