- The notable slide of the US dollar in the last six-to-nine months has refocused the spotlight on how currency movements can impact investments, including private equity.

- Risks stemming from large currency swings can occur on several plateaus, including the portfolio level, deal level and operational level.

- Investors can help mitigate these risks through PE by constructing a diversified portfolio of assets, as well as taking advantage of the asset class’ long-term nature

Has the buck stopped here?

If 2023 is anything to go by, it certainly looks like the US dollar has come back down to earth with a bang.

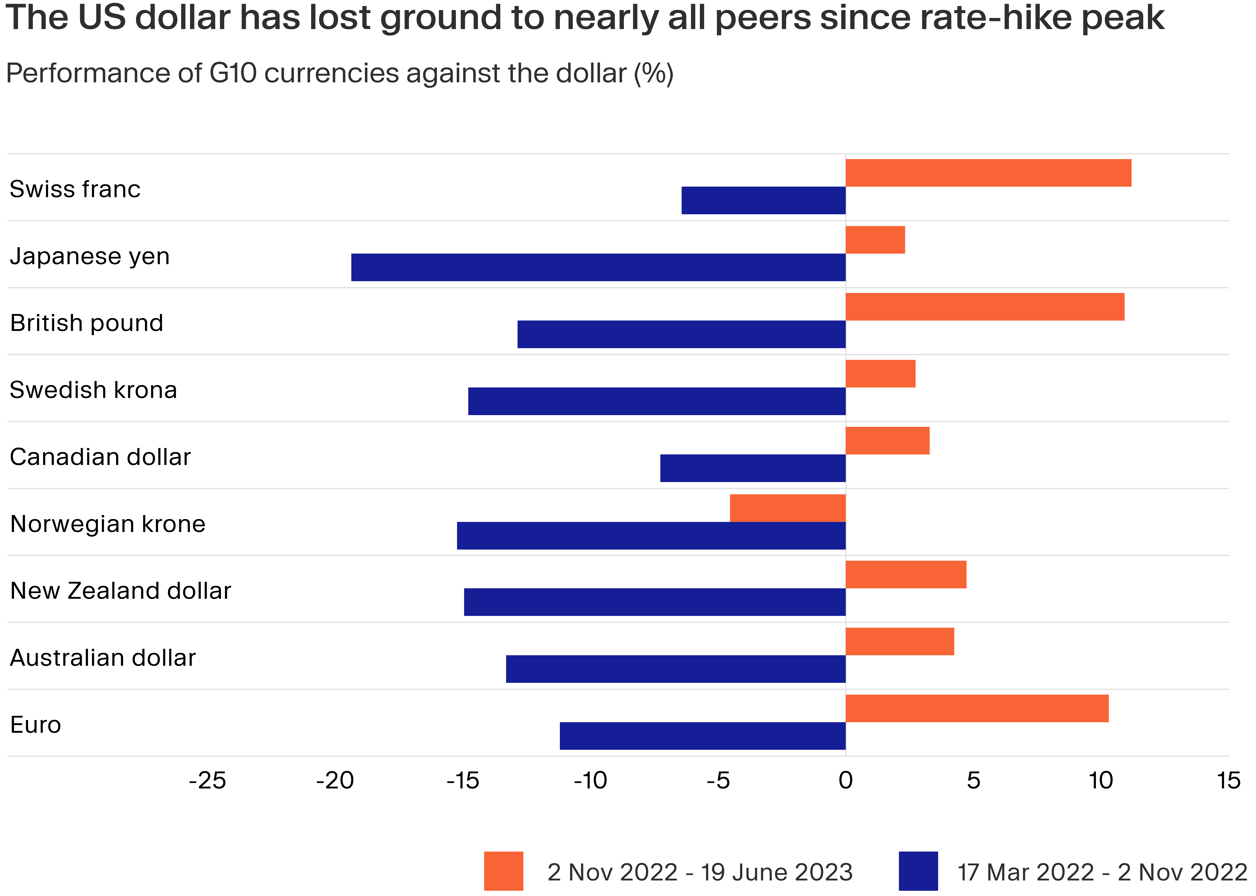

According to the US Dollar Index — a measure of the value of the currency against a basket of the greenback against a basket of other developed market currencies — the dollar has fallen some 10 basis points over the past nine months, as investors looked to move exposure away from the currency against a backdrop of weaker than expected economic data and the Federal Reserve’s (Fed’s) slowing rate-hike cycle, relative to other central banks.

