Private equity market size

Private equity markets - growth history

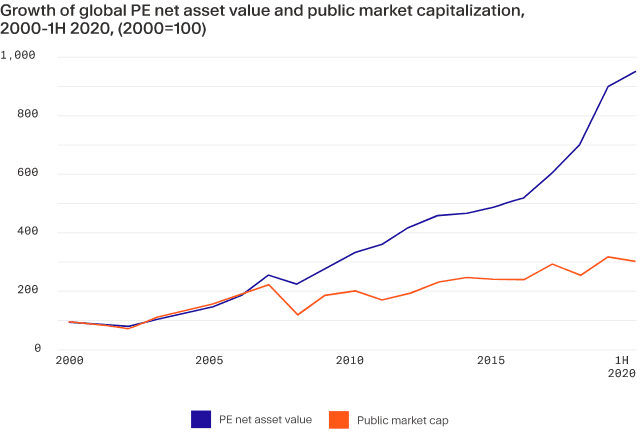

Until the late 20th Century, public equity investment dwarfed private equity, but in the past few decades there has been a steady shift towards private markets, especially in developed countries.

Globally, the private equity market is growing far faster than public markets.

Breaking the market down by strategy subclass and region provides a more detailed picture of where this growth is coming from.

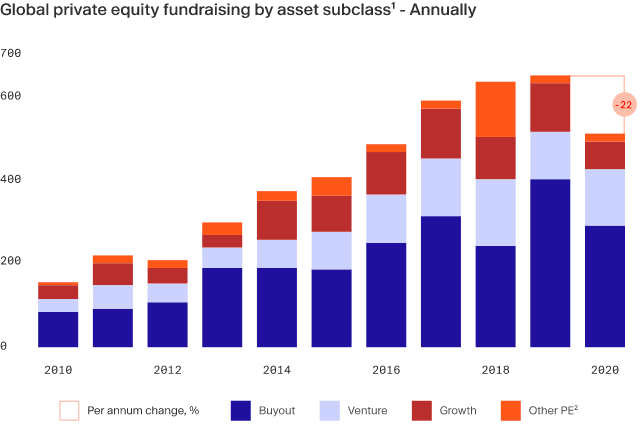

Private equity market size by asset subclass

The above chart shows that buyout funds make up around half of the market growth, with growth and venture capital making up around a quarter each.

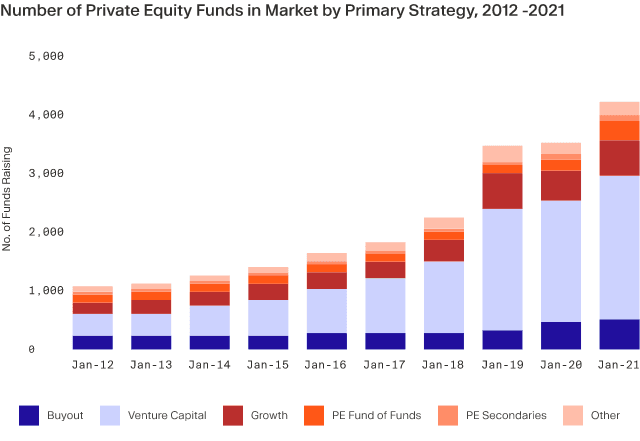

Private equity market size by number of funds

When it comes to the number of funds, there are far more venture capital funds than any other strategy, followed by growth, then buyout. This may seem counterintuitive but venture capital funds invest smaller amounts at an earlier stage of a company’s life than buyout funds. Therefore, while there are more venture capital funds in number, buyout funds dominate the market in total size.

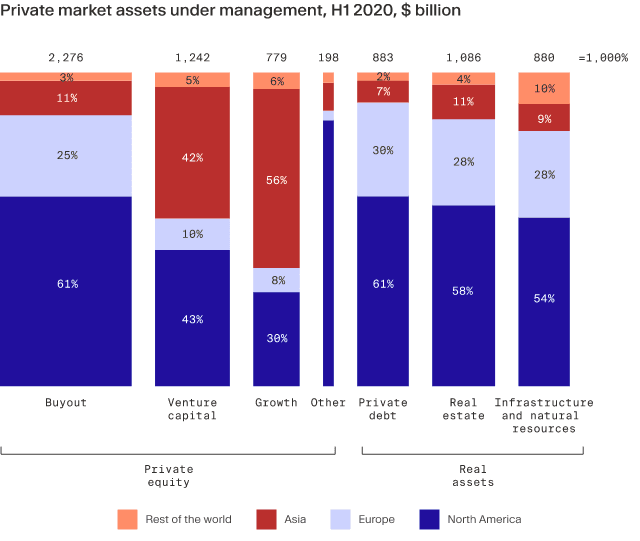

Private equity market size by region

At a regional level, North America (particularly the United States) makes up more than half of the market, followed by Asia, Europe and the rest of the world. This split is relatively representative of how long each region has been taking part in the industry, with Asian and European funds starting out a lot later than the United States.

We dig deeper into strategies within private equity in the section Explore strategies.

Private equity market - a current snapshot

According to Preqin - a research house specialising in alternatives - the global private equity market surpassed $4.74 trillion at the start of 2021¹.

Taking private equity alongside other private market assets including private debt, real estate and infrastructure, the wider private market has surpassed $7.3 trillion.

Note that this is a static picture of the market in 2020, purely for illustrative purposes.

Private equity market growth - forecast growth

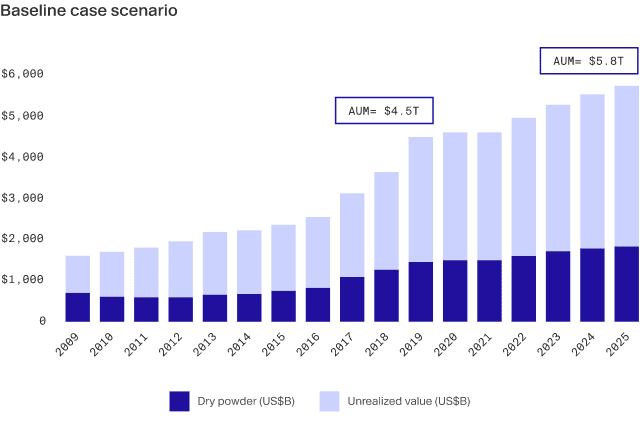

Deloitte - in their baseline case for growth - forecasts global private equity to reach US$5.8 trillion assets under management by 2025². In their prediction, Deloitte takes into account an important element: the proportion of investments that are not yet put to use (also known as “dry powder”).

In sum, global capitalization of private equity well exceeds that of public equity and the trend over the last decade suggests that PE assets will continue to grow faster than public equity assets in the years to come. This holds true for all subclasses of PE, each of which exhibits overall 10-year growth as well. While still considered an “alternative” asset class as a result of its unique characteristics, it is clear that private equity has solid foundations among institutional investors and is viewed as a primary asset class for investment allocations.

¹Preqin Global Private Equity & Venture Capital Report 2021, February 2021. https://www.preqin.com/insights/global-reports/2021-preqin-global-private-equity-and-venture-capital-report

²The growing private equity market. Deloitte, November 2020. https://www2.deloitte.com/us/en/insights/industry/financial-services/private-equity-industry-forecast.html