Key takeaways

- Private equity investments and certain types of real estate investments are assets that possess a long-hold nature and the ability to provide income.

- Buying physical real estate is a highly location-dependent investment and requires time and money to be managed properly.

- Real estate investment trusts and private equity real estate offer publicly and privately managed property-investment funds, both of which have different approaches and target returns.

- Equity and real estate both have a place in a balanced portfolio, and depending on the investment horizon, offer private counterparts.

This article will assume a certain degree of knowledge of the characteristics of private equity. For a guide to private equity, take a look at our PE Masterclass.

Investing in assets for the long term is a key element of any balanced portfolio strategy. As well as discouraging speculation, viewing investments over a further time horizon can help wed income targets with an investor’s longer-term goals.

Recently, the number of asset types available on the market to achieve this has increased markedly, and adding private equity variants to portfolios is increasingly seen as a way to add diversification and long-term return benefits. Many people, however, may think they need to decide between investments that might seem similar but have critically different characteristics.

In reality, investors should look to have a mixture of assets as part of balanced portfolio construction, rather than consider them to be mutually exclusive. Within private market strategies, however, individuals may hold a preference for certain assets depending on their risk appetites and goals.

Here, we compare the two most common types of investment that fit the long-hold strategy with a potential for outsized returns: real estate and private equity.

Types of Real Estate investments

At a high level, we can identify three different basic types of real estate investment one might consider when adding alternatives to your portfolio.

Direct Real Estate Investments

The most hands-on approach are direct real estate investments, where you - as an individual or with a group of others - buy and manage properties. An investor might take out a mortgage on a property with a view to receiving long-term income and selling for a profit, years in the future. This can be lucrative, as using leverage can magnify capital gains in the long term alongside the potential for consistent income.

It can also be advantageous if you are investing in a location and market you are familiar with; previous research has indicated that residents who purchased second homes locally earned more from their property and sold into stronger markets than out-of-town investors.¹ The downside here is that it can narrow the focus to areas that you know - meaning that the pool of options is far smaller.

The level of personal involvement can also be incredibly high. Sourcing properties in person, managing renovations, dealing with tenants and running the risk of vacancy in the wrong market can all be resource-consuming and stressful. In addition the benefits of investing in a property market locally are mitigated by its concentrated nature; pooling your capital into a single property leaves it static and vulnerable to local movements that may not affect the wider market.

Real Estate Investment Trusts (REITs)

To mitigate this risk of lack of diversification, some investors favour real estate investment trusts (REITs). These vehicles actively buy, manage and sell rental properties, usually cash-producing leases.

REITs are traded on exchanges and– as they are required to pay out 90% of profits as dividends– are similar in many ways to a dividend-paying stock. It also acts as a quasi-fixed income investment, given that rent payments provide a steady income stream to investors similar to yield. Managed by professionals, REITs are fully hands-off, however they do charge fees, and still run the risk of vacant properties during periods of economic downturn.

Private Equity Real Estate

As the name suggests private equity real estate uses a private equity fund structure to invest in real estate opportunities. These investments relate to public REITs in much the same way as a regular private equity fund relates to public equity.

Private equity real estate funds often take on a far more active role than REITs, usually focusing on properties with some value and opportunities to renovate, reposition or redevelop, as well as more opportunistic approaches such as taking on distressed sellers.

This latter method targets, by nature, more illiquid properties, with a “buy-fix-sell” approach over a three-to-four year holding. Compared with REITs, private equity real estate is targeting longer-term and higher returns, without any requirement to distribute income as dividends.

These strategies are highly similar to the approach of private equity managers, and many PE giants have also large real estate activities. These include Blackstone, which is currently fundraising for its 10th real estate fund, which at its latest had raised more than $24 billion.

These asset types all provide different ways of investing into real estate with different levels of risk and participation involved. Yet while it is difficult to compare the personal involvement of researching, buying, servicing and then exiting a property to investing in a managed PE fund, the comparison of PE and real estate funds is one worth exploring.

Private equity vs real estate

How does liquidity compare?

Private equity funds are closed-end vehicles with a fixed maturity determined in the limited partner agreement–usually around 10 years. This is designed to give the manager time to source investments, grow companies and harvest capital.

Real estate liquidity, on the other hand, is variable. While the ability to sell a physical property can vary depending on market conditions, closed-end PE real estate funds have the same constraints as more traditional PE vehicles with slightly shorter maturities on average.