Recent data showing slower consumer spending has further reinforced the view that the Fed could loosen the reins and add further downward pressure on the dollar.

This is illustrated more starkly when looking at individual currency pairs. The euro, for example, hit a two-decade low against the dollar last year, falling to parity and eventually becoming worth less than one dollar for the first time since 2022. Since then, the dollar has faded to around 90 cents.

Currency fluctuations are a key factor in the modern economy, with the profits and losses of many large businesses sometimes at the mercy of these movements. Sportswear company Nike, for example, warned last year that it expected heavy dollar strengthening to knock about $4 billion off of its annual revenue.

Naturally, such a potential impact on companies will have a knock-on effect on their investors, both in the public and private spaces. And while private equity’s decade-long appreciation appears at odds with the daily ups and downs of foreign exchange, understanding how currency changes can impact your investment performance is still part of the puzzle to learn.

How currency moves affect private equity funds

At a high level, we can sort the different ways that currency changes can have an impact on a fund’s performance broadly into three categories: portfolio risk, transactional risk, and operational risk.

Portfolio risk relates to how investments made beyond the fund’s home currency can potentially hinder or boost performance. This is due to the fact that these usually non-domestic investments made in a foreign currency need to be converted back into the fund’s home currency before distribution.

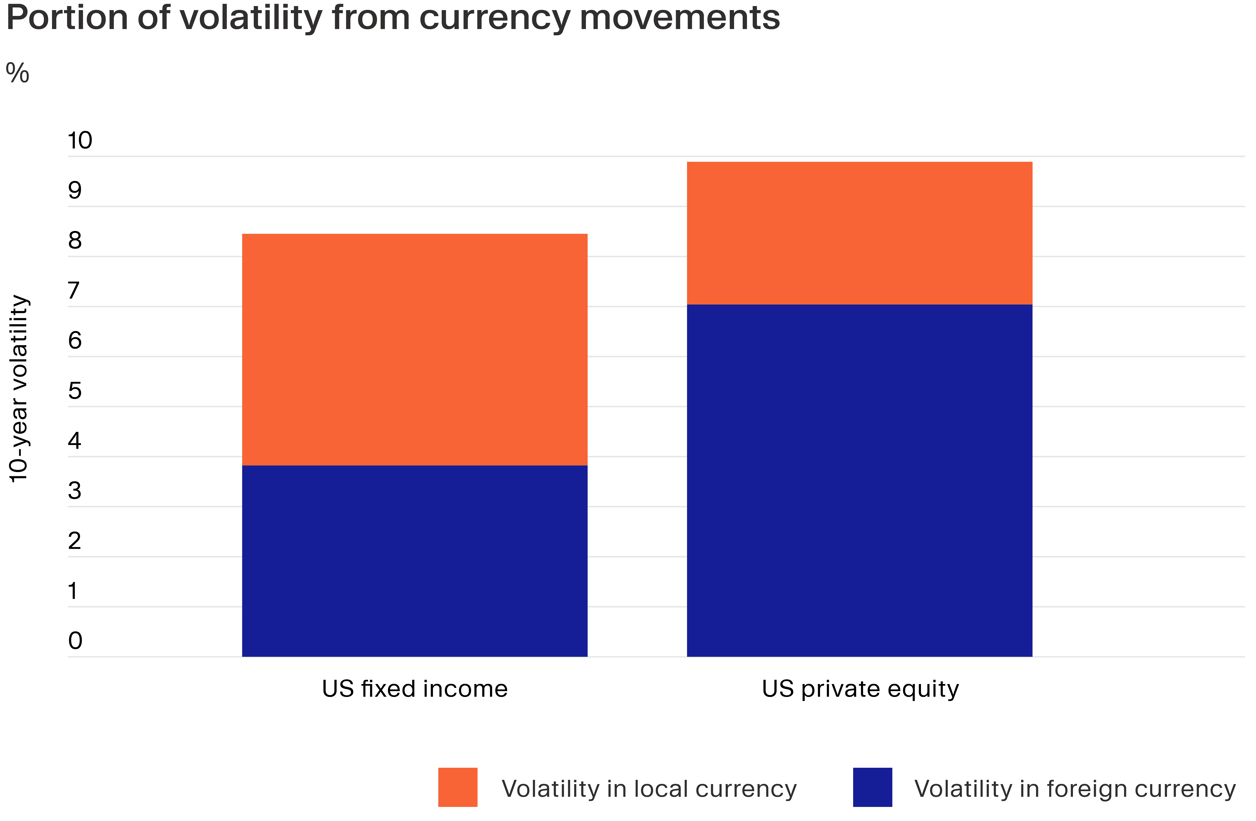

Situations like this can occur among larger investors with a global presence. EQT’s ninth flagship fund, for example, includes investments across the US, UK and European Union, conducting deals across several different currencies. The effect can be significant. According to Hamilton Lane research, using the example of a Europe-based investor with money in US private equity over the past 10 years, nearly 28% of their volatility came from currency fluctuation.

Elsewhere, transactional risk can cover two elements. On a macro level, it is the fund’s overall currency exposure as it buys, sells and finances new investments, while on a deal-by-deal basis, it can refer to how an exchange rate could alter between the agreement and closing of a transaction. Operational risk, meanwhile, covers the effects of currency movements on normal fund or business operations, as outlined by the Nike example above.

