In 1985 David Swensen — a 31-year-old economics graduate with limited investment experience — was approached to lead the US$1.3 billion endowment of Yale University.

Swensen took the job and during the next three decades would transform portfolio management and challenge the dogma of the 60/40 principle, which prescribes allocating 60 percent of a portfolio to equities and 40 percent to bonds in order to lower volatility and deliver consistent long-term returns.

Instead of splitting assets according to the 60/40 formula, Swensen implemented what became known as the ‘Yale Model’, expanding exposure to more volatile but higher returning assets across public and private markets.

Swensen’s approach would revolutionise long-held portfolio construction beliefs. By June 2022, the Yale Investments Office was managing around $41.4 billion, having generated an average of 13.1 percent over the past 30 years.

Increasingly, individuals are starting to follow suit, with the digitisation process opening up the asset class for less sophisticated investors. However, as they add exposure in greater numbers, finding the right assets to fit their objective becomes increasingly key.

Aligning allocations with targets.

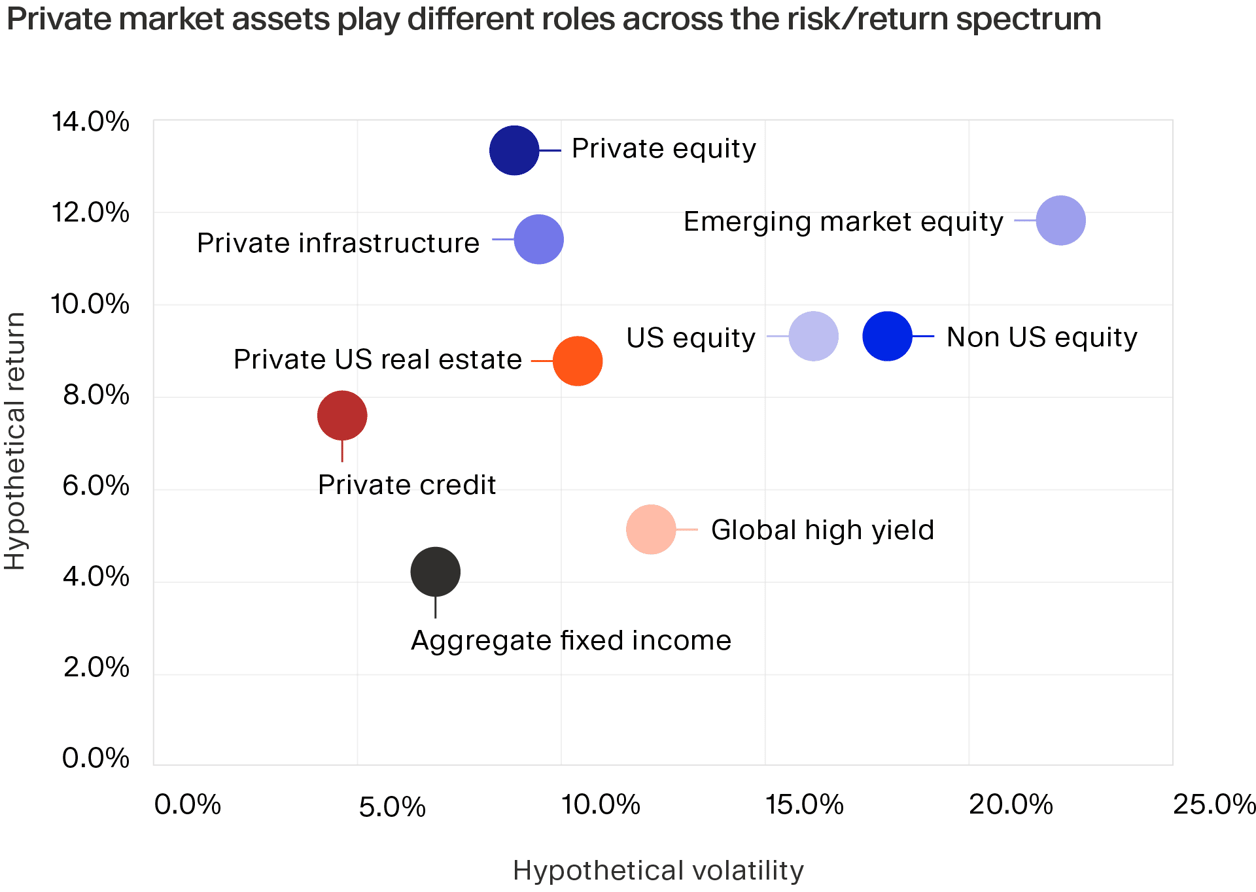

However, a boilerplate approach may not be appropriate when allocating to private markets at an individual level. People have differing risk tolerances, for instance, and need to consider which assets across the private markets spectrum align with their investment horizons and return objectives.

For example, more risk-tolerant investors seeking to maximise long-term wealth may prefer to allocate to higher-returning–but higher-risk and less-liquid–private market assets. Indeed, a 2022 Bank of America study found that 75 percent of investors between the ages of 21 and 42 did not believe it was possible to secure above average returns by investing only in stocks and bonds, with 80 percent of these young investors turning to alternative investments and making larger allocations to alternatives than their older counterparts.

Factors such as risk profile and time horizons aren’t the only considerations, however. Investments in infrastructure and private equity, for example, can offer exposure to assets that are less correlated to stock markets and help improve portfolio diversification. Furthermore, private equity exposure may also align well with the objective of charitable giving and/or leaving a lasting familial legacy.

Allocation examples across investor types.

Looking long term

- Who: Investors with higher risk tolerance and no immediate income needs.