Even more liquid real estate options, such as exchange-traded REITs, work best as long-term investments, as returns are volatile in the short term. For example, in the volatile year to June 2022, REITs fell by more than 10%, illustrating how risky they can be over a shorter period.²

The nature of private equity illiquidity is very different. While commitments will be used to invest across a long time horizon, funds will typically begin to return capital to investors much earlier. PitchBook data, for example, shows that while most funds take 12 years to fully liquidate, half begin returning capital by year 1.5, while a further quarter starts distributing cash after 2.5 years.³

It is also possible to sell or buy a private equity stake during the lock-in period on the secondary market. This allows investors to actively rebalance a portfolio while potentially accessing earlier cash returns from a more mature fund. Purchasing secondary stakes can also mitigate the “blind pool” risk of a fund by offering better visibility on fund assets and performance that come once a fund has begun actively investing. Read our article on demystifying private equity for more.

How do returns compare?

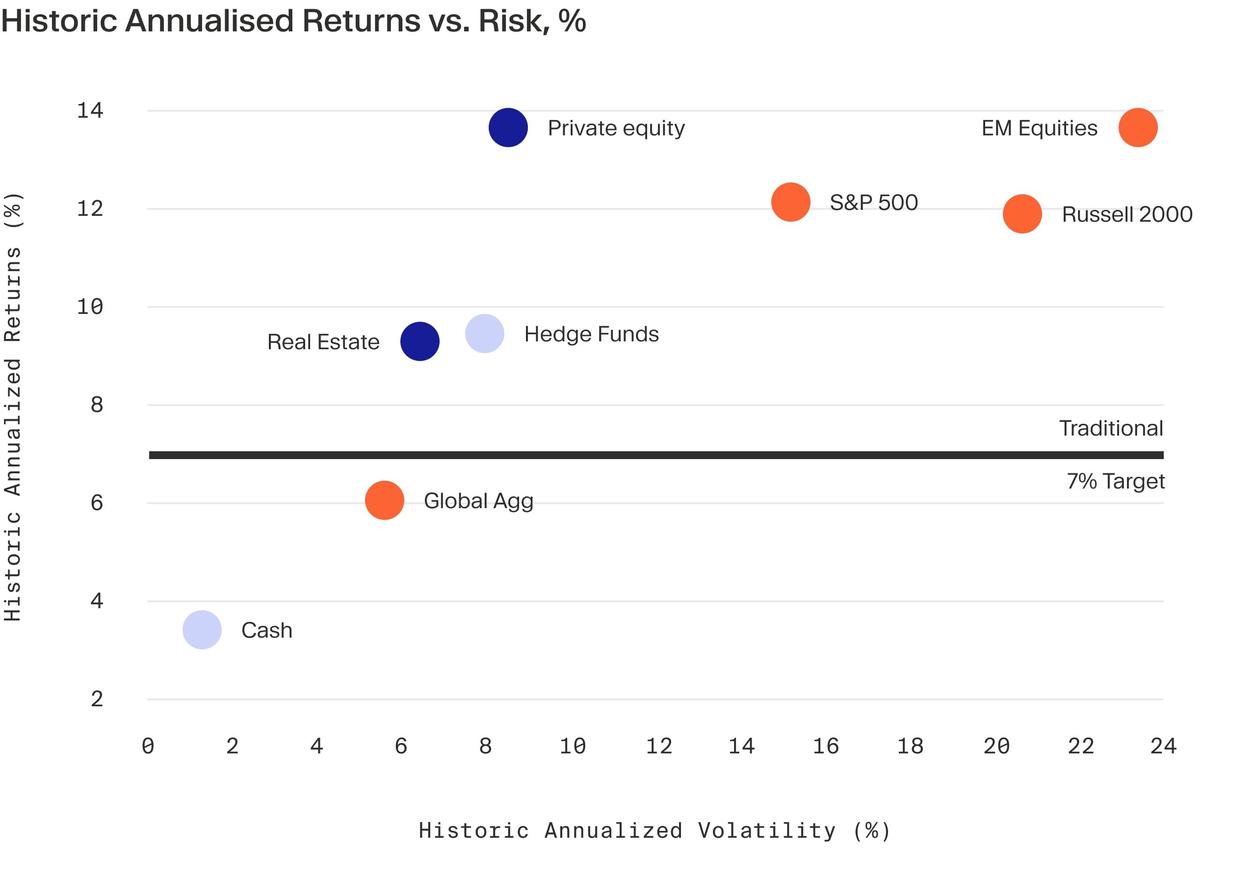

Putting aside the ability to trade on a secondary market, let’s compare the two asset classes in terms of long-term returns. Overall, private equity has historically offered higher returns than real estate overall by more than 4%, albeit with higher volatility.

