Public market indices so far in 2025 appear richly priced and increasingly volatile, potentially limiting further upside.¹ ²

Various metrics for gauging long term market movements tend to support this sentiment. The S&P 500, the most followed equity index in the world,³ trades at a cyclically adjusted price-to-earnings (CAPE) ratio of 36 in early March — the highest reading since 1930 with the exception of the dot-com period.⁴ CAPE smooths out short-term fluctuations by averaging earnings over 10 years and can therefore reflect structural shifts in the markets more clearly.

Equity risk premium (ERP) is another helpful indicator for gauging how cheap or expensive stocks are. It measures the extra return investors receive for choosing stocks over treasury bonds. In a ‘normal’ market, the ERP should be comfortably in the positive territory yet it currently hovers near its lowest level in almost 25 years and has — by some calculations — even dipped into negative range.⁵

In other words, based on the above metrics, investors appear to be receiving relatively little reward for the risk of holding stocks over ultra safe assets.

Over concentration

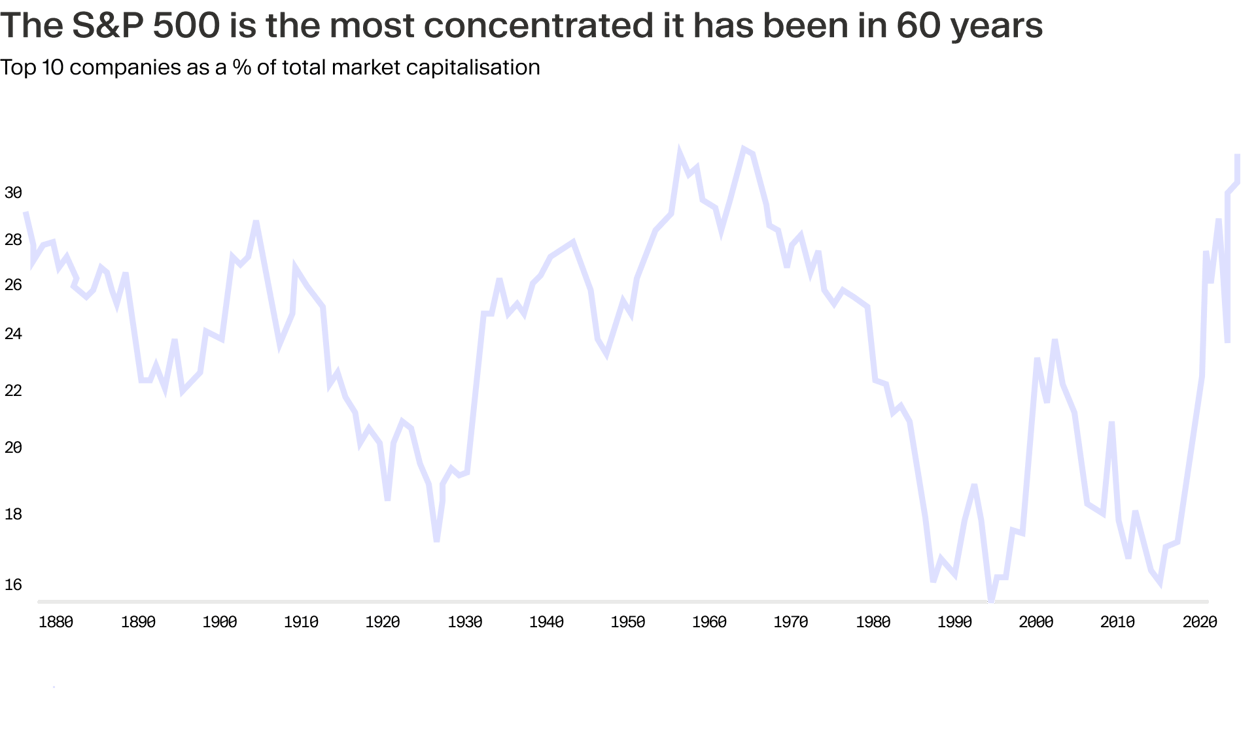

Equity investors should also be mindful of the growing concentration of value within market indices. This is not unusual — markets tend to coalesce around a small group of leading performers. The railroad industry, for example, dominated the American stock market up until the first world war, and was followed by the emergence of the original Magnificent Seven with General Motors, AT&T and IBM, which controlled the New York stock exchange until the 1960s.⁶ The growth of modern telecommunications and periods of turbulence disrupted these old industrial hegemons, leading to a more balanced distribution of value. By 1993, the share of the top ten stocks fell to a historic low of 14%. It then surged during the dot-com period, declined again, but has since climbed to record levels of well over 30%.⁷

