Key takeaways:

- Higher interest rates will continue to affect valuations and debt quantum in private equity deals, making value creation through operational improvement critical to generating strong returns.

- Strategies with natural resilience to inflation, such as value-oriented buyouts, infrastructure, real estate and private credit look set to benefit as investors also weigh the prospect of recession.

- Secondary strategies may gain from the current volatility in public markets, increased liquidity needs and growing considerations for portfolio rebalancing among institutional investors facing the denominator effect.

- Investments and exits may be more muted through 2023, but there will be attractive buying opportunities for distressed investing specialists and for firms seeking to grow portfolio companies through add-ons.

After a volatile 2022, the new year looks set to offer both challenges and opportunities to private market investors. Here’s our pick of the top ten trends for 2023.

Looking back on a volatile 2022

Investors entered 2022 on a high. Public markets were still riding a tech boom and the US had seen a record period for new initial public offerings in 2021.¹ Within private equity, investment activity breached $1 trillion for the first time in 2021², and at the turn of the year, as many as 93 percent of buyout and venture capital fund managers were expecting 2022 deal activity to at least keep pace with the previous year, according to Standard & Poor’s.³

As we know, the year didn’t quite turn out that way. Inflation and interest rate rises – a measure of which had broadly been expected – accelerated sharply. Russia’s invasion of Ukraine in February resulted in a global energy shock and food price hike. This has since led global economies grappling with double-digit inflation for the first time in 40 years.

The ensuing market turbulence has spared hardly any portfolio type and had an especially destabilising effect on the relationship between bonds and equities. This has weakened the impact of a traditional 60-40 model, reinforcing the rationale for adding alternative assets to increase diversification and potentially drive outsized returns.