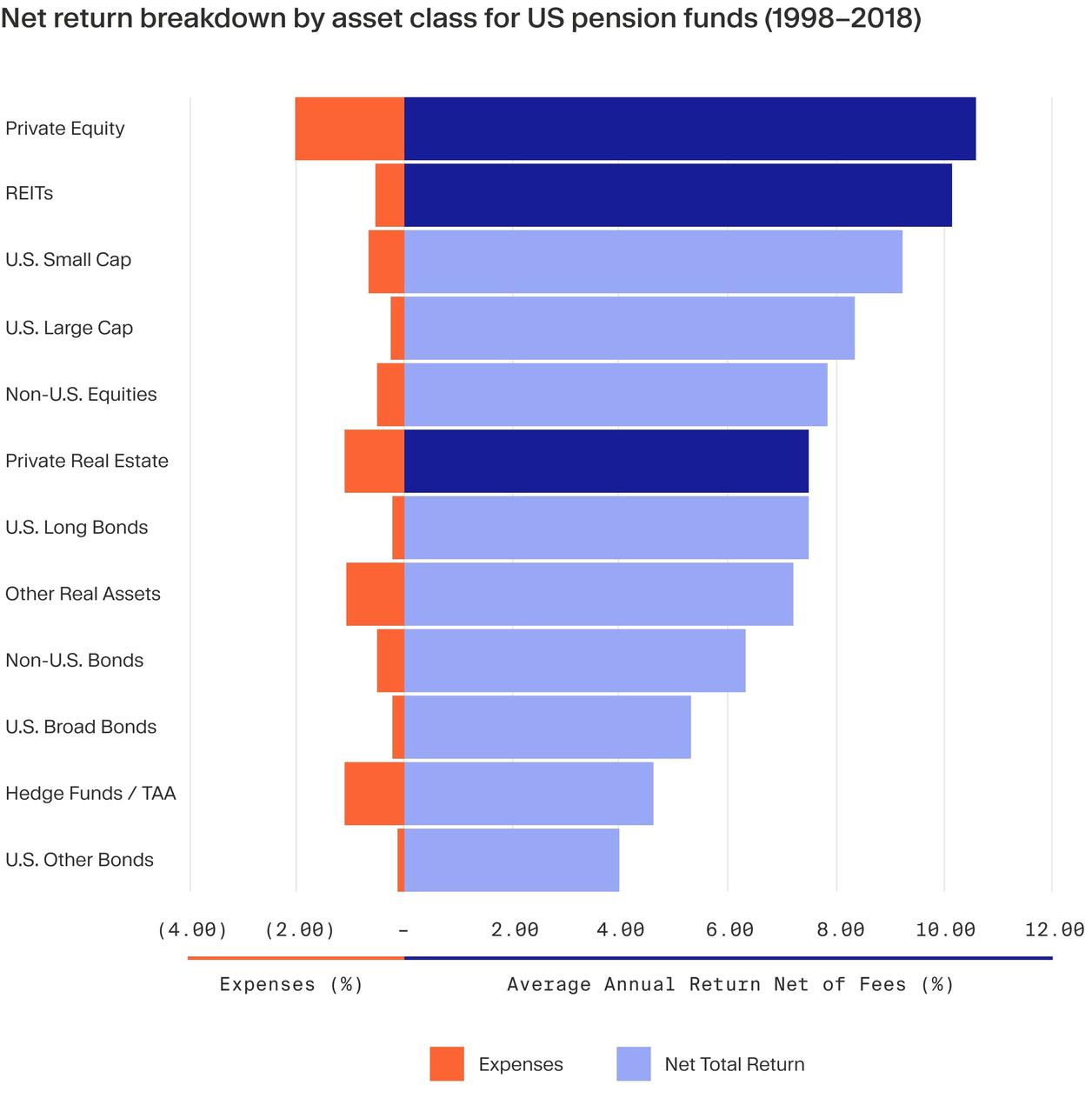

When you break down the real estate asset class on a net basis (what the investor actually receives after fees), private equity has also outperformed private real estate and has an edge over REITs. Looking at data based on returns from U.S. pension funds – one of the most active and developed institutional investors in PE for decades – the asset class has outperformed REITs and private real estate in their portfolios.⁴

Building a diversified, balanced and dynamic portfolio involves a clear understanding of what a new investment will affect the portfolio as a whole. This is especially crucial for long-hold investments, whether including real estate, private equity or a blend of both. However, it is always worth bearing in mind how allocations to both fit with investment goals. For instance, long-term focused investors may prefer private real estate exposure versus publicly listed REITs given the hands-on approach, higher return target and lower volatility, while at the same time complementing existing PE exposure by virtue of being a different, diversifying asset.

To learn more about how to construct and rebalance a portfolio with private equity over time, read our detailed guide.

¹ https://www.nber.org/digest/may14/local-knowledge-matters-real-estate-investors ² https://seekingalpha.com/article/4518662-the-state-of-reits-june-2022-edition ³ https://pitchbook.com/news/articles/for-pe-fund-distributions-timing-is-everything ⁴ https://www.reit.com/sites/default/files/media/DataResearch/NAREIT_CEM_ES_2020_October.pdf