Key takeaways:

- Co-investments offer LPs a cost-effective way to gain direct private equity exposure.

- Many LPs now consider co-investment rights one of the essential factors in selecting GPs, as they seek alternative ways to deploy capital and build deeper manager relationships.

- With the market having cooled, more opportunistic investors have exited, allowing experienced LPs to secure co-investment opportunities with attractive terms and greater strategic alignment.

Gaining direct exposure to private equity via co-investments is a strategy almost as old as the asset class itself, for one simple reason. Limited partners (LPs) have long been drawn to the opportunity for more favourable economics.

When a PE firm finds a company to invest in, they might seek additional capital to complete the transaction or to prevent over-concentration in a single deal. These deals are offered up as co-investments to LPs, who invest their money directly into that specific company alongside the PE firm.

By reducing or eliminating entirely the standard management fees and carried interest charged, co-investments are more cost effective and can therefore improve net returns. Research indicates that more than 60% of co-investment deals outperform the net Total Value to Paid-In Capital (TVPI) of parent funds, and 75% outperformed the loss ratio.¹

Added benefits for LPs include greater control over their investment selection and deeper relationships with GPs. By doubling down on high-potential deal opportunities, investors are able to construct a portfolio that better aligns with their investment strategy and goals. And through close collaboration during the due diligence process and throughout the holding period of an investment, LPs gain a deeper understanding of a GP’s strengths, weaknesses and how exactly they drive value creation.

Equity gaps

While this has always held true, recent trends have created even stronger incentives for GPs to offer co-investment rights. Multi-decade high interest rates have made debt financing expensive, which can erode returns and may require larger equity contributions on deals. Today’s slower fundraising market is also a factor. The median time to close across US PE funds rose to 18.1 months in H1 2024, up from 14.7 months in 2023 and 11.2 months in 2022.² Co-investments provide a way to keep capital deployment on track even when funds face capital shortfalls. Despite this need to bridge the equity gap, co-investment activity cooled in the first half of 2024. Data from S&P Global show that $7.3 billion worth of such deals were minted through July, whereas $30.6 billion were made throughout 2023.³

This is hardly a surprise. Industry participants believe this merely reflects the broader torpor in M&A markets. Co-investment activity also soared in 2021 and many tourist investors who entered during that brief boom period have since exited.⁴⁵ This market correction has been beneficial, refocusing co-investments on committed investors and laying the ground for a rebound.

Firm intentions

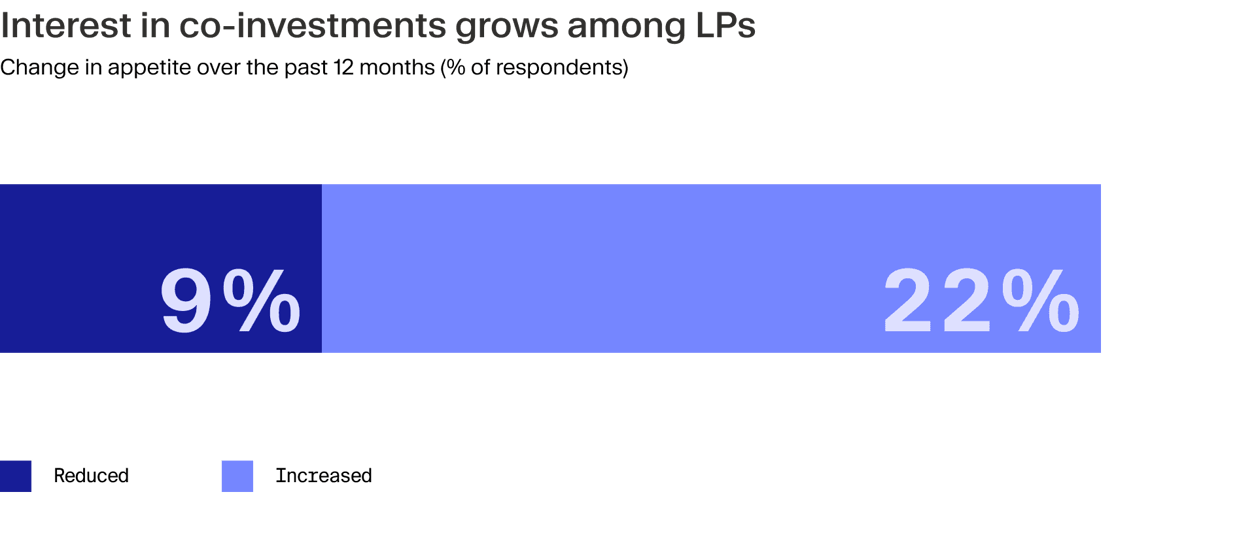

Investors have firm intentions to increase their exposure to the strategy and expect GPs to satisfy this demand. A survey from Coller Capital Winter Barometer found that 22% of LPs have increased demand for co-investment, while only 9% have said they are doing less of these investments.⁶

