Key takeaways:

- Private equity fund managers and their investors are now tapping into an increasing variety of options to generate liquidity in what continues to be a difficult exit market.

- Signs of a more stable macro-economic outlook may boost exit numbers in the second half of the year, but alternative routes to liquidity will continue to be important.

- Alternatives to traditional exits offer GPs and LPs additional choice and flexibility in the way they free up capital from their portfolios.

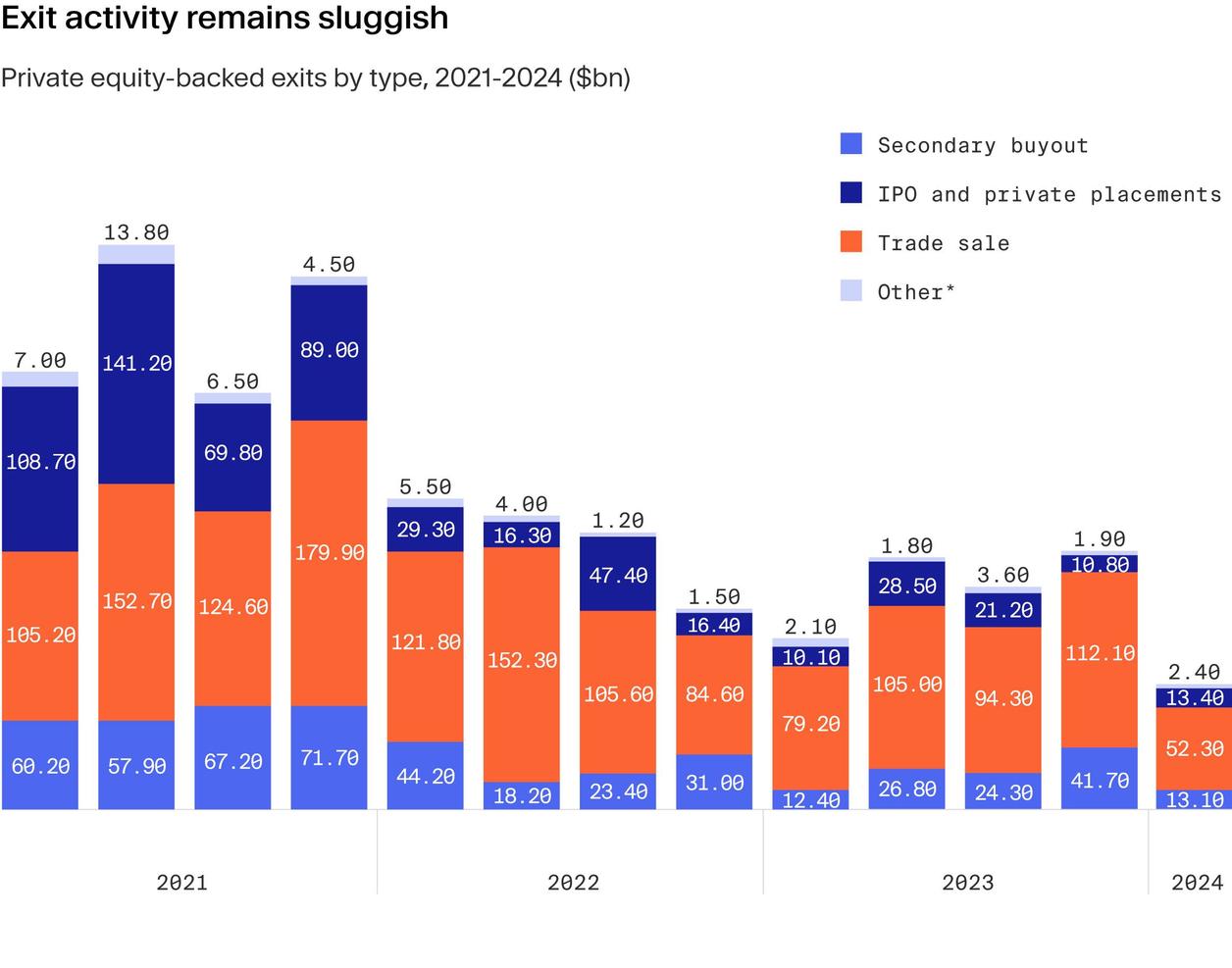

Last year’s challenging exit conditions for private equity have continued into 2024 so far as global values fell in the first quarter of the year. At $81.2 billion, exit value was down by 22% year-on-year and by half from Q4 2023, according to Preqin.¹

General partners (GPs) have been holding off selling portfolio companies in an unfavourable and uncertain environment. This is evident from the average holding period for European exits in 2024: it rose to 5.8 years, the highest on record, according to Gain.pro.²

However, waiting for better conditions inevitably delays distributions to investors and creates liquidity issues in the market since limited partners (LPs) cannot use distributions to commit to new funds.

