Moonfare’s Chief Economist, Mike O’Sullivan, is travelling the world to bring you insights into each country’s unique economic landscape. His analysis covers macroeconomic trends, local market dynamics and implications for private investors.

Follow Mike right here on the Moonfare blog or through our LinkedIn account as he explores financial hubs around the world. Read also his previous note from Vienna.

Macro Environment

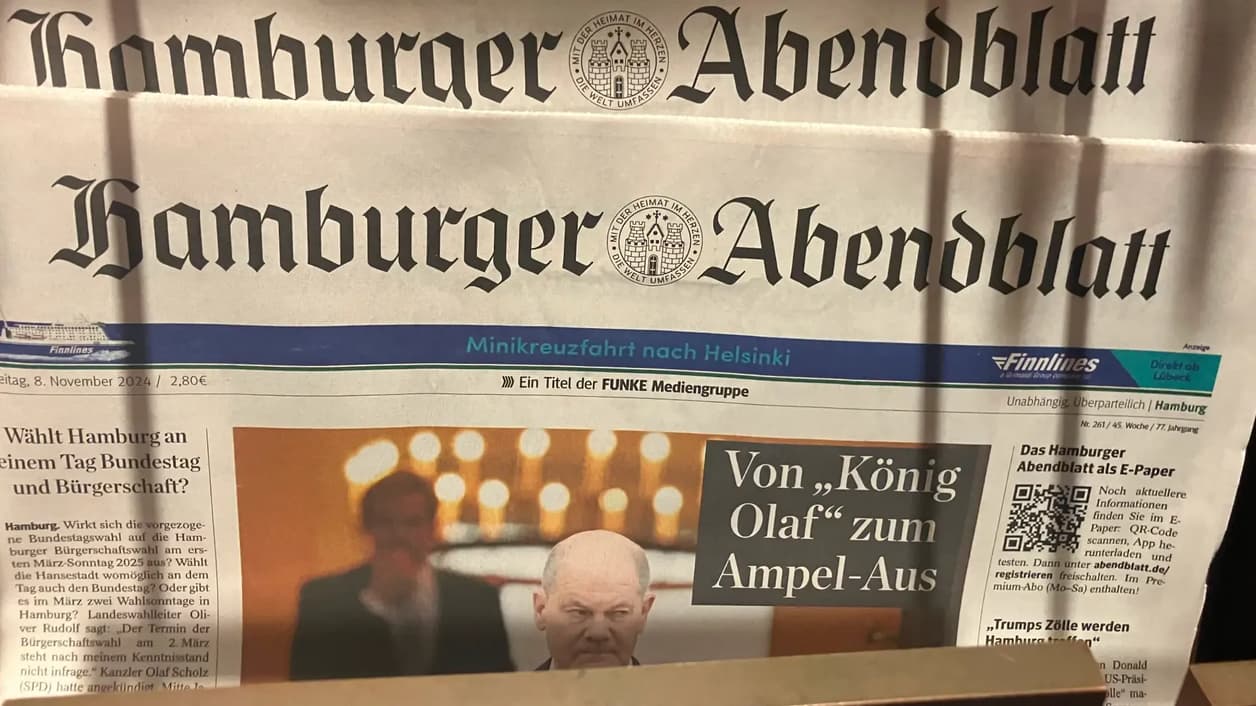

Fittingly, when I was in Hamburg, the German government collapsed, which was not a surprise and I think from a macro point of view will be a positive. A lot of the feedback I picked up from Hamburgers was that building regulation, energy policy and investment are all areas that need fixing.

Economist’s Observations

Hamburg is an old fashioned favourite of mine, my preferred activity is a run around the Aussenalster. It is a paragon of Hanseatic charm, if that makes sense and a visible reminder of the prosperity of the region and its Hanseatic League.

Private Markets in Germany

Hamburg — apparently the largest non-capital city in Europe — is wealthy, much of it invested in what we might call 'old money'. Still, we saw plenty of interest in PE and VC and suspect that the trend is up here in terms of investor behaviour.