- What: Buyout, growth equity, and venture capital strategies.

- Why: Buyout funds in non-cyclical sectors with value creation can provide a foundation of stable returns, while growth equity and venture capital funds can provide exposure to higher-growth sectors to amplify upside potential.

Prioritising income

- Who: Investors with lower risk tolerance and greater need for regular cash income in the short term.

- What: Private debt solutions, in particular senior or mezzanine funds.

- Why: Returns are typically lower than buyouts, but private debt funds often have shorter fund terms and can make distributions earlier, and throughout the fund life. Due to the structure of portfolio company financing and therefore returns, there tends to be a narrower dispersion between the top and bottom quartile funds.

Mix and match

- Who: Investors preferring a balanced approach.

- What: Mix asset classes including upside buyout strategies, private debt exposure, infrastructure and secondaries.

- Why: Provides access to upside strategies while also including some downside protection; a broader suite of assets also boosts diversification.

Exploring the options.

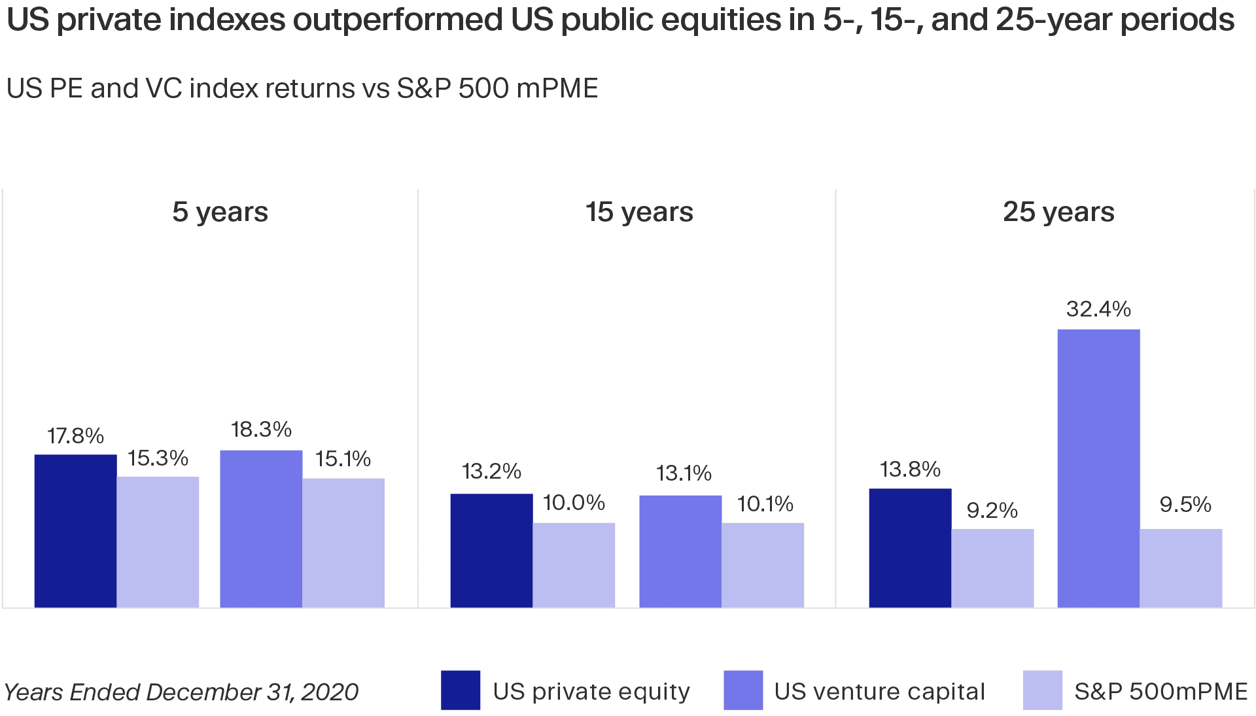

For investors with longer horizons, higher risk tolerance and/or no immediate liquidity requirements, strategies that are focused on generating higher returns — with less emphasis on providing volatility protection–could be a good fit. According to research from Cambridge Associates, venture returns for the US VC Index have significantly outperformed both the US PE Index and then S&P 500 modified public market equivalent over the last 25 years.

At the opposite end of the spectrum, some debt-led private market options may be more suited to investors with a lower tolerance for risk.

In particular, some private debt strategies and high yield bond funds can deliver regular cash flows with potential upside on returns. According to McKinsey, private debt strategies in the 2008 to 2018 vintage delivered a net IRR of 9.4 percent in 2021.

Although this was lower than the 19.5 percent return delivered by private equity, the dispersion was much narrower; private equity’s spread between top- and bottom-quartile performers came in at 20 percentage points, compared with 5.4 percentage points for private debt.

Investors in the middle of the pack, meanwhile, can take a measured approach to private markets positioning, with more emphasis on diversification of strategies to provide a balanced risk-return profile over time. Time horizons for these investors may vary and they will typically have moderate income and liquidity needs and moderate risk appetite.

These investors may want to take on some risk to allow for generation of potential upside, while also looking to balance this with strategies providing downside protection. This could see a mix of private markets strategies come into the frame, with buyout plays and some exposure to growth and late-stage venture capital providing upside. In the meantime, various flavours of debt-led strategies such as senior or mezzanine debt may offer some income and downside risk protection, alongside allocations to infrastructure and secondaries.

With more choice opening up to them, regular investors can tailor private markets assets to their bespoke needs, with a broad scope of private markets strategies available to suit investors across the risk spectrum. Finding the right private markets fit for individual investors can help unlock the same return and diversification benefits that institutions have capitalised on during the last 50 years.