Brighter skies ahead?

There are signs that the outlook for exits is improving. Among the biggest barriers has been high financing costs stemming from elevated interest rates. Yet inflation is now coming under control. In the UK, for example, the Consumer Prices Index rose by 2.3% in the 12 months to April 2024, significantly down on the 8.7% recorded a year earlier.³ In the euro area, the annual inflation rate was 2.6% for May this year, which is a slight increase month-on-month but still a significant decline from 6.1% the 12 months previously.⁴

This has led to interest rate reductions across Europe. Indeed, the Swiss⁵ and Swedish central banks have already made one cut in the past few months, while the ECB lowered its benchmark deposit rate by a quarter percentage point to 3.75% in early June.⁶ Should interest rates start to reduce further and in the US as well, lower financing costs could stimulate M&A activity, leading to a more accommodating exit environment.

Some green shoots have also started to emerge in IPO exit activity this year. EQT-backed dermatology business listed on the SIX Swiss Exchange in March, while Triton portfolio company RENK, which makes components for defence and civil vehicles and machinery, went public in February. Both companies — at the time of writing at the end of May — have shown strong aftermarket performance.⁷⁸

These suggest that markets are warming to IPOs once more, although investors are being selective — CVC-backed Parfumerie Douglas also listed this year, but with more mixed results.

Exit activity therefore may pick up as we move through the second half of 2024. However, we’re unlikely to see a full rebound.

What’s the alternative?

So, with $3.2 trillion sitting unrealized in buyout portfolios globally, and more than 40% of companies held in portfolios for at least four years, according to Bain & Co⁹, the pressure is on for GPs to find liquidity routes.

Even with the potential for some improvement in the exit markets by the end of the year, LPs are looking for ways to free up capital from their private equity portfolios. Meanwhile, GPs are making use of, and developing, alternative realisation strategies to return capital to their investors. Here are some of the current and emerging options.

