Key takeaways

- Distributions, the means by which private equity funds return capital to investors, are paid when fund managers realise their investments in underlying companies or assets.

- Some capital will usually start flowing back to investors within the first 1.5 to 4 years, with larger distributions typically following later in the fund life.

- Fund managers may delay realising investments —and therefore paying distributions—in more challenging environments, seeking to sell assets in better times to optimise returns to investors.

The way in which private equity funds distribute capital to investors is unique and it’s worth taking a little time to understand the mechanics of it.

The path to distributions

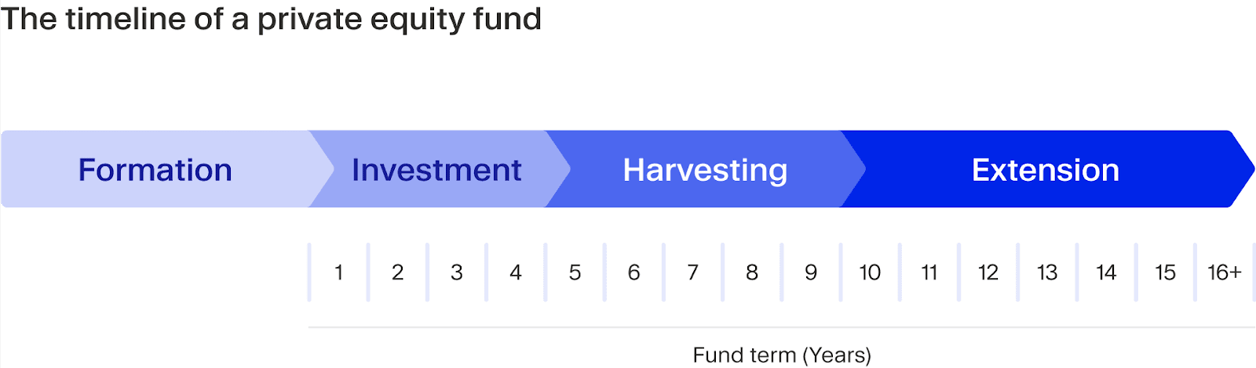

The lifecycle of a typical private equity fund follows several distinct stages. Fund managers first source opportunities after raising capital from investors, then they execute a value creation plan over a period of roughly three to five years before selling or “harvesting” their investments. To learn more about how these phases look up close, jump over to our PE Masterclass educational series.