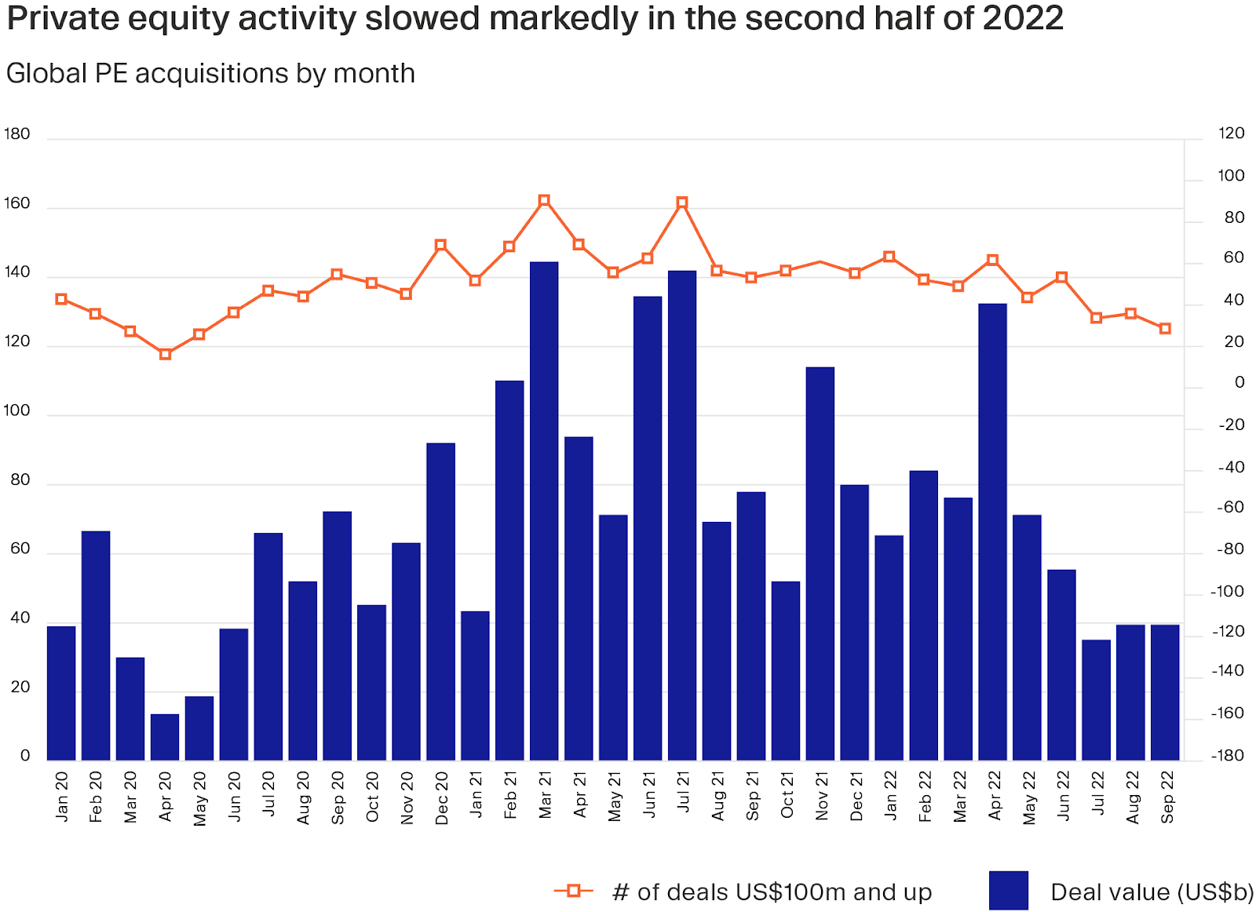

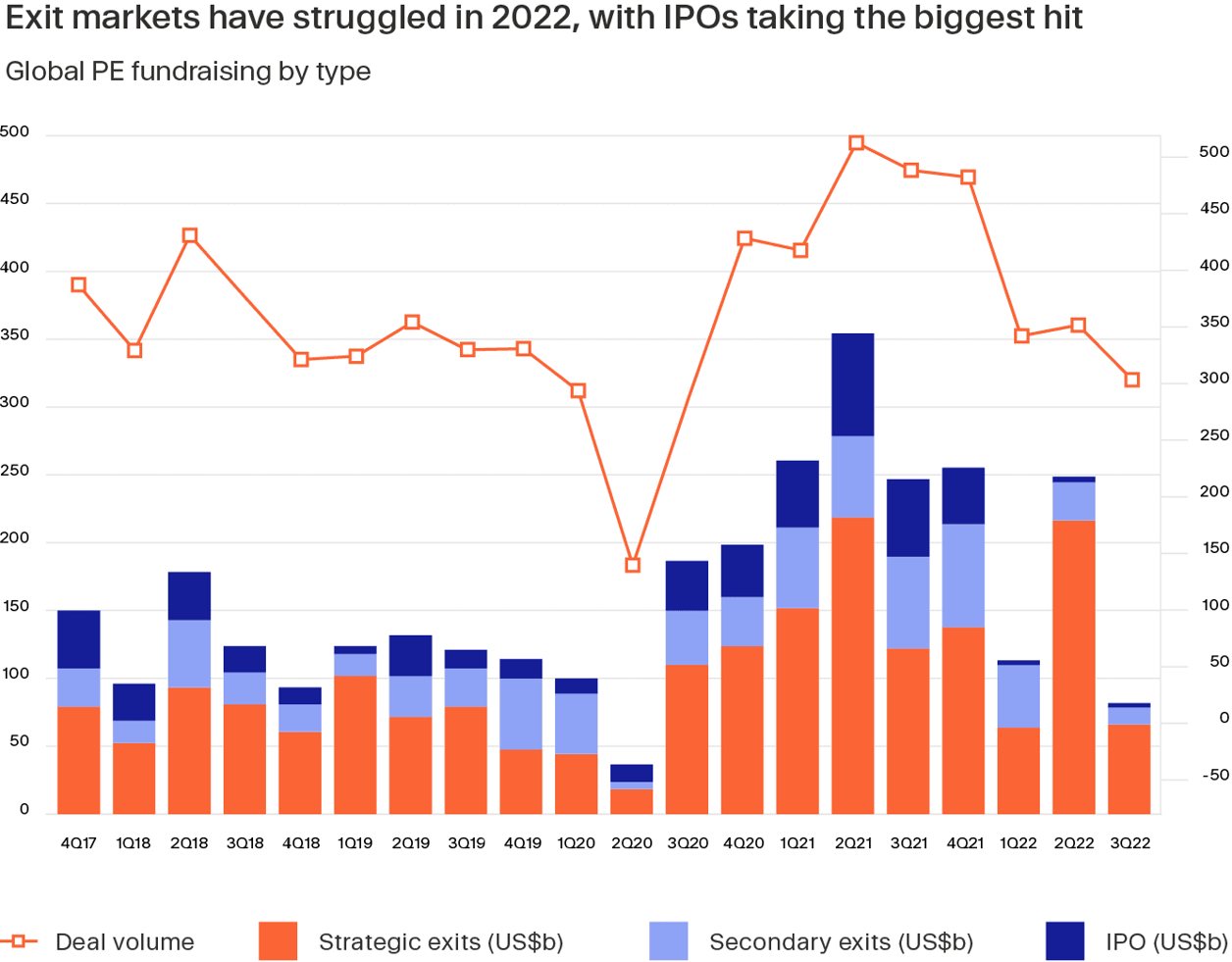

Meanwhile, private equity dealmaking moderated through 2022 as firms took stock of the effect on existing portfolio companies, focused on business resilience and worked to mitigate the price expectations gap on exits and new investments that naturally — and temporarily — occurs between buyers and sellers following a market reset. In the first half of 2022, global deal values were down by 18 percent on 2021 totals, according to EY figures, with activity by value falling 55 percent in Q3 versus Q2 2022.⁴

What’s in store for 2023?

The OECD is forecasting just 2.2 percent global GDP growth for 2023⁵, with some even predicting that a global recession is on the cards.⁶ This sentiment is clearly already on the mind of market participants; for example, in a recent Moonfare survey, 62 percent of investors expected a downturn lasting between one and two years.⁷

That said, there are indications that global inflation may have peaked as we leave 2022 behind⁸, offering some glimmers of hope that we will start to see a modest improvement in the economic outlook as we move through 2023. Here, we present Moonfare’s view of the year ahead for private markets.

(1) Private markets remain in favour, but fundraising will become more challenging

Applicable strategies in a challenging economic environment are likely to be more value-oriented. These include buyouts, infrastructure, real estate, secondaries and private credit, including distressed and restructuring specialists.

All provide something of a shelter from volatility. Value-oriented buyouts generally target businesses that require more heavy lifting from an operational perspective, which means they can be acquired at lower prices. In real assets and infrastructure, the energy transition is providing a strong tailwind. Private credit’s position in the capital structure means that it is usually less risky than equity, while also offering investors regular cash payments and shorter investment horizons. Traditional secondaries, meanwhile can be highly diversified, which offers protection from volatility, and have the potential to offer earlier and more frequent cash distributions than primary private equity.

Many investors have said they are looking more closely at value-oriented buyouts – Abrdn, for example, has said it’s positioning its portfolio towards value-oriented buyouts and away from growth.⁹ Individual investors share a similar sentiment. In a recent Moonfare survey, 56 percent of investors said they consider buyouts as the best bets in today’s economy.