Higher interest rates in recent years have greatly accelerated this process as investors moved away from cyclical assets towards a handful of mega-cap technology companies with strong pricing power.⁸ Nvidia, Apple, Meta and the rest of the group have reported robust profit margins and earnings growth, which analysts expect to continue — though at a much slower pace given the more tempered economic outlook and cooling labour markets.⁹

Public markets nevertheless remain relatively optimistic with S&P 500 trading at record levels in mid-February before dipping in recent weeks¹⁰ due to uncertainties around US trade policies.¹² Expectations of regulatory easing and tax reform in the US have been driving lofty valuations, leaving stocks vulnerable to any growth disappointments, says Goldman Sachs.¹¹ Equity returns are likely to be characterised by declining valuation multiples, notes Amundi,¹³ while Morgan Stanley argues that the outsized returns of mega-cap equities mean it's “probably a good time to reassess and rebalance” your portfolio.¹⁴

Case for diversification

The question on the minds of many asset allocators is how should one invest in a seemingly fully-valued public market while also facing fluctuating correlation between equities and bonds? The simple but not always easy answer is to optimize investment selection and diversify the return drivers. In this effort, alternative investments and particularly private equity may offer attractive growth opportunities for investors who can tolerate a somewhat higher degree of illiquidity. In our view, three arguments for ‘why private equity and why now’ are worth highlighting.

Attractive valuations

Though private equity valuations seem to have bottomed out and are now recovering, they are still trailing public markets by a considerable margin. In the year to mid-November 2024, the S&P 500 index was up 22.1%, the NASDAQ by 21.8% and MSCI World by 19.3%, yet buyout fund valuations rose by only 5% and venture capital declined by 1.6%, according Neuberger Berman.¹⁵ This gap has opened opportunities to invest in private assets at often attractive valuations, per Blackrock.¹⁶ Based on our best estimates, we expect valuations to stabilise as debt becomes more available, driving deal activity upwards in 2025 and 2026.

Exposure to critical technologies and sectors

The number of public companies has been steadily shrinking over the past few decades. At its peak in 1996, the US had over 8,000 listed companies, yet only half remain today.¹⁷ Meanwhile, nearly 90% of companies with revenues exceeding $100 million are private.¹⁸

This leaves investors in public equities with a shrinking pool of opportunities at an arguably critical juncture for the global economy with the emergence of game-changing technologies such as AI and a growing focus on strategic autonomy. In our view, sectors such as defence, cyber and broader AI space will generate substantial value in the next 10 years. However, for investors, many of these opportunities will be primarily accessible through private equity and venture capital.

Future outperformance

Private equity has evolved into a major asset class by generating handsome rewards for many investors.* Even with recent declines in exit multiples, median private equity funds outperformed S&P 500 over 5- and 10-year horizons.¹⁹ Top-quartile PE funds have been able to produce even greater returns, often in the range of 20-30% annual return rate.*²⁰ (*Past performance does not guarantee future results.)