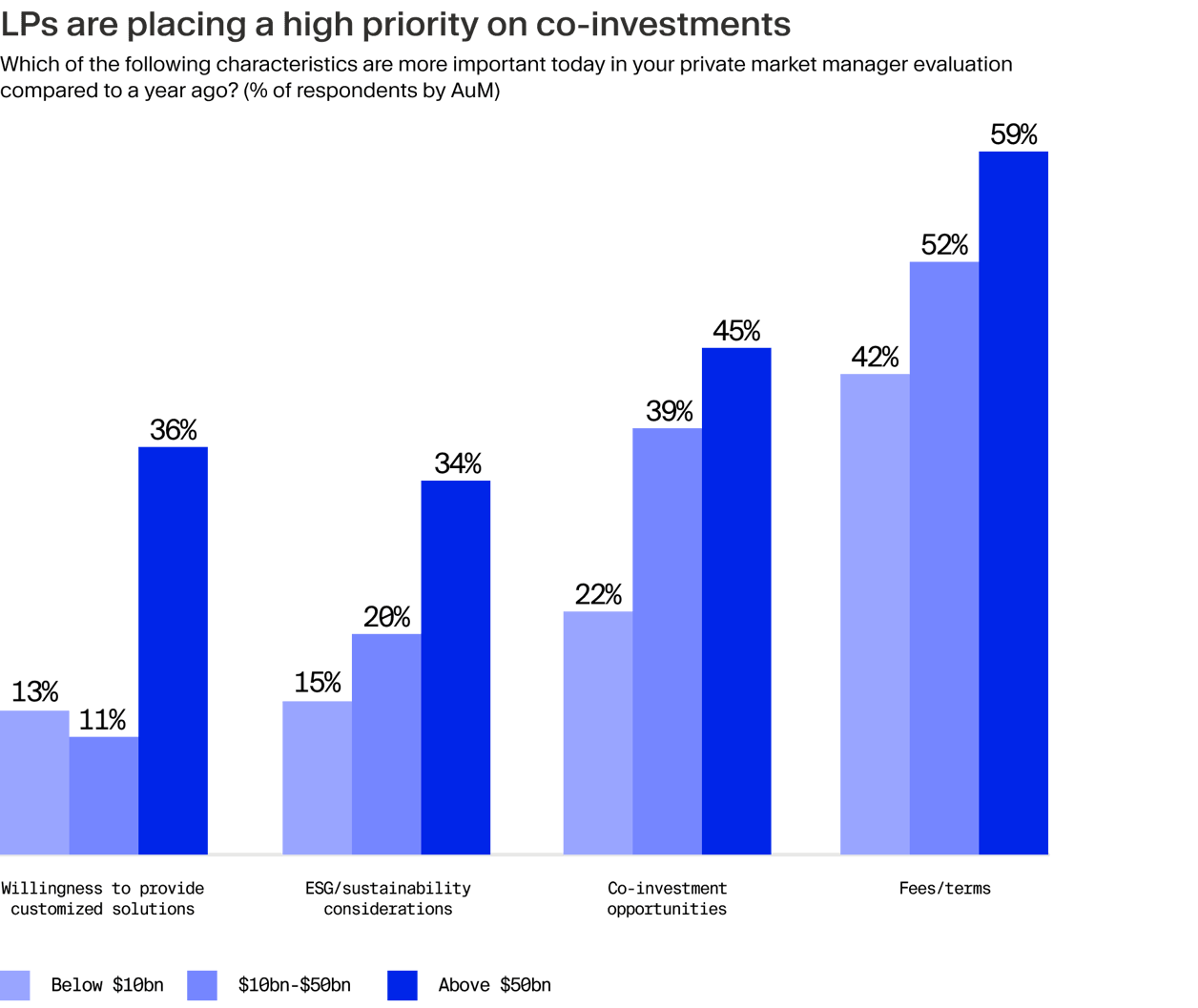

What’s more, co-investment rights are playing a greater hand in manager selection. On a weighted average basis, 35% of LPs of various sizes in a recent Goldman Sachs survey reported that co-investments are more important today than a year ago when analysing which GPs to back.⁷ This scored even more highly than ESG credentials.

