Key takeaways:

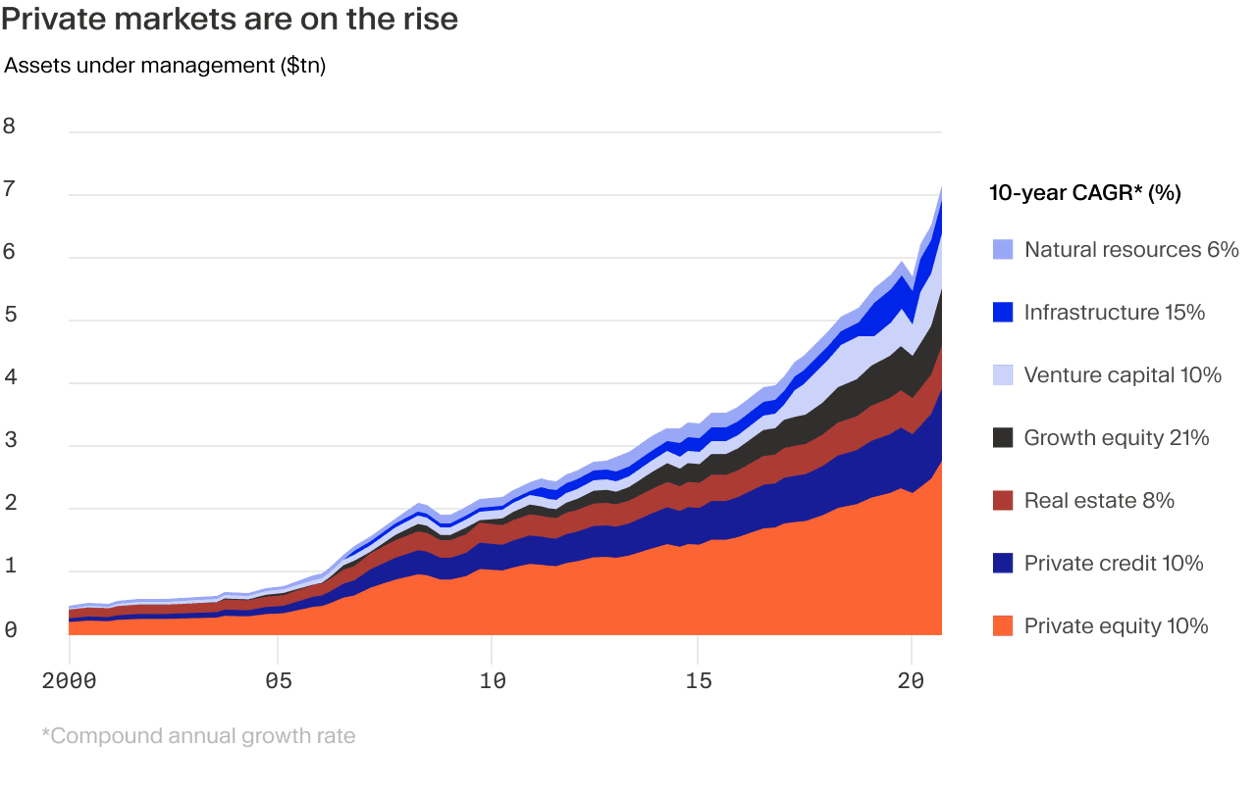

- Investment strategies in private markets vary significantly — from higher-risk, high-reward assets like venture capital to potentially more stable, but lower-return options like infrastructure.

- Each strategy suits different investor goals and risk appetites. It's not about which is best but which best fits your needs.

- However, it’s important to remain mindful of the limitations as most private market investments are relatively illiquid and carry varying degrees of risk.

Learning the differences between asset classes can help investors make the best choices for their goals, but it can also feel overwhelming, especially for those new to private equity. Moonfare is here to help with that.

This article provides an overview of seven core private market asset classes, covering their fundamental properties, average rates of return and risk profiles.

