Key aspects of PE investments

As a consequence of the unique attributes of private equity investments and the nature and life cycle of the PE fund structure, investors in PE funds will realise an investment experience that differs from other investments, such as public equities and fixed income securities. Among the most important aspects to consider when adding private equity investments to a portfolio are the investment's cash flows, return profile and impact on portfolio diversification.

1. Cash flows

Investments in public securities or funds can be made all at once and liquidated all at once. Investors also have the ability to add funds or liquidate portions of the investment at their discretion. In private equity funds, however, investors make a commitment to invest but do not deposit their capital all at once. Instead, the General Partner issues a ‘capital call’ for a portion of the investor’s commitment as it is required to purchase interests in private companies.

The process can extend for up to several years before an investor’s entire commitment is requested. The investor does not have discretion and is obligated to deliver capital to the fund when requested.

As the fund liquidates its interest in private companies, the General Partner issues distributions to the investors. These occur at the GP’s discretion and in accordance with a distribution plan that is spelled out in the offering documents. Here, too, the investor has no discretion on when these cash flows are made.

2. Return profile (the J-Curve)

Public equity investments are primarily secondary market transactions between investors. So proceeds from a public equity investment (unless part of an IPO) do not actually go into the company. In private equity investments, however, capital goes directly into the company to fund their growth. There is then normally a lag between the infusion of new investment capital to a target company and the realisation of increased value in the company through revenue or earnings improvement.

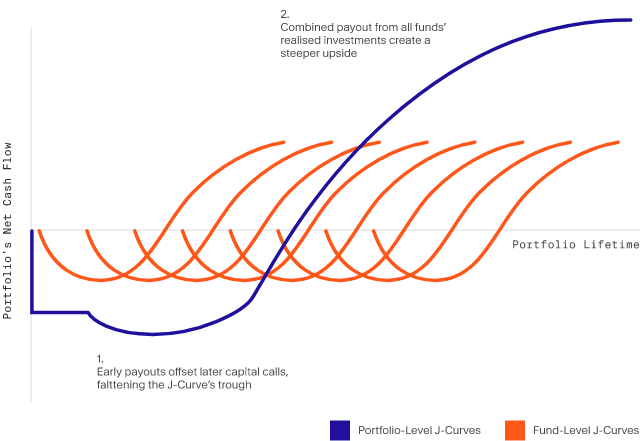

During this lag period, investment money has gone into target investments without an attendant increase in company value yet. As such, the value of private equity investments tends to dip below the valuation of the initial investments while capital is being deployed and then accelerate in future quarters as the target begins to realise growth from that investment. Consequently, the resulting curve of investment value over time takes the shape of a letter ‘J’ as investments are made but increased value is not yet realised.

As the target investments produce measurable growth, they increase in value at an accelerated rate. The GP can then plan exits during the harvesting period that will realise that increased value for investors in the fund.

The shape of the return profile experienced by the investor is known as the “J-Curve”.

From the Limited Partner perspective, a somewhat flatter J-Curve is preferred. This can be achieved with smaller, more gradual capital calls and faster exits from earlier investments to soften the impact of negative returns during the early years of a fund.

You can read more about the J-Curve in our Moonfare White Paper here.

The lock-in period of a private equity fund and J-Curve return profile can create both opportunities and issues for investors looking to maintain a dynamic portfolio - one that is flexible to their changing needs and can be adapted to unexpected events.

On the one hand, the cycle of capital calls and distributions can create a self-funding portfolio where profits from one private equity investment are reinvested in the capital calls of another. This is especially possible if the fund has a particularly flat J-Curve (as mentioned above).

On the other hand, if a private equity fund investment does not return cash until late in the life cycle, Limited Partners can suffer from the illiquid nature of the asset class. Even if a fund generates an excellent return by the end of its lifetime, investors might find themselves in urgent need for liquidity - to fund capital calls, pay debts or any other need for cash.

3. Portfolio diversification

In general, private equity has been shown to be sufficiently uncorrelated with public equities as to provide positive diversification attributes when added to public equity portfolios.¹ The degree of correlation between private equity performance and public equity funds, however, will differ among the various types of private equity and various configurations in public equity portfolios, depending on their concentration in industry sectors, size, or factor weightings, such as value vs. growth.