Historically private equity funds have tended to accept these risks, banking instead on being able to overcome them through active management and the asset class’ general history of outperformance. However, the wild foreign exchange swings of the last year have, anecdotally at least, seen more investment managers consider currency hedging when going into deals.

Yet despite these changes, hedging at the transactional level is more of an exception rather than the rule for private equity for several reasons. Beyond being expensive, servicing hedging costs does not neatly fit with a private equity fund’s relatively unpredictable cash flow profile. The same goes for the unpredictability of holding periods; while managers can forecast timelines, uncertainty over the length of the holding period, size of exit and underlying portfolio company exposure to foreign exchange make effective hedging very difficult. In addition, should managers wish to spend on hedging, they would typically prefer to do so against historically more volatile currencies, such as the Turkish lira, Brazilian real and Argentinian peso, rather than against the world’s reserve currency of the US dollar.

Currency movements in the context of allocations

Despite this, currency movements pose real risks for funds and investors alike. Gaining a broad understanding of what these risks are in the context of an individual allocation remains a key consideration before committing capital to a private equity allocation. This is particularly salient in the current environment given many of the world’s largest private equity and venture capital funds are US based and US dollar denominated.

But what does this mean in practice? In simple terms, an individual investing in a private equity fund housed in a different currency than their own will benefit in terms of foreign exchange if their home currency depreciates against that of the fund.

Let’s take the example of a Germany-based investor allocating in euros to a US dollar-denominated fund from a US private equity firm. Should the euro weaken against the dollar over the investment timeline, the investor stands to gain from a currency exchange perspective considering nothing else. This derives simply from the fact that in this scenario, dollars will be able to buy and return more euros to the investor during the distribution period than it would have been able to when the investor originally committed capital.

