Moonfare’s Chief Economist, Mike O’Sullivan, is travelling the world to bring you insights into each country’s unique economic landscape. His analysis covers macroeconomic trends, local market dynamics and implications for private investors.

Follow Mike right here on the Moonfare blog or through our LinkedIn account as he explores financial hubs around the world. Read also his previous note from Iceland.

Macro Environment

Economically, Austria is doing better than Germany, but so are most countries. The recent election was a headline grabber due to the rise of the far-right Freedom party, around which the other parties are now trying to form a government.

Economist’s Observations

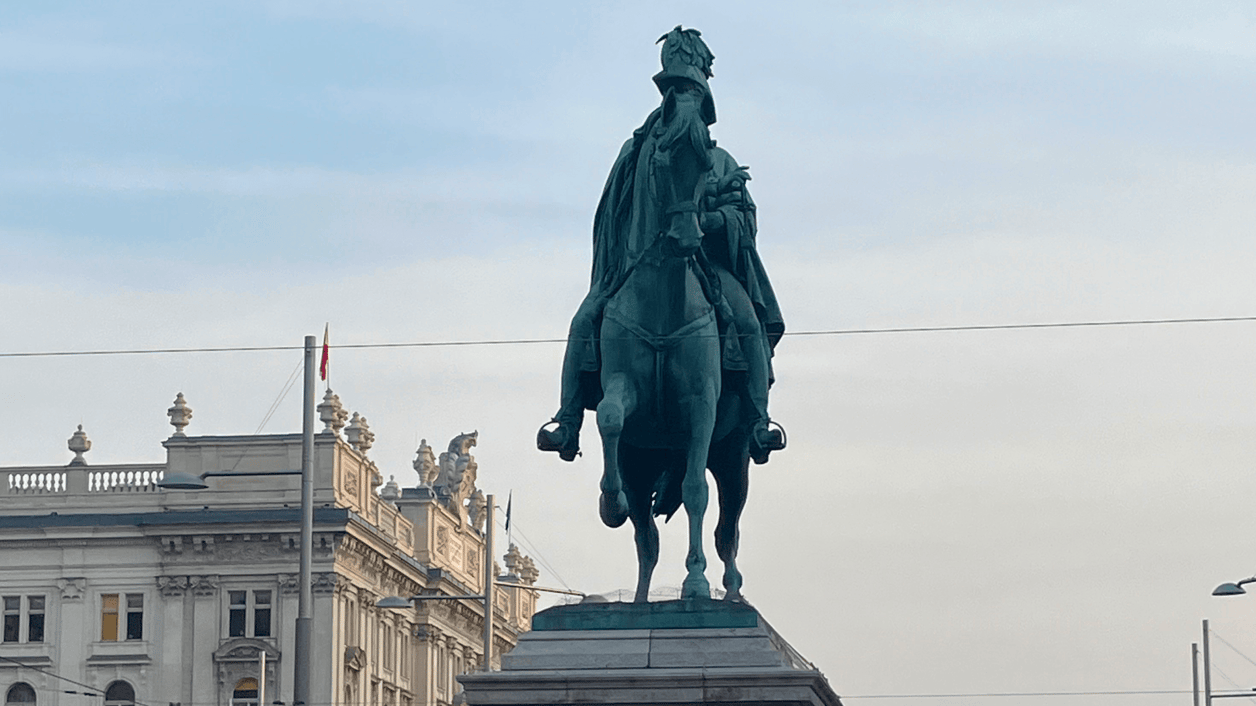

Vienna still has great charm and style — in many ways the best parts are the metro stations which a friend commented have a certain 'Wes Anderson' feel. The city bears the magnificence of its Habsburg empire days.

Private Markets in Austria

From a private assets point of view, the invest.austria conference was revelatory — for the range of Austrian companies (AI swarm driven forklifts to compliance software for dentists) that are funded by private equity. Yet like in many other European countries, the non-institutional take-up of private assets is only just starting, and there is great scope for policymakers to help this process, especially so in terms of having more private investment from pension funds.