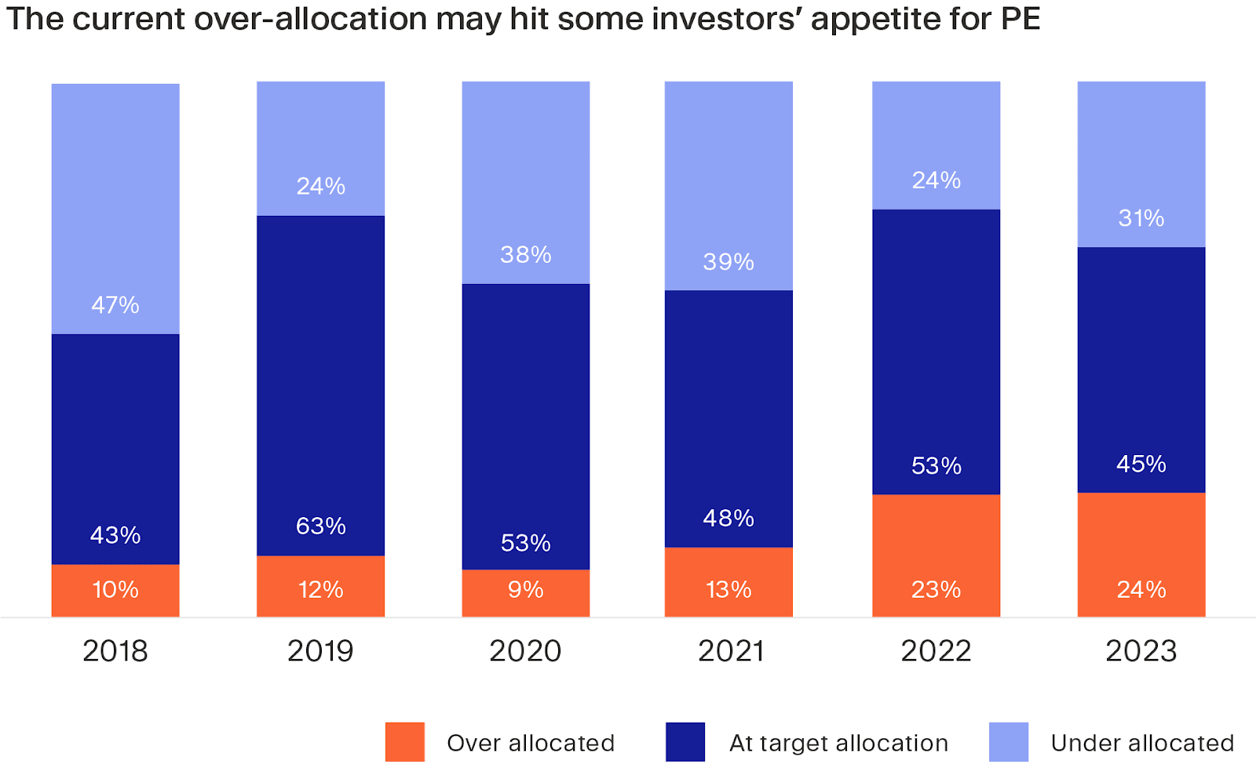

While limited partners (LPs) continue to rate private markets’ prospects highly¹⁰ the shift in economic reality has forced many LPs to recalibrate their portfolios to deal with rising interest rates and falling valuations. For example, many now find themselves over-allocated to private markets and this is leading some to moderate their investment pace in 2023 but also pursue secondary strategies to rebalance portfolios.¹¹ All this will likely impact fundraising. Preqin anticipates a 2.7 percent decline year on year in 2023 private equity fundraising.¹²