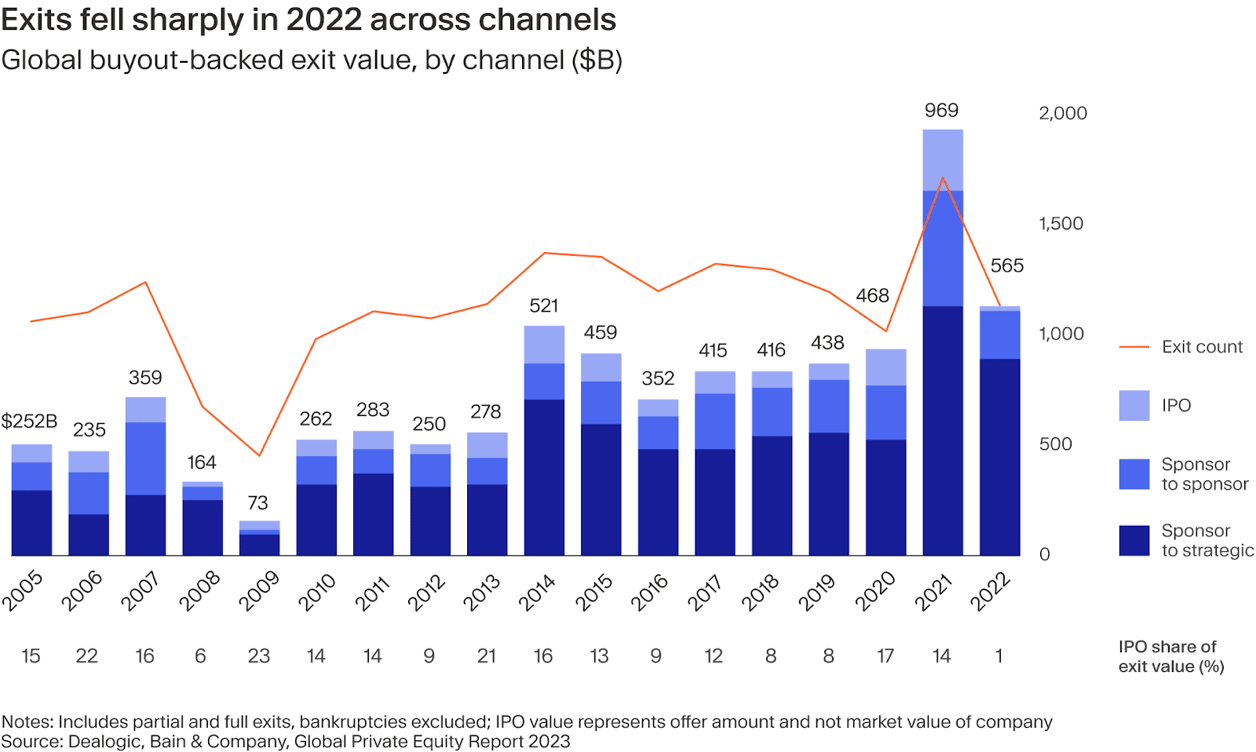

In the “harvesting stage”, fund managers have a range of options for realising investments. The main routes include selling the company to another business, to another private equity buyer or listing the asset on stock exchanges (IPO).¹

A fund manager may also decide to hold the investment beyond the fund’s life by transferring it to a so-called continuation vehicle managed by the same firm. This route offers investors a choice to either remain invested in the asset(s) or receive a distribution.

Learn more: distributions in 2023

The choice of realisation route may depend on market conditions as private equity funds seek to maximise returns. The chart below of the three main exit routes, for example, shows that IPOs increased in 2021, when public markets valuations were rising, but fell during market turbulence in 2022.

As the downturn continues to persist in 2023, investors can expect the distribution pace to remain somewhat subdued. Find out more about the current state of distributions in our recent article, where we also explain which private market strategies can potentially demonstrate more resiliency in generating distributions during times of dislocation.

When do distributions happen?