Private markets at a glance

| Strategy | Key value creation strategy | Investment horizon | Average rate of return\* | Impact of economic cycles |

|---|---|---|---|---|

| Private equity buyouts | Operational, strategic and financial optimisation of companies. | 4-7 years | 16.4% | Sensitive to economic downturns, but with opportunities for value creation. |

| Growth equity | Capital for expanding companies, focusing on scale-ups rather than start-ups. | 5-8 years | 17.3% | Can thrive during economic growth; somewhat vulnerable during downturns. |

| Venture capital | Funding to transform ideas into high-growth businesses. | 5-10 years | 15.1% | Sensitive to economic cycles; potential for high returns in boom times. |

| Private credit | Lending capital directly to companies or to finance leveraged buyouts, generating income. | 3-7 years | 8.2% | Generally stable during economic downturns; loans typically tied to floating rates. |

| Secondaries | Buying existing investments from other investors at a discount. | 2-5 years | 13.5% | Less sensitive as investments are more mature and diversified. |

| Infrastructure | Developing, maintaining or enhancing essential services and facilities. | 10+ years | 10.4% | More resilient to economic cycles due to essential nature of infrastructure. |

| Real estate | Managing property to generate income and capital appreciation through market dynamics. | 5-10 years | 11% | Vulnerable to economic shifts, but certain sectors (e.g., industrial) may be more resilient. |

Private Market Investment Strategies

Private equity buyouts: targeting majority control in mature companies

There are various and sometimes interchangeable definitions of private equity. However, what we typically understand as private equity includes venture capital, growth capital and buyouts. We’ll look at each of these strategies separately.

Private equity buyouts focus on acquiring a majority control over mature companies. Managers will then aim to increase efficiencies, streamline operations and maximise the profitability of that company. It’s a hands-on approach aimed at increasing the company's value for a profitable exit, typically through a sale or IPO.

Real-world examples of fund managers operating in the buyout space include well-known firms like KKR, Blackstone and Carlyle.

Investments in private equity buyouts may carry a certain risk because of the use of leverage and the complexity of transforming businesses. Mitigating these risks requires selecting experienced managers with proven success records. Despite the risks, however, the strategy's appeal lies in its potential for high returns, historically outperforming public markets as well as other private market investments.¹²

Linked to this, the amount of work involved in private equity buyouts usually demands a long-term commitment. Average timelines range from four to seven years but can extend longer than that.³ This timelines can allow managers to implement value-creating strategies and adjust to market conditions before exiting.

Growth equity: investing in stable business models with high growth potential

Both private equity buyouts and growth equity target companies with more or less established business models, but growth investors will seek companies where there's a clearer growth potential. These companies are typically earlier in their life cycle compared to companies that PE buyouts would target, which can mean a greater upside potential but also a relatively higher risk level.

The focus is therefore on companies seeking capital to expand operations, enter new markets or finance a transformative acquisition without fundamentally changing the company's existing management or business model. Fund managers in this space typically seek minority shares and don’t use significant leverage compared to buyout funds.

These investments have a medium to long term horizon, ranging from four to seven years.⁴

One of the more established firms in the growth space is TA Associates with more than $65 billion dollars of raised capital.⁵ Boston-based Summit Partners is another industry heavyweight who typically invests between $10 and $500 million into their target companies.⁶

Venture capital: fishing for home-run investments

Venture capital (VC) targets companies in the early stages of their lifecycle, with demonstrated potential for explosive growth. VCs provide the funding to nurture these startups with capital, mentorship and strategic guidance.

NP-Hard Ventures, for example, is a venture capital fund that focuses on investing in pre-seed startups, primarily in Europe.⁷ Bain Capital Ventures, on the other hand, invests across the startup lifecycle — seed, early and late stage.⁸

VC is typically riskier than buyouts and depends on a small number of successful deals, or home runs, to make a fund a success.

The investment horizon for venture capital is usually long-term because it takes time for startups to mature into big enough and (potentially) profitable companies. Between 5 and 10 years is an average lifecycle.