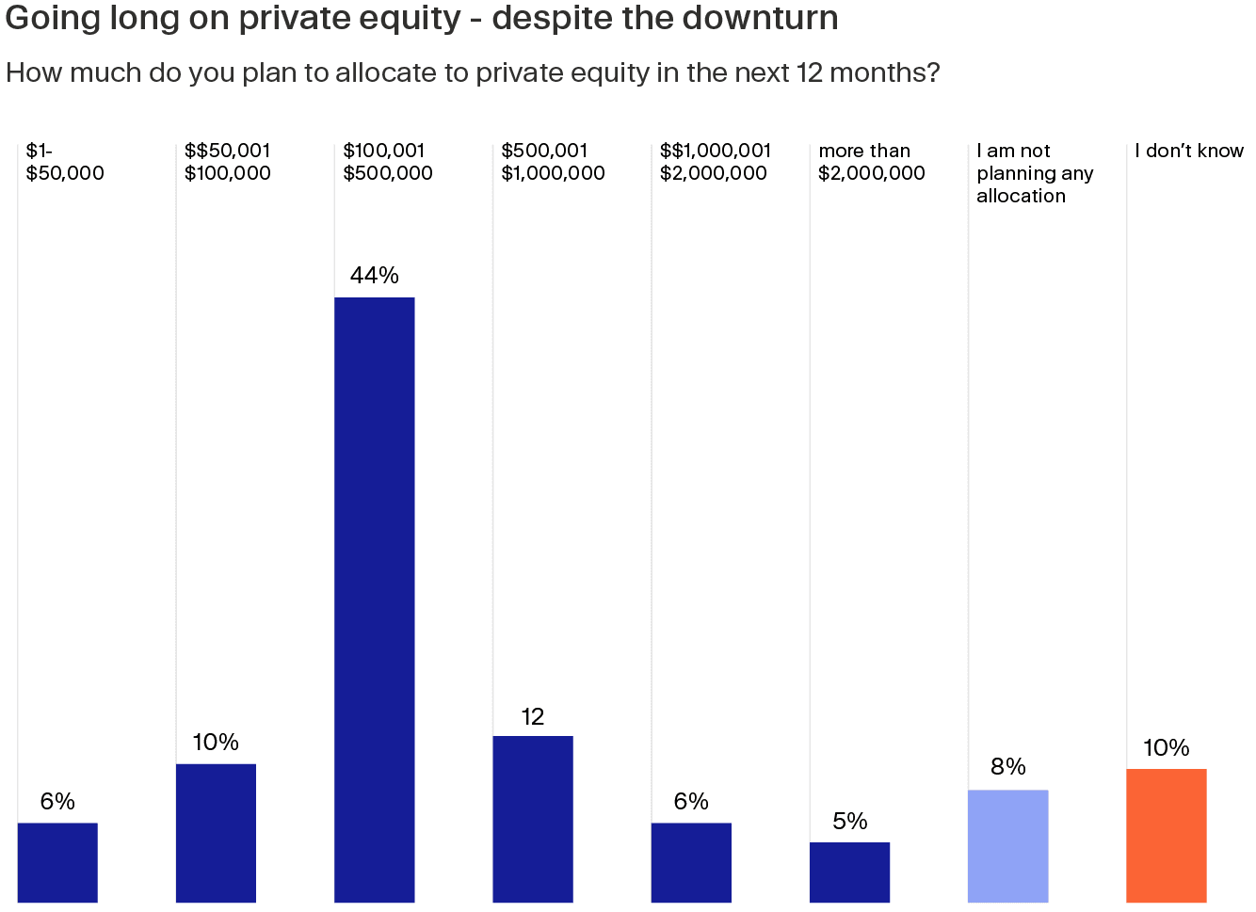

In the face of reduced demand from institutional LPs, private-market funds are increasingly turning to high net worth individuals and retail investors for funding. These may help plug some fundraising gaps. As the Moonfare survey shows, individual investors are continuing to allocate to private equity, with 69 percent planning to invest more than US$100,000 over the next 12 months.¹³