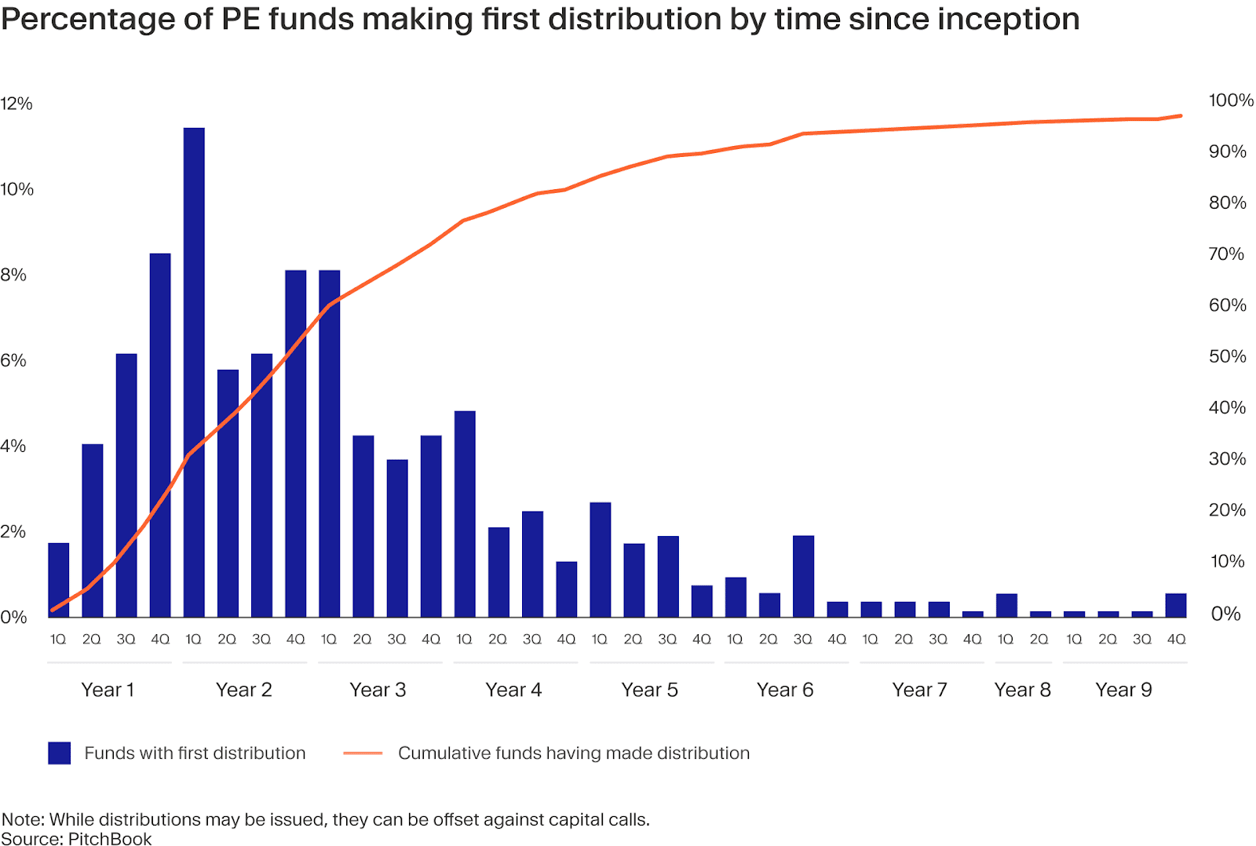

Although the pace of distributions can vary according to a fund’s strategy and to market conditions, in most instances, investors can expect at least some distributions relatively early in a fund’s life.

Research shows that around half of all funds make their first distribution just 1.5 years into a fund’s life, around a quarter make their first distribution at around 2.5 years and a further 10% do so at 3.5 years, as the chart below illustrates.²

The size of distributions

Given that private equity funds invest in a range of companies or assets to provide diversification and avoid too much capital being concentrated in a single investment, each distribution is usually relatively small compared to the full fund size.

Pitchbook, for example, estimates that the average size of distribution tends to be about 5% of a fund size. However, it also notes that some distributions can be significant, with the average largest distribution during a fund’s life of 32% of the fund size.²