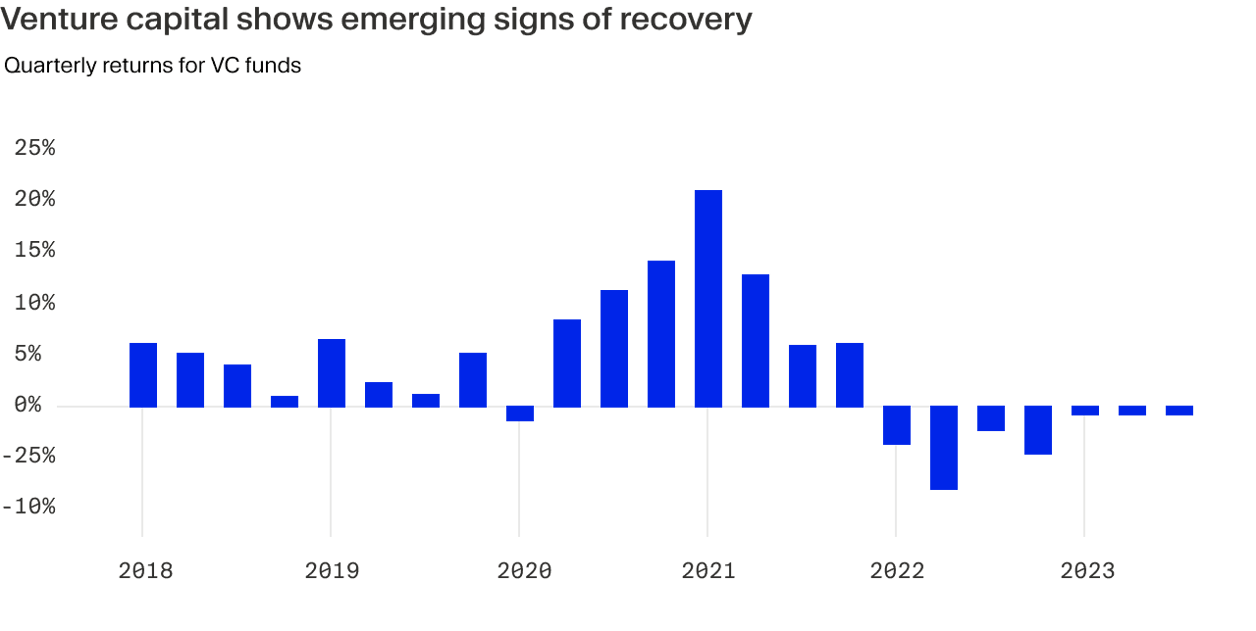

After a dip in returns over the pandemic, VC looks to be making a recovery this year. As we explain in our recent article, now could be a good time to think about reengaging with VC investing as it begins a possible upswing.

Private credit: offering a path to a steady income

Private credit involves lending capital outside of traditional banking channels. In most cases, credit investments can offer a predictable stream of cash flow through regular, scheduled and contracted repayments. Compared to equity, income-oriented private credit does not have to rely on earnings or growth to drive returns.

A large part of private credit’s activity is providing financing for leveraged buyouts, but these funds also engage in other types of lending.

Examples of private credit types include direct lending, mezzanine financing, distressed debt and special situations financing. Oaktree Capital Management, for example, is a fund manager focused on distressed debt investments. Many industry heavyweights, who started out as buyout managers, have also entered private credit space in recent years, including KKR and Carlyle.⁹¹⁰

The risk in private credit is generally lower than equity-focused strategies, because debt positions typically have priority over equity if a company defaults. However, the risk profile also depends on the creditworthiness of the borrowers, the seniority of the debt and the collateral backing the loan, if any.

Private credit investments often have a medium-term horizon, usually 3-7 years.