(2) Higher interest rates will change the rules of the game

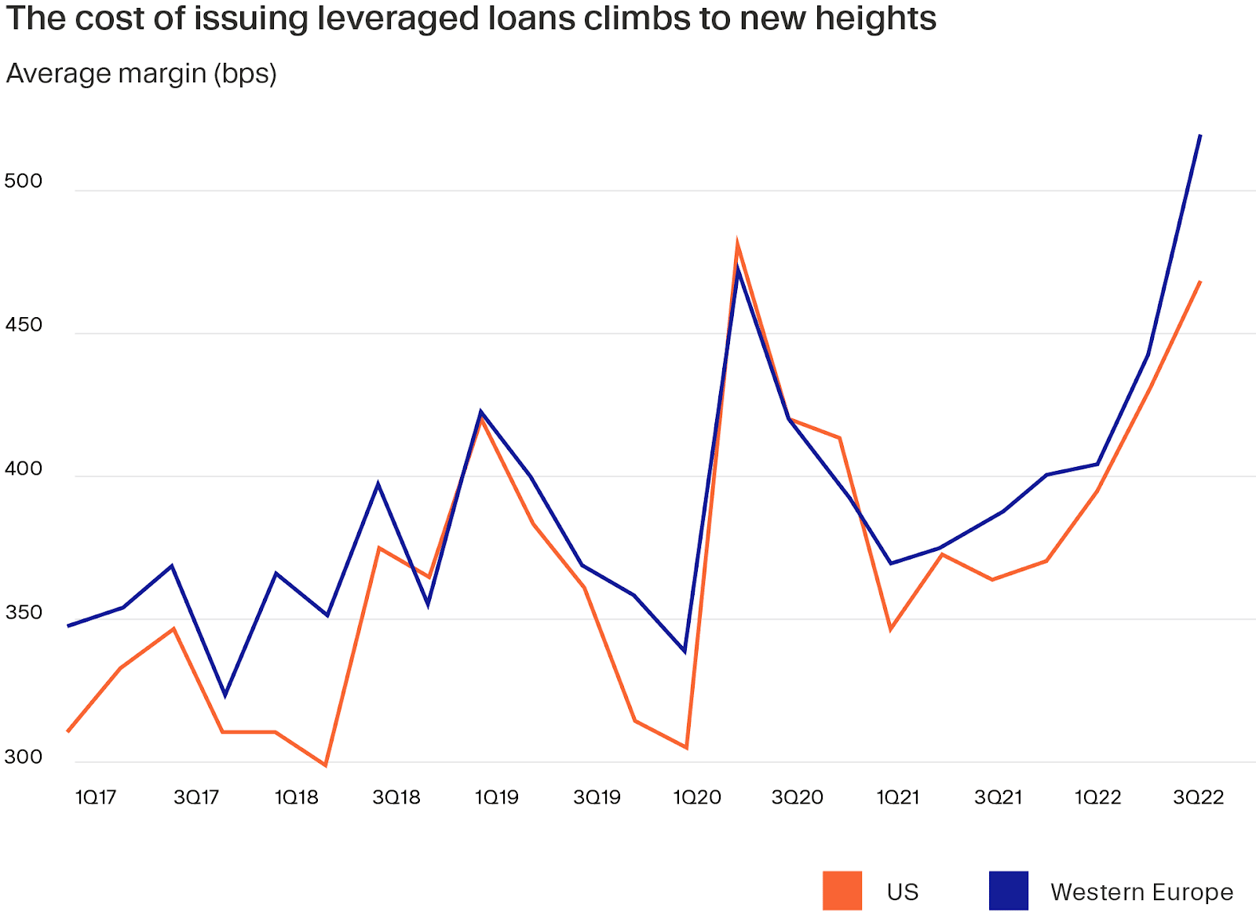

The cheap and abundant credit available from the end of the global financial crisis to the beginning of 2022 allowed many firms to enhance returns using significant leverage. In 2021, debt multiples in deals reached 6x earnings, the highest in over two decades.¹⁴

Yet debt has become more costly with interest rate rises — the Federal funds rate in the US increased from near zero in 2021 to over four percent as of December 2022¹⁵, while lending conditions have further tightened through the end of quantitative easing programs. Given this context, the use of leverage in new deals and refinancings could reduce considerably. We may even start to see liquidity issues and falling valuations in some existing portfolio companies as recessionary forces bite and earnings reduce.

(3) Operational expertise will come to the fore

In the absence of cheap debt and rising valuations, private equity managers will need to reduce reliance on financial engineering and focus more heavily on operational improvements to drive value creation and returns. Areas of focus will include cost control, supply chain optimisation, risk management, workforce optimisation and —increasingly — climate awareness. Firms will invest in, and deploy, enterprise technology and process automation to increase efficiency against a backdrop of rising costs and labour shortages.

The emphasis will therefore shift from growth to profitability, which may spell an opportunity for buyout firms. As John Park, who leads the technology team at KKR’s private equity platform, said recently: “We try to manage margin the right way, and determine the best ways to grow faster, profitably. That can do wonders for companies that have gotten into the mindset of growing at all costs.”¹⁶

Through 2023 and beyond, we also expect the dispersion of returns between the best and worst performers to increase sharply. Those experienced and skilled at supporting portfolio companies and building businesses through periods of uncertainty will post the strongest results.

(4) Private credit will fill the void left by banks – again

Private credit as a form of finance stepped into the breach following the global financial crisis, as many traditional institutions retreated from leveraged loans. The result was a strong decade for this form of debt, with US$1.2 trillion assets under management in 2021, while estimates predict the asset class will grow to US$2.3 trillion by 2027.¹⁷

The gloomy global outlook may accelerate this trend. Faced with a difficult economic backdrop, banks have already increased lending standards and loan loss provisions in 2022. In Europe, 19 of the 25 largest banks reported higher provisions in the third quarter of 2022 compared with a year ago.¹⁸

Private credit funds have a greater appetite for risk than banks and can offer more flexibility to borrowers and sponsors. This includes providing loans to finance deals in private equity like the US$9.5 billion buyout of software company Zendesk, which was financed by a consortium of direct lenders led by Blackstone.¹⁹

(5) Larger, more established managers will continue to attract funding

The years running up to 2022 saw a marked increase in the pace of private markets fundraising. In 2021, the average time between fundraises for general partners (GPs) fell to around three years from the historical norm of about four, according to StepStone²⁰, with some raising capital within just two years of a previous fund close.

Yet the coming period could see a reversion to historical patterns, given many LPs’ high exposure to private markets versus other asset classes and the slower GP investment pace in a more challenging environment. As we enter 2023, nearly a quarter of LPs are over-allocated to private equity, according to Private Equity International.²¹

As well as thinning the supply of funds to raise, LPs could favour commitments with more established fund managers with long track records and with whom they have an existing relationship. This will clearly benefit larger funds, but it will make for a difficult period for emerging managers and first-time funds.

This was evident even in the first half of 2022, with the 10 largest funds accounting for 39 percent of capital raised, according to Private Equity International.²² Blackstone, for example, saw US$350 billion of fundraising in the past year and reported that the second quarter 2022 was one of their best ever for fundraising.²³ We expect the trend of fewer funds raised and increased fund sizes to persist through 2023.