LP-led secondary deals

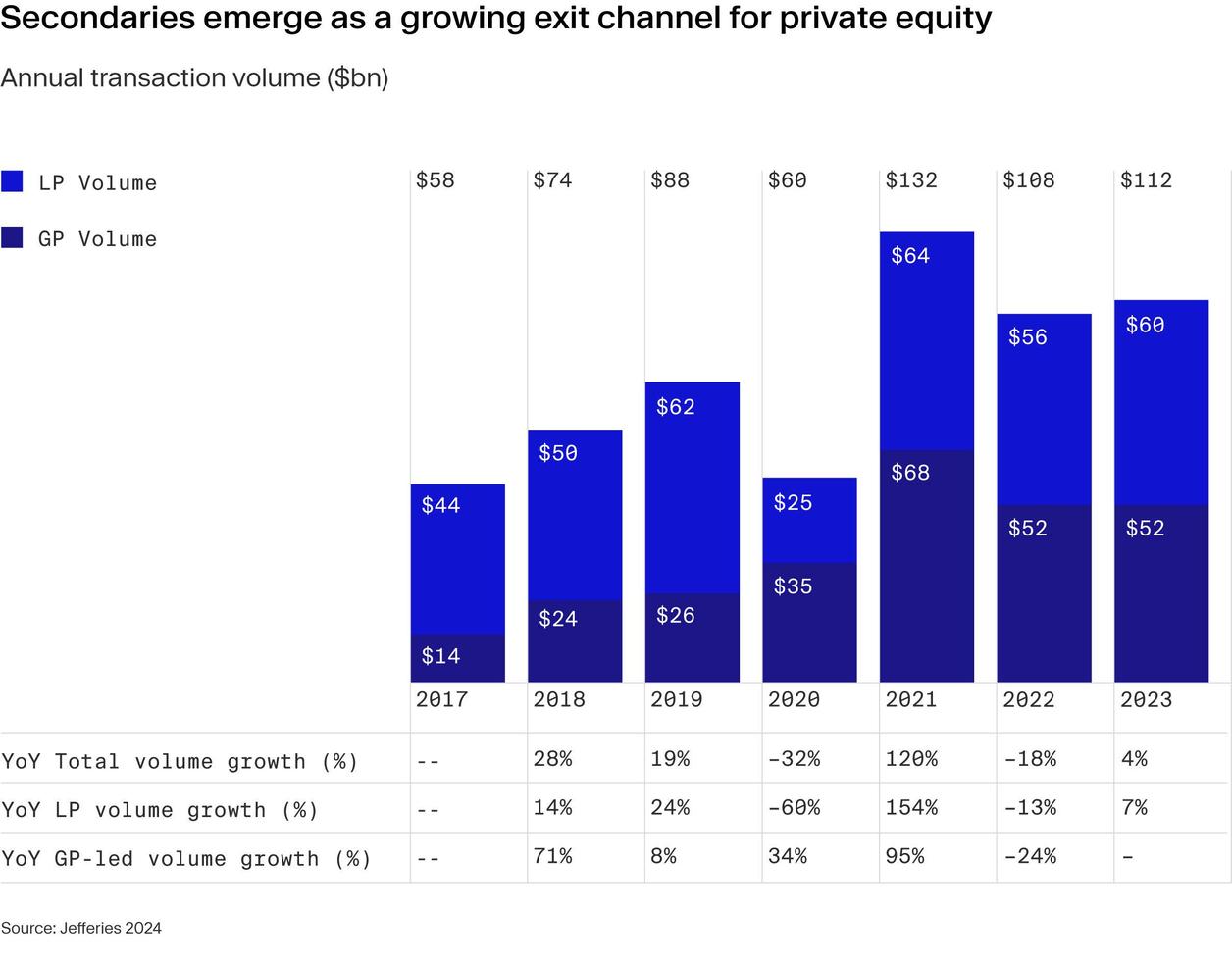

The most established route to liquidity, secondaries funds have for decades offered to buy up portfolios of assets from LPs seeking liquidity or, as the market developed, from those wishing to rebalance their private equity portfolios or manage them more actively.And LP-led activity has been brisk over recent years, with 2023 registering transaction volumes of around $60 billion.¹⁰

This year could end up being record-setting as LPs increasingly seek to release capital¹¹ — there are signs these predictions might be correct. In the first quarter, 65% of secondary deals by volume were LP-led, according to PJT Park Hill, with the overall secondaries market activity up around 20% compared to the same period in 2023.¹²