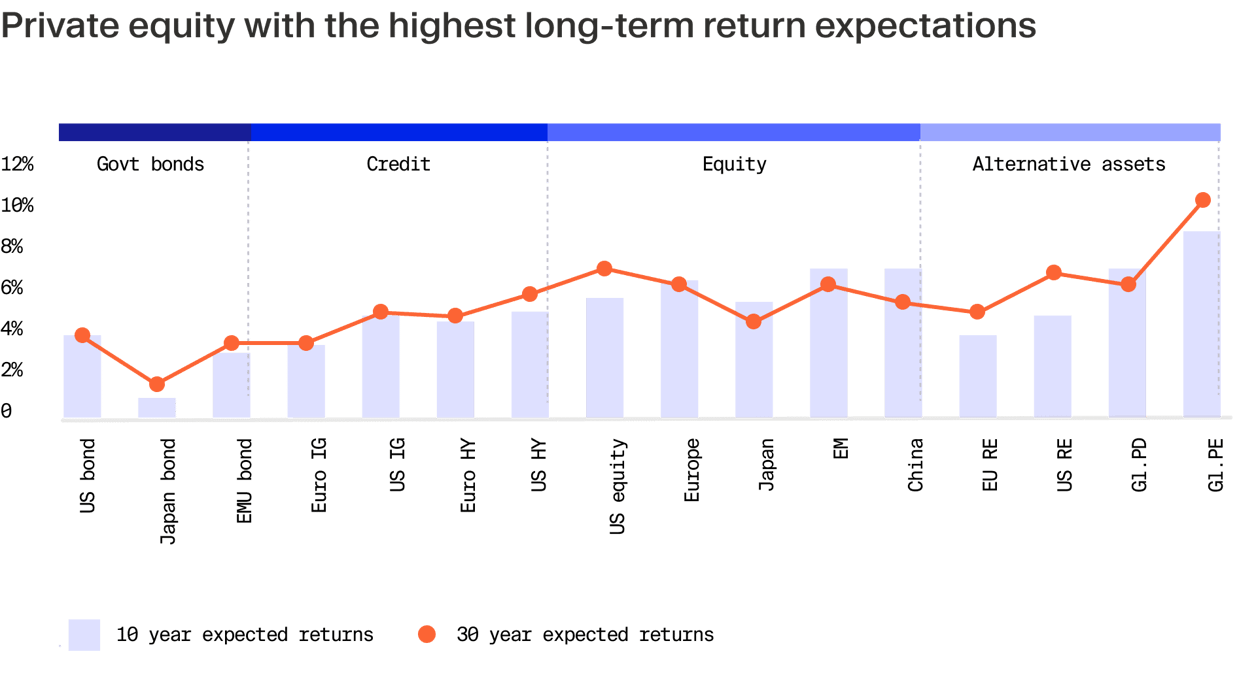

Does private equity have what it takes to sustain its outperformance against public markets? In our view, PE’s hands-on ownership model, strong focus on operational efficiencies, massive amounts of dry powder and industry’s overall flexibility are key drivers in the long run. These advantages are quantified favourably in all major capital market assumption reports which seek to predict return levels for different assets over the next 10 years. Amundi, for instance, anticipates a 8.8% annual return for global private equity,²¹ BNY a 9.7% return for US private equity²² and Blackrock a 10.5% return.²³ These returns exceed US equity by 2 to 4 percentage points.*²⁴ ²⁵ ²⁶ (*Past performance does not guarantee future results.)

¹ www.marketwatch.com/story/u-s-stocks-have-never-been-more-expensive-based-on-this-metric-841989b5 ² https://www.investing.com/indices/volatility-s-p-500 ³ https://www.spglobal.com/spdji/en/index-family/equity/us-equity/us-market-cap ⁴ https://www.multpl.com/shiller-pe ⁵ https://www.reuters.com/markets/us/sinking-us-equity-risk-premium-rings-alarms-mcgeever-2025-01-10/ ⁶ https://www.brewmarkets.com/stories/2024/06/12/original-magnificent-7-apple-amazon-google-nvidia ⁷ https://www.finaeon.com/200-years-of-market-concentration/ ⁸ https://www.jpmorgan.com/insights/global-research/markets/market-concentration ⁹ https://www.morganstanley.com/ideas/magnificent-7-stocks-cyclical-stocks-market-rotation-2025 ¹⁰ https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview ¹¹ https://www.reuters.com/markets/us/futures-slide-marvells-forecast-fails-impress-tariffs-focus-2025-03-06/ ¹² https://www.goldmansachs.com/insights/articles/global-stocks-are-vulnerable-in-2025 ¹³ https://research-center.amundi.com/article/capital-market-assumptions-2024 ¹⁴ https://www.businessinsider.com/sp500-returns-outlook-decade-flat-returns-mike-wilson-morgan-stanley-2024-12 ¹⁵ https://www.nb.com/handlers/documents.ashx?id=62ec8e46-0646-458c-8770-71c0f18c7290 ¹⁶ https://www.blackrock.com/institutions/en-us/literature/whitepaper/2025-private-markets-outlook-stamped.pdf ¹⁷ https://apolloacademy.com/wp-content/uploads/2024/03/030424-Chart.pdf ¹⁸ https://www.apolloacademy.com/many-more-private-firms-in-the-us/ ¹⁹ https://files.pitchbook.com/website/files/pdf/Q2_2024_PitchBook_Benchmarks_with_preliminary_Q3_2024_data_Global.pdf ²⁰ https://files.pitchbook.com/website/files/pdf/Q2_2024_PitchBook_Benchmarks_with_preliminary_Q3_2024_data_Global.pdf ²¹ https://research-center.amundi.com/files/nuxeo/dl/632647dc-5c23-4fe3-8050-01897f30c271?inline= ²² https://www.bny.com/wealth/global/en/insights/2025-capital-market-assumptions.html ²³ https://www.blackrock.com/institutions/en-us/insights/charts/capital-market-assumptions ²⁴ https://research-center.amundi.com/files/nuxeo/dl/632647dc-5c23-4fe3-8050-01897f30c271?inline= ²⁵ https://www.bny.com/wealth/global/en/insights/2025-capital-market-assumptions.html ²⁶ https://www.blackrock.com/institutions/en-us/insights/charts/capital-market-assumptions