(6) Larger deals will be down; add-ons will be up

Higher financing costs mean that GPs may need to write larger equity cheques at increased risk. Given this context, GPs could avoid larger transactions to preserve capital in a more challenging fundraising environment.

Instead, add-ons will gain even more traction as GPs seek out value-adding acquisitions for existing portfolio companies. This was already a popular strategy — more than 70 percent of US private equity deals were add-on acquisitions in 2021, according to PitchBook.²⁴ We expect further focus on these as GPs look to acquire smaller businesses at lower multiples.

(7) Distressed opportunities will emerge

The number of turnaround and distressed deals is likely to rise through 2023 on both the credit and equity sides as some companies come under financial and operational pressures. S&P, for example, is predicting a trailing 12-month default rate for speculative-grade corporates to rise to between 1.75 percent and six percent by September 2023, up from 1.6 percent in September 2022.²⁵

Turnaround specialists will therefore see abundant opportunity throughout the year in this environment; however, these deals are not for the faint-hearted. To be successful, GPs will need specific expertise in restructuring and risk management, while also being highly selective and ensuring investor protection is built into deal structures.

(8) Lower valuations will persist, creating attractive acquisition opportunities

As we’ve explored previously, recessionary periods have historically been some of the strongest vintages for private equity returns. This is driven in part because GPs continue to deploy capital through cycles, and can therefore selectively acquire businesses at lower valuations in more challenging times.

We expect company valuations to continue declining, at least through the first part of 2023. This will particularly be the case in private markets portfolios, since the falling valuations seen in public markets have yet to fully filter through to the private side. There is always a lag when prices correct.

More broadly, a range of factors could influence entry multiples. These include the increased cost of debt and tightening lending standards, a divergence between the performance of cyclical industries and those that are resilient to changes in consumer spending, and the level of dry powder in private markets.

We may also see a growing number of take-private transactions as GPs take advantage of public companies trading at a discount.

(9) Utilities and energy will benefit from tailwinds; technology investing will need a long-term perspective

Utilities and energy are naturally well positioned to weather inflation and are less affected by swings in consumer spending. Energy transition to renewable sources will also drive investments to these sectors, in particular as energy security has risen up the agenda over the past 12 months.

However, as the sector most affected by market turbulence, the outlook for technology may remain uncertain in the near term. The NASDAQ was down over 30 percent year to date on 19 December 2022²⁶, while valuations have fallen markedly in M&A, from a median multiple of 4.9x TTR revenue in the third quarter 2021 to just 2.3x in the same period in 2022, according to S&P.²⁷ More persistent inflation and the prospect of companies in the sector missing earnings estimates could affect valuations still further.

In this environment, fund managers and investors started preferring early stage and seed opportunities that typically have longer runways to exits and are therefore more insulated from the impact of market cycles. Although not entirely immune to the overall venture slowdown, these investments have shown more resilience in 2022.²⁸

However, the secular trends of digitalisation across the economy and the adoption of new technologies, such as automation, are going nowhere. Technology will continue to play an increasing role in our personal and working lives. The long-term prospects for returns from technology remain strong.

(10) Secondary buyouts will be the main exit route

The virtual disappearance of the IPOs as a route to monetisation, plus uncertainty and a mismatch between buyer and seller expectations meant that exits were down considerably through 2022: they fell 67 percent in third quarter 2022 versus the same period in 2021, according to EY.²⁹

It is likely to be some time before IPO markets reopen, given the prospect of recession and the continued uncertainty around inflation and interest rate rises. We expect few public listings from private markets portfolios in 2023.

Trade sales will also be challenging since many corporates will be in protective mode, placing M&A lower down the board agenda. And while GP-led deals on the secondary market may provide a liquidity option on some assets, completed deals here will be limited to the best companies in a portfolio.

Instead, secondary buyouts — or sponsor-to-sponsor deals — could take up the slack in 2023. With dry powder standing at US$1.81 trillion in January 2022, according to Preqin estimates³⁰, plus pressure on GPs to invest within their investment periods, sales to other private equity investors could become the most active exit route in the year to come.

2023 investor playbook: Four considerations to look out for

Focus on value creation. Monetary tightening and uncertain inflationary and geopolitical outlooks will favour strategies with an active approach to value creation. Buyouts and turnarounds, for example, could generate higher returns than more passive investment models that rely on multiple expansion, market timing, and financial engineering.

Prepare for lower distributions. A more muted exit environment may bring longer holding periods and lower distributions. However, distributions are likely to come from secondary buyouts, some M&A transactions, and GP-led secondary deals.