GP-led secondaries

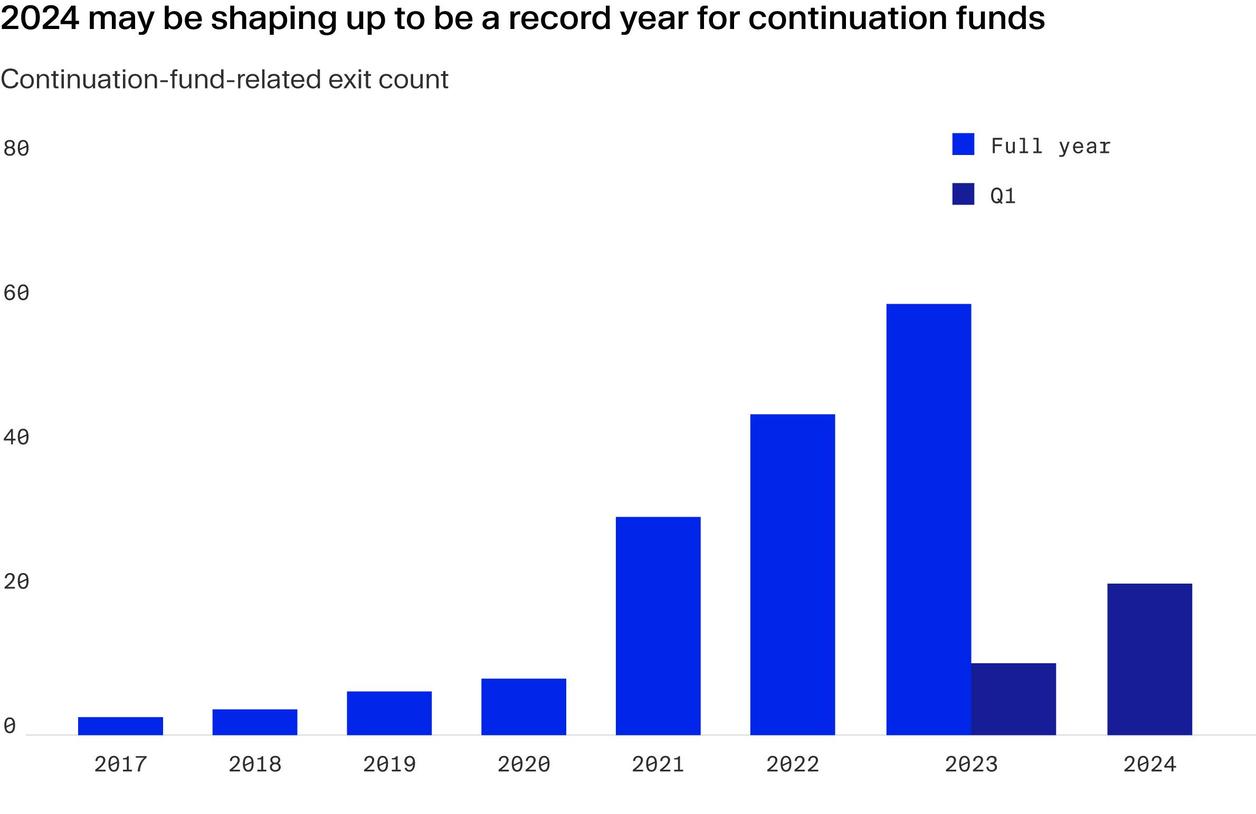

The LP-led market’s younger cousins, GP-led deals, have grown markedly over the past five years and today represent around 50% of secondary deals. This is a significant increase compared to 2017-2019, when GP-leds made up less than 30% of the entire secondary volume.¹³ Initiated by the GP, these deals typically see a company or companies rolled into a continuation vehicle, with LPs offered the chance to hold their investment or sell and receive distributions.

And 2024 so far suggests that GPs are increasingly tapping secondary capital to offer their LPs a liquidity option. In the US, the number of announced continuation fund deals was up in Q1 2024, versus the same period in 2023. The largest was a $3 billion single asset deal — Alterra Mountain Partners, backed by KSL Partners.¹⁴ A notable recent UK GP-led deal was also Permira’s continuation fund consisting of five companies, with Coller Capital acting as lead investor.¹⁵

GP-leds have really come into their own in the difficult environment of the past two years. Many GPs now view them as a mainstream, fourth exit route, alongside IPOs, trade sales and secondary buyouts. Activity here is likely to continue well past any future exit rebound, although GPs will clearly need to fully realise these investments at some point in the future.

Evergreen structures

Evergreen, or semi-liquid, funds are another growing alternative to traditional closed-ended private equity limited partnership vehicles. These funds offer investors immediate exposures and subscriptions and redemptions at set intervals.

Primarily targeted at individuals, their profile, also appeals to some institutional investors that value periodic liquidity features. Over the past five years, the number of evergreen funds has nearly doubled, reaching 520 by the end of 2023, with an estimated $350 billion of net asset value.¹⁶

NAV lending

NAV lending is not new, but adoption has been rising recently to meet GPs’ and LPs’ quest for liquidity. It involves borrowing against the underlying assets in a portfolio, based on their net asset value — hence the name.

GPs are using NAV lending in a variety of ways, for example, to build value and fund further growth in older portfolio companies and to ready the business for exit or perhaps as an alternative to a GP-led deal. Another use is to refinance portfolio companies more cheaply than might be the case elsewhere.

NAV lending is also applied to fund GP commitments or, occasionally, to provide LPs with distributions. LPs also use NAV facilities to generate liquidity from their portfolios as an alternative to a secondary sale.

Independent estimates of the market size are difficult to come by, but recent analysis by fund administrator Citco — which is also looking to expand NAV lending — suggests that NAV facilities experienced a 30% compound annual growth rate between 2019 and 2023.¹⁷

The fact that relative newcomers Citco, Axa Investment Managers¹⁸ and Pemberton Asset Management¹⁹ are joining more established players, such as 17Capital, in growing their platforms in this area points to expectations of strong future demand.