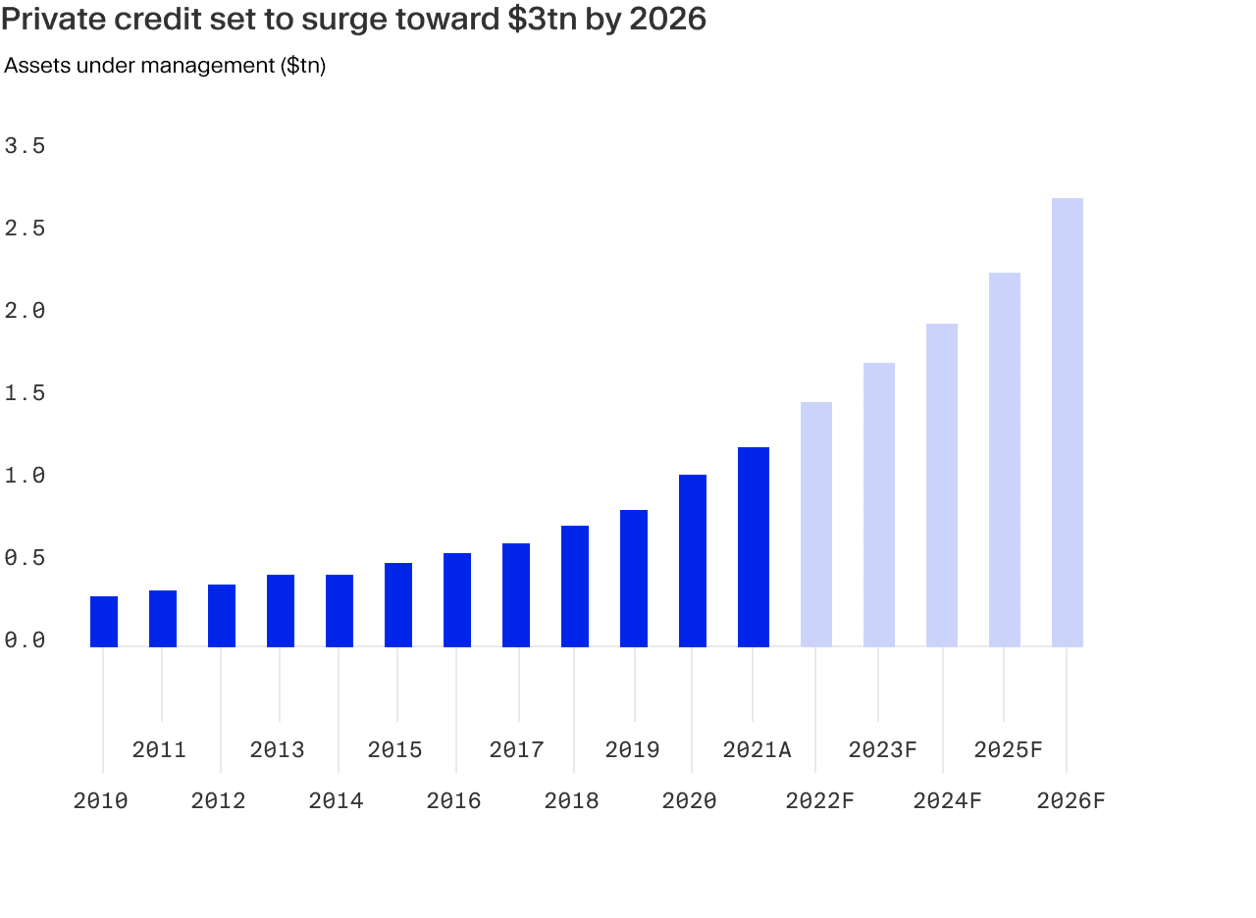

According to projections from Preqin's analytical model (see graph below), the total assets under management (AuM) within the private credit sector is anticipated to reach $2.7 trillion by 2026.¹¹ This expectation is based on an estimated compound annual growth rate (CAGR) of 17.4% over five years, a pace that exceeds the 12.8% CAGR recorded in the decade leading up to 2020.¹²

Secondaries: exposure to more mature assets, often at a discount

Private investments are relatively illiquid. They are also generally closed-end, meaning investors can’t simply redeem their money during the course of the fund's lifecycle.