Choose funds carefully. In private markets, return disparities widen during downturns.³¹ The best fund managers take action to protect existing investments and can take advantage of market dislocations; others may not be equipped to do this. Investors should take time to evaluate a fund manager’s strategy, team, and performance, to form a view on whether they believe the GP can deliver the risk-return profile they are seeking.

Keep a long-term mindset. During a typical eight-to-twelve-year lifespan of a private markets fund, there are likely to be periods of economic turbulence. With this in mind, investors need to keep a long-term perspective and avoid timing the market. They should remain disciplined in their annual commitment plan and diversify by vintage year, manager and asset class to protect against volatility and provide downside protection through market cycles.

Endnotes:

¹ https://news.crunchbase.com/public/largest-startup-ipos-2021-rivian-coupang-lucid-motors/ ² https://www.spglobal.com/marketintelligence/en/news-insights/research/2022-global-private-equity-outlook ³ https://www.spglobal.com/marketintelligence/en/news-insights/research/2022-global-private-equity-outlook ⁴ https://www.ey.com/en_gl/private-equity/pulse ⁵ https://www.oecd.org/economic-outlook/november-2022/ ⁶ https://www.economist.com/the-world-ahead/2022/11/18/why-a-global-recession-is-inevitable-in-2023 ⁷ https://assets-global.website-files.com/5ffb7d86352880856dbd363e/6380b51f2ad958330ffc33a0_Moonfare-InvestorSurvey2022.pdf ⁸ https://www.ft.com/content/b20afc56-037d-4098-b7e3-8d52ddfa5097 ⁹ https://www.investmentweek.co.uk/interview/4053603/abrdns-gauld-eyes-tilt-value-sectors-amid-market-rotation ¹⁰ https://www.collercapital.com/sites/default/files/Barometer.pdf ¹¹ https://www.collercapital.com/sites/default/files/Barometer.pdf ¹² https://www.preqin.com/Portals/0/Documents/Preqin%20Global%20Report%202023%20Private%20Equity.pdf?ver=2022-12-14-085452-297 ¹³ https://assets-global.website-files.com/5ffb7d86352880856dbd363e/6380b51f2ad958330ffc33a0_Moonfare-InvestorSurvey2022.pdf ¹⁴ https://www.bloomberg.com/news/articles/2022-01-13/private-equity-s-latest-deal-wave-brings-more-leverage-than-ever ¹⁵ https://www.newyorkfed.org/markets/reference-rates/effr ¹⁶ https://www.buyoutsinsider.com/why-are-buyout-firms-undeterred-by-the-tech-downturn/ ¹⁷ https://www.preqin.com/Portals/0/Documents/Preqin%20Global%20Report%202023%20Private%20Debt.pdf?ver=2022-12-14-085706-953 ¹⁸ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/europe-s-banks-to-set-aside-higher-bad-loan-provisions-as-recession-looms-73077012 ¹⁹ https://www.bloomberg.com/news/articles/2022-06-24/blackstone-led-group-provides-5-billion-of-debt-for-zendesk ²⁰ https://www.privateequitywire.co.uk/2022/01/31/311703/chapter-two-fundraising ²¹ https://www.privateequityinternational.com/lp-perspectives-portal/ ²² https://www.privateequityinternational.com/fundraising-sees-122bn-drop-in-the-first-half-of-2022/ ²³ https://www.ey.com/en_gl/private-equity/pulse ²⁴ https://pitchbook.com/newsletter/why-pe-add-on-acquisitions-are-seeing-rise-in-popularity-DJt ²⁵ https://www.spglobal.com/ratings/en/research/articles/221121-default-transition-and-recovery-the-u-s-speculative-grade-corporate-default-rate-could-reach-3-75-by-sept-12565939 ²⁶ https://www.marketwatch.com/investing/index/comp ²⁷ https://pages.marketintelligence.spglobal.com/rs/565-BDO-100/images/BigPicture_MA_1022_FINAL.pdf ²⁸ https://files.pitchbook.com/website/files/pdf/Q3_2022_US_VC_Valuations_Report.pdf ²⁹ https://www.ey.com/en_gl/private-equity/pulse ³⁰ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/another-pe-dry-powder-record-set-vc-rounds-in-us-fintech-surged-in-2021-68838564 ³¹ https://cepres.com/insights/private-equity-performance-during-a-recession