Securitisation and structured transactions

Securitisations and structured transactions have been gaining both GP and LP interest of late. They can also offer liquidity plus the potential to benefit from future upside, unlike in a traditional secondaries sale.

One recent example is Dawson Partners’ $425 million structured transaction involving 19 of Churchill Asset Management’s buyout fund interests to offer liquidity for investors, as well as generate capital to expand the firm’s GP-led and co-investment activities.²⁰

Singapore-based Azalea launched a collateralised fund obligation involving its stakes in 38 funds back in 2022²¹, while there are reports that several US public pension plans have been also considering these structures as an alternative to secondaries sales.²²

Private stock sales and private placements

While not yet a fully formed option, private stock sales are under active discussion as a new alternative exit route. Among those considering these deals is EQT chief executive Christian Sinding, who believes there is the opportunity to “replicate the public markets, but keep the business private” by running private auctions among the firm’s 1,200 LPs for portfolio companies, as he explained in a recent ‘Deal Talk’ interview with Steffen Pauls, Moonfare’s Founder and co-CEO.

These kinds of private placement could, in future, offer an alternative to IPOs when markets are less welcoming to new issues.

Increasing options

Alternative exit strategies are growing in importance for private equity, offering more choice and flexibility in the way GPs and LPs can gain liquidity. This is particularly pertinent at points in the cycle when more traditional exit routes are either closed off or are less attractive.

The vast majority of distributions to investors will still come from trade sales, secondary buyouts and IPOs, but alternatives are adding to private equity’s liquidity toolbox. They also demonstrate the industry’s resilience and adaptability through all points of the economic cycle.

¹ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-exit-value-sinks-to-3-year-low-in-q1-81247928 ² https://www.gain.pro/investor-reports/the-state-of-european-private-equity-full-report?submissionGuid=b8da7cff-7f60-4e1c-836d-574d88d80ea4 ³ https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/april2024 ⁴ https://ec.europa.eu/eurostat/web/products-euro-indicators/w/2-17052024-ap ⁵ https://www.snb.ch/en/the-snb/mandates-goals/statistics/statistics-pub/current_interest_exchange_rates#t00 ⁶ https://ec.europa.eu/eurostat/web/products-euro-indicators/w/2-31052024-ap ⁷ https://markets.ft.com/data/equities/tearsheet/summary?s=R3NKX:GER ⁸ https://investors.galderma.com/share-information/share-price ⁹ https://www.bain.com/insights/topics/global-private-equity-report/ ¹⁰ https://www.jefferies.com/wp-content/uploads/sites/4/2024/01/Jefferies-Global-Secondary-Market-Review-January-2024.pdf ¹¹ https://www.jefferies.com/wp-content/uploads/sites/4/2024/01/Jefferies-Global-Secondary-Market-Review-January-2024.pdf ¹² https://info.pjtpartners.com/PJT_Park_Hill_Secondary_Market_Insight_Q1_2024 ¹³ https://www.jefferies.com/wp-content/uploads/sites/4/2024/01/Jefferies-Global-Secondary-Market-Review-January-2024.pdf ¹⁴ https://files.pitchbook.com/website/files/pdf/Q1_2024_US_PE_Breakdown.pdf ¹⁵ https://files.pitchbook.com/website/files/pdf/Q1_2024_US_PE_Breakdown.pdf ¹⁶ https://www.preqin.com/insights/research/blogs/evergreen-capital-funds-hit-record-high-at-350bn-on-private-wealth-demand ¹⁷ https://www.citco.com/insights/nav-lending-grows-rapidly-as-heightened-disclosure-looms ¹⁸ https://axa-im.co.uk/media-centre/full-year-2023-earnings ¹⁹ https://pembertonam.com/nav-financing/ ²⁰ https://dawsonpartners.com/post/dawson-partners-and-churchill-asset-management-complete-425-million-structured-liquidity-solution-transaction/ ²¹ https://www.ft.com/content/e4c4fd61-341e-4f5b-9a46-796fc3bdcb03 ²² https://www.privatefundscfo.com/large-pension-fund-plans-fund-interest-securitization-by-end-of-year/