Market developments

Some large LPs are evidently taking steps to gain an edge in the co-investment field. This summer, it emerged that the California State Teachers' Retirement System (CalSTRS), the largest education-only pension fund in the world, adjusted its policy to allow investment staff to bypass third-party approvals for co-investments valued under $250 million.

This move aligns with CalSTRS’ “collaborative model”, an initiative launched in 2018 to grow its private equity portfolio through direct and co-investments, reducing its reliance on traditional fund structures.⁸

CalSTRS' stronger push into co-investments is partly driven by rising competition from Middle Eastern sovereign wealth funds like the Abu Dhabi Investment Authority and Mubadala Investment Co. These funds have increasingly seized co-investment opportunities, deploying billions in recent years to help close private equity deals.⁹

Meanwhile, recent deals where LPs invested alongside their GPs include a $1.3 billion investment in eStruxture Data Centers, Canada’s largest data centre platform, co-led by Fengate Asset Management and Partners Group. The Labourers' Pension Fund of Central and Eastern Canada and the Wener Family Office participated in the transaction.

Another large transaction included Paine Schwartz Partners closing a $960m take-private of Australian fruit and vegetables producer Costa Group alongside Driscoll’s and British Columbia Investment Management Corporation.¹⁰

Key considerations

Co-investments are not without risks. A common concern is adverse selection, or the so-called “lemons problem”. This is widely considered to be a result of GPs offering co-investors lower-quality deals while retaining the best ones in their funds to maximise their carry.

There is limited evidence to suggest this is a real-world phenomenon.¹¹ After all, GPs are strongly incentivised to perform well, making it unlikely they would invest in deals they view as subpar. Additionally, it is difficult to predict a deal’s success at closing.

For investors concerned about adverse selection, this risk can be reduced through careful selection. It’s essential to co-invest with reputable PE firms that have strong track records in specific sectors or geographies, and which can offer high-quality deal flow.

Another key risk to consider is concentration. By investing larger amounts in individual companies, LPs may expose themselves to excessive sector or company-specific risk, which can impact portfolio diversification and increase volatility.

Additionally, the potential for resource strain cannot be overlooked; sourcing, conducting due diligence and managing a meaningful co-investment program require substantial resources and expertise, which many LPs lack.

Co-investing through a fund: best of both worlds

One solution to the risk management, perhaps paradoxically, is investing in a dedicated co-investment fund. This mitigates the blind-pool risk associated with traditional primary funds while keeping management fees and carried interest costs to a minimum. For investors seeking to increase their private equity exposure while potentially maximising their potential net returns, co-investment funds offer a unique middle ground. These vehicles combine the selective exposure and reduced fee structure of direct co-investments with resources of a structured fund and professional management.

Moonfare’s co-investment opportunities, for example, are sourced and vetted by seasoned PE professionals with 200 years of combined experience and deep connections with over 250 top-tier fund managers. This access allows us to curate a selection of high-quality co-investment deals rarely found elsewhere.

¹ https://www2.stepstonegroup.com/Doubling_down_on_private_equity_coinvestments ² https://pitchbook.com/news/articles/private-equity-longer-fundraising-timelines ³ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/limited-partner-coinvestment-deals-decline-in-h1-2024-82788279 ⁴ https://www.privateequityinternational.com/roundtable-the-future-of-co-investment/ ⁵ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/limited-partner-coinvestment-deals-decline-in-h1-2024-82788279 ⁶ https://www.collercapital.com/wp-content/uploads/2023/12/Coller-Capital-Global-Private-Equity-Barometer_Winter-2023-24_DIGI.pdf ⁷ https://am.gs.com/cms-assets/gsam-app/documents/insights/en/2024/am-private-markets-survey-2024.pdf ⁸ https://pitchbook.com/news/articles/calstrs-new-policy-expands-co-investment-capabilities ⁹ https://www.pionline.com/sovereign-wealth-funds/us-pensions-compete-gulf-sovereign-wealth-funds-private-equity-deals ¹⁰ https://paineschwartz.com/news/costa-group-enters-new-ownership-phase-as-experienced-consortium-takes-control/ ¹¹ https://www.sciencedirect.com/science/article/abs/pii/S0304405X19302144