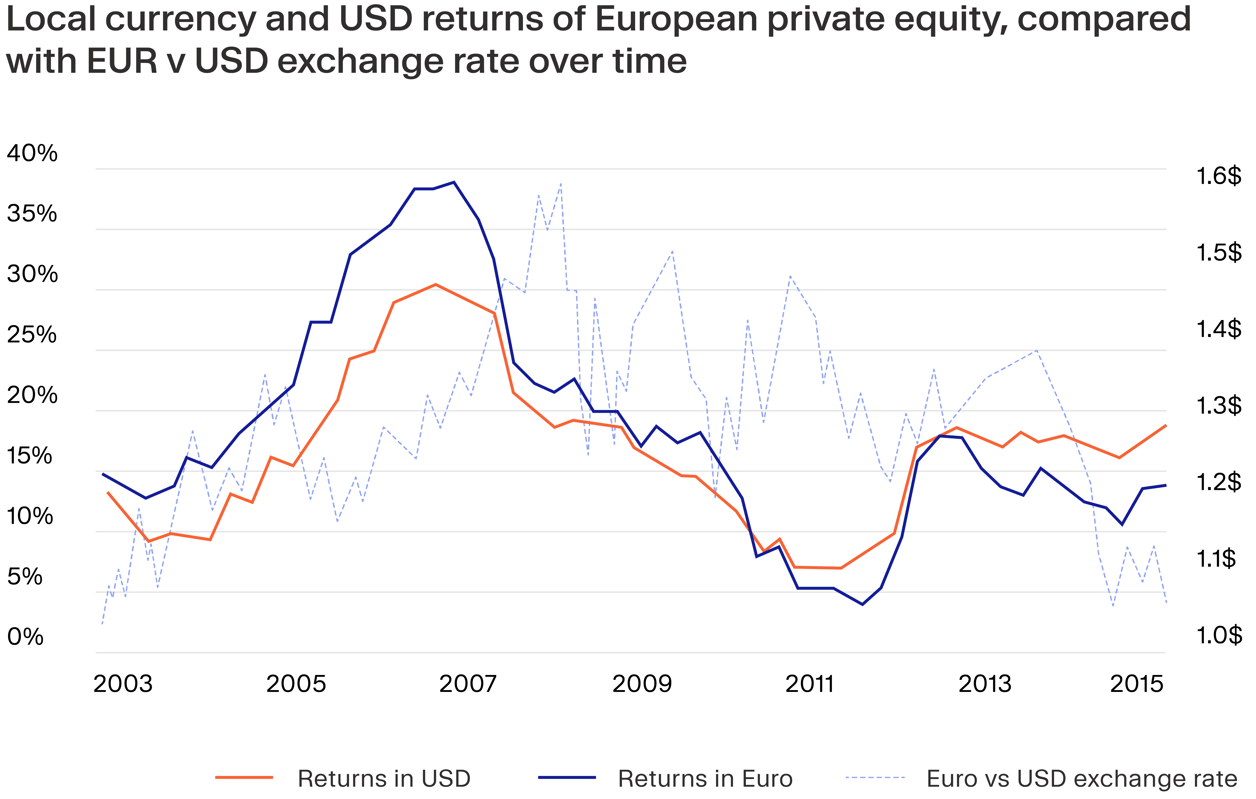

We can see the effect of currency movements on returns by looking further at the euro/dollar relationship. Hamilton Lane research in 2017 highlighted how returns on European private equity in local currency terms outgunned the same asset class in US dollar terms by some 480 basis points in the five preceding years. This trend was reversed, however in the mid 2000s during an environment of prolonged euro strengthening.

Avoiding short-term thinking for long-term results

Trying to ‘time’ investments based on currency movements in this way, however could see many miss out on private equity’s inherent value creation. Private equity has a history of outperformance relative to other asset classes, with one of its main benefits being its long-term investment horizon and ability to take short-term focus on current market conditions out of the equation. (See Why Invest in Private Equity for more detailed information.)

Leaving money on the sidelines due to short-term focus on things such as currency can also see investors missing out. A Charles Schwab study looking at hypothetical investors in the S&P 500, for example, found that even a theoretical investor with the worst possible market timing outperformed those who left investments in cash proxies.

Furthermore, private equity investors can still benefit from a degree of currency risk mitigation by taking advantage of the asset class’ staggered cashflow profile, as well as actively building a well-rounded portfolio:

