Invest in venture capital.

Moonfare's Venture Portfolio offers a simple, diversified approach to investing in VC. Our top-tier global VC fund managers seek to invest at the ground floor of the next unicorns.

VC funds invest in early-stage companies with enormous upside potential.

Facebook, Apple, OpenAi (ChatGPT). Top-tier venture capital managers invest in startups before they become industry-defining businesses.

VC has some of the highest risk-adjusted returns across asset classes.

Venture capital has historically achieved higher risk-adjusted returns than several other well-known asset classes, such as fixed income, public equity and late-stage private equity.

Our curated mix of top-tier VC funds gives you instant diversification.

Our carefully curated basket of top-tier venture capital funds provides you with diversification across company stages, sectors, and geographies. This helps mitigate risk while providing exposure to a broad range of underlying startup investments.

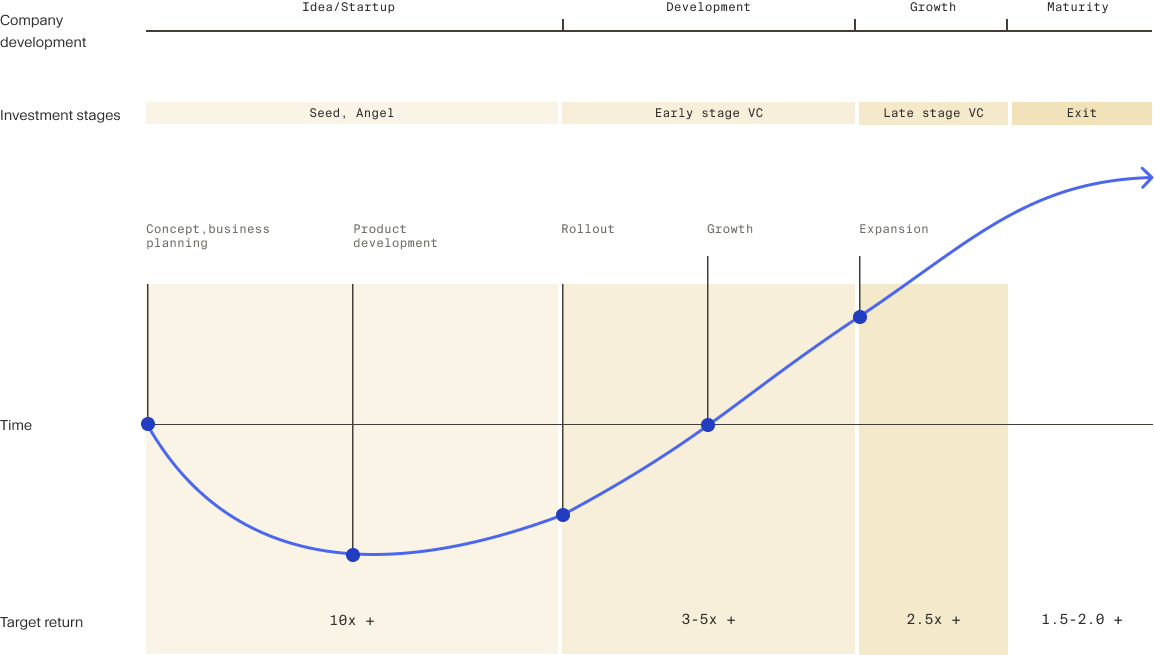

How venture capital works.

Venture capital investments support early-stage companies developing a product to fill a specific market need. Startups are not necessarily profitable yet, making them bad candidates for debt financing.

This is where venture capital managers step in. VCs identify and invest early in those businesses with the greatest potential, capturing the highest possible returns in the process.

View chart details

Source: Moonfare

Cash flow

How venture capital fuelled Slack’s meteoric rise.

Accel invested roughly $200 million in workplace communications technology platform Slack over a period of seven years. When the company debuted on the NYSE in June 2019, Accel held 24% of the company. Their shares were worth $4.6 billion at IPO, generating a 23x return.

View chart details

Source: Moonfare and S&P Cap IQ

The Moonfare advantage.

Your gateway to top-tier venture fund managers.

Pavel Ermoline

Thomas Jetter

We take the stress out of venture investing. Our dedicated investment team leverages their relationships with top-tier GPs to bring the best funds to our groundbreaking portfolio products.

As a private markets investor, picking the right managers is critical to achieving the kind of returns for which venture capital is known.

This is Moonfare’s greatest advantage. Backed by an Investment Committee with over a century of experience, our investment team meticulously evaluates hundreds of potential deals each year and selects only the most promising for the MVP portfolio.

Moonfare applies a rigorous fund selection process.

We strive to ensure that the funds we bring to you are, in our mind, archetypal top-quartile performers — a key factor behind successful private equity investing. Moonfare also evaluates each investment opportunity against a defined set of ESG criteria.

Coverage

Moonfare actively covers more than 250 fund managers via personal and institutional relationships established on IR and deal team level.

5,000+

Sourcing

The team sources well over 300 opportunities per year through its coverage activities and inbound offers.

1,790

Screening

Roughly half of the deals sourced are looked at more closely to determine their fit with Moonfare’s investment criteria.

494

Due diligence

During this phase, our team has full access to the fund or deal data and team. Based on the work performed, the team presents a full due diligence report to the Investment Committee for consideration.

272

Investment recommendation

The Investment Committee evaluates investment proposals based on rigorous standards across all Moonfare’s investment criteria and makes a recommendation on whether to pursue the investment.

99

As of Feb, 2023* Includes funds and co-investments. # of funds

Manager selection is key to outperformance in VC.

The yield dispersion between top and bottom quartile performers is the most pronounced among venture capital funds. This is why a thorough due diligence process is so important.

Global PE fund performance by strategy, net IRR to date through Sep 30, 2021, 2008-18 vintages

View chart details

Source: Burgiss, as cited in McKinsey (2022), Private markets rally to new heights: McKinsey Global Private Markets Review 2022.

Our portfolio aims to diversify across stages, geographies and sectors.

Diversification across company life cycles stages, geographies and industries helps to mitigate risk while taking advantage of a variety of secular trends. Moonfare works with GPs who have deep experience in each facet of VC investing to craft the right mix for our portfolios.

View chart details

1) The allocation targets are indicative and based on historical/expected portfolio diversification of the target funds.

Making venture capital work for you.

Our curated portfolio provides you with unique exposure to a basket of leading global venture fund managers with high upside potential. Find out for yourself how this can complement your existing investments.