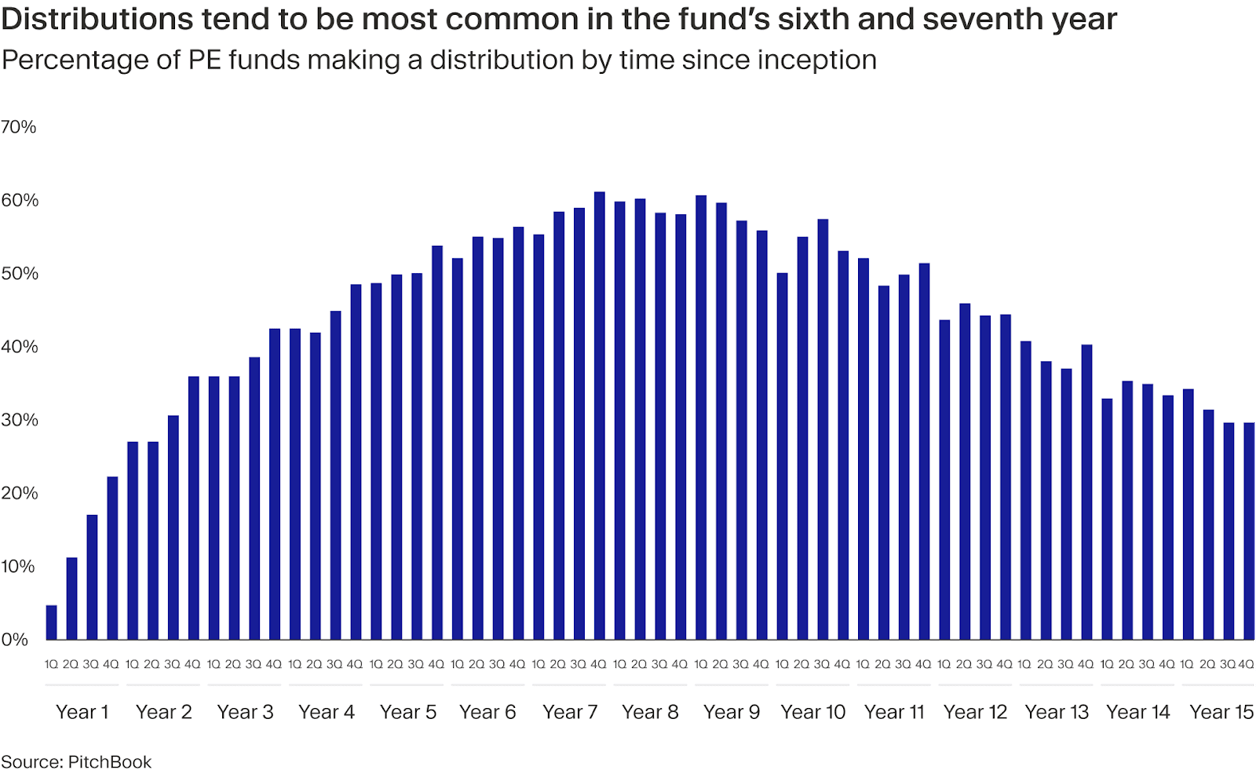

These larger distributions—which may be made up of more than one realisation—are most likely to occur some way through the fund's life. Fund managers need time to make the investments, execute value creation plans and then realise returns. Indeed, distributions tend to be most common in the fund’s sixth, seventh and eighth year, according to Pitchbook.² They can also continue beyond the traditional ten-year life of a private equity fund – extensions to the fund life are commonplace to allow all investments to be realised.

The range of distribution sizes and the fact that funds make distributions when selling or realising an investment means that capital flows back to investors tend to be lumpy. In addition, fund managers may not realise a position all in one go but instead over time to avoid influencing the price, which is often the case when a private equity sponsor lists a portfolio company on a stock exchange.

The effect of waterfalls on distributions

An essential part of the private equity model is alignment of fund manager’s compensation with the fund’s returns. To achieve this, private equity fund managers charge a performance fee, or carried interest, typically set at around 20% of the excess profits of the fund.

This affects how funds distribute capital. Investors will always receive their capital back, plus some element of return, before the fund manager can start to share in the profits. The model for this is known as a waterfall and has three main steps:

- The fund distributes capital to investors until they have received back the full amount they initially invested.

- The fund then distributes capital to investors up to a pre-agreed preferred return or hurdle rate – this is a return on capital, usually set at around 8%, that investors receive before the fund manager can start receiving any carried interest.

- Catch-up and carried interest then kicks in. This means the fund manager receives the next distributions until it has caught up its percentage of carried interest. So, if this were 20%, the fund manager takes distributions until profits are split 20% to the fund manager and 80% to the investors. All future distributions continue with this 20/80 split.

The pecking order of distributions also varies according to whether a fund uses a US-style waterfall or European-style waterfall:

- In US waterfalls, distribution splits are applied on a deal-by-deal basis. The proportion of capital invested and the preferred return allocated to each deal must be returned to investors before the fund manager receives carried interest.

- In European waterfalls, distributions are split on a whole fund basis. This means that investors in a fund must receive the entirety of the capital they have committed to a fund, plus the preferred return on that amount, before the fund manager can receive any share of the profit.

A final word: to understand distributions is to better manage portfolio

Private equity’s cash flows are markedly different from other asset classes and distributions, in particular, can be quite a complex area. However, for investors, understanding the basic mechanics of when and how capital flows back to them can help them manage their liquidity and investment portfolios more effectively.

¹ In an IPO, PE sponsors have a lockup period of a few months to a year, at which point they will usually exit the public position over time. ² https://pitchbook.com/news/reports/2020-basics-of-cash-flow-management#downloadReport