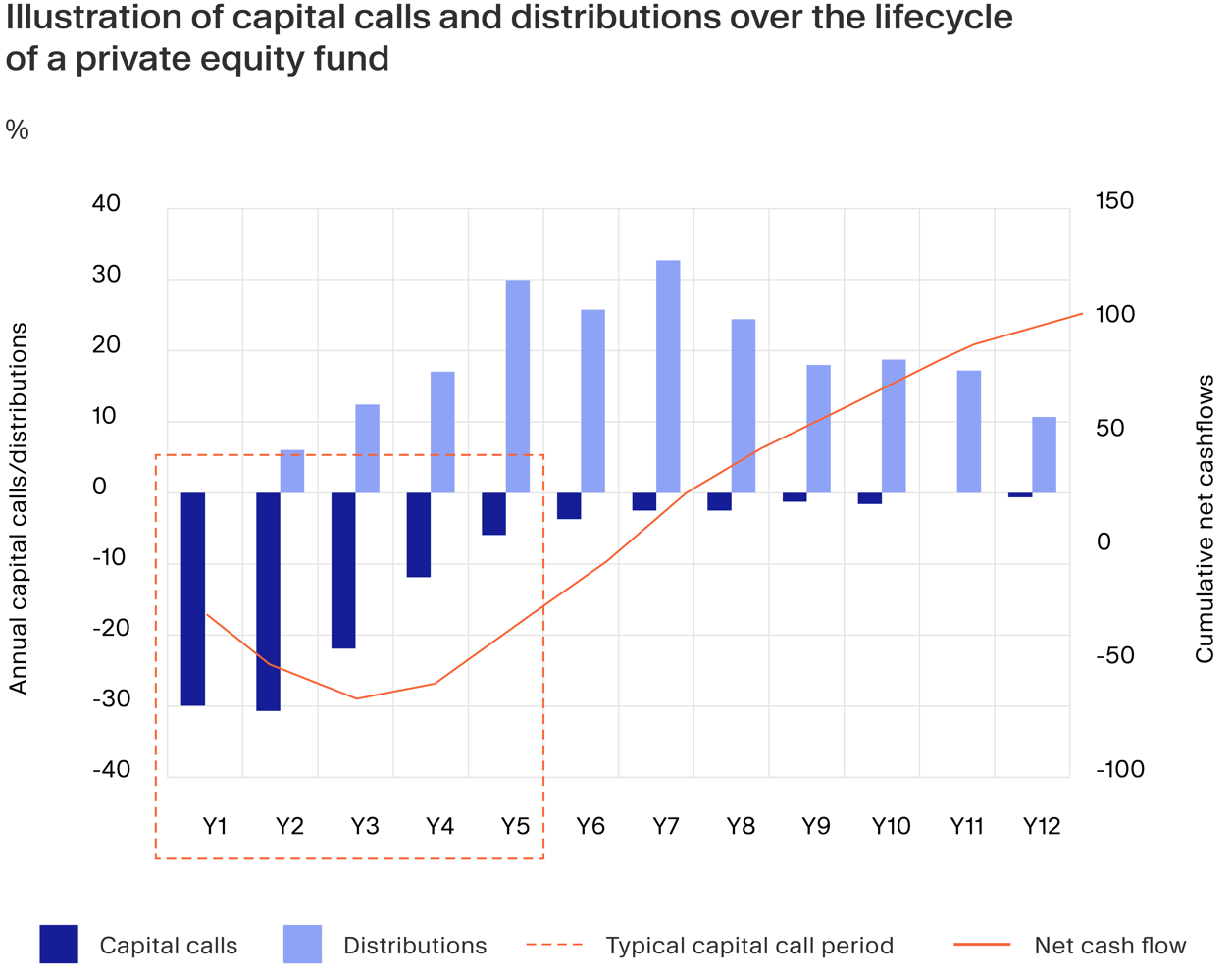

- Blending exchange rates through a fund’s lifecycle. A private equity investment’s cashflow profile is drawn out over time. This is split up into initial ‘capital calls’ when the fund requests money, and eventual distributions when money is returned to investors, over the period of a decade. This long-term structure of inflows and outflows can help smooth out the uneven nature of currency markets over this prolonged period.

- Downside protection through diversification. Individuals can further mitigate currency risk within their private markets allocation by purposefully constructing a diverse, balanced portfolio with interests in funds invested across a swathe of sectors and geographies. This is doubly effective in long-term asset classes such as private equity, which are able to withstand shocks from interest rate changes and currency fluctuations that short-term portfolios may not be able to.

Looking ahead

The dollar’s recent downfall has understandably focused investor attention on how this could impact their portfolios, particularly in the current uncertain economic environment.

However, in a private equity context, focusing too much on short-term exchange rate fluctuations could lead investors to leave money on the sidelines. In turn, this may mean missing out on private equity’s inherent ability to spread out foreign exchange risk through its long-term cash flow profile and diversification over time.

The movements of the dollar or any other currency are important to consider when it comes to investing, private equity or otherwise. However, they should be considered alongside, and not instead of, the wider range of factors — such as the investment’s risks, opportunities and long-term horizon — so that decisions can be made in the proper context.