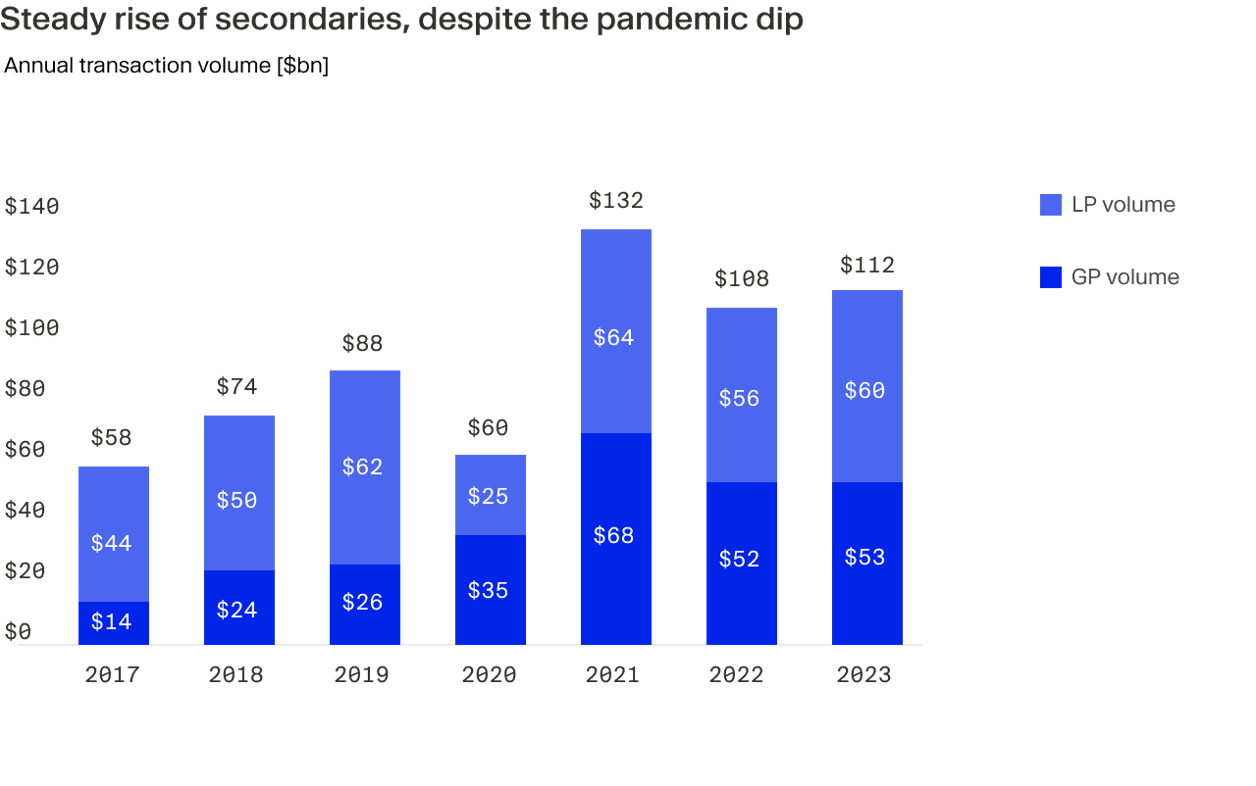

However, circumstances sometimes change, and private market investors can find themselves seeking liquidity sooner than expected. Secondaries funds emerged to address this need by acquiring investors’ active fund positions. These deals are known as LP-led because they are made directly with LPs (limited partners).

In recent years, secondaries have adapted to meet various liquidity needs. The biggest development is the rise of GP-led transactions. In these deals, secondaries funds provide follow-on capital to further the growth of portfolio companies.

This gives existing investors the option to exit the private fund or roll over into a new continuation vehicle, giving the GP (general partner) more time to create value before securing exits.

Secondaries investing also allows investors to enter mature investments at potentially discounted prices, which can mean a shorter path to liquidity than primary investments like private equity or venture capital.¹³

In addition, secondaries are generally considered lower risk than primary investments because the underlying assets are more mature and their performance can be more accurately assessed.¹⁴¹⁵ These investments typically have a investment horizon between 2 to 5 years.

Infrastructure: financing everything from essential services to energy transition

Infrastructure investing focuses on essential services and facilities like energy, transportation and utilities. Investors contribute capital to develop these assets, driving value through long-term, steady, predictable cash flows generated from fees and tolls.

Sweden-based EQT, for example, has a large infrastructure platform, and is particularly interested in clean energy transition and critical infrastructure in the medical field.¹⁶

Infrastructure investments typically have a lower risk profile because they are often essential services like waste treatment or energy supply, which makes them more resilient to inflation impacts. As a result, they can adjust tariffs in line with inflation, protecting returns to investors.

The investment horizon for infrastructure is usually long-term, and can extend to 10 years or more because of how long projects like developing renewable energy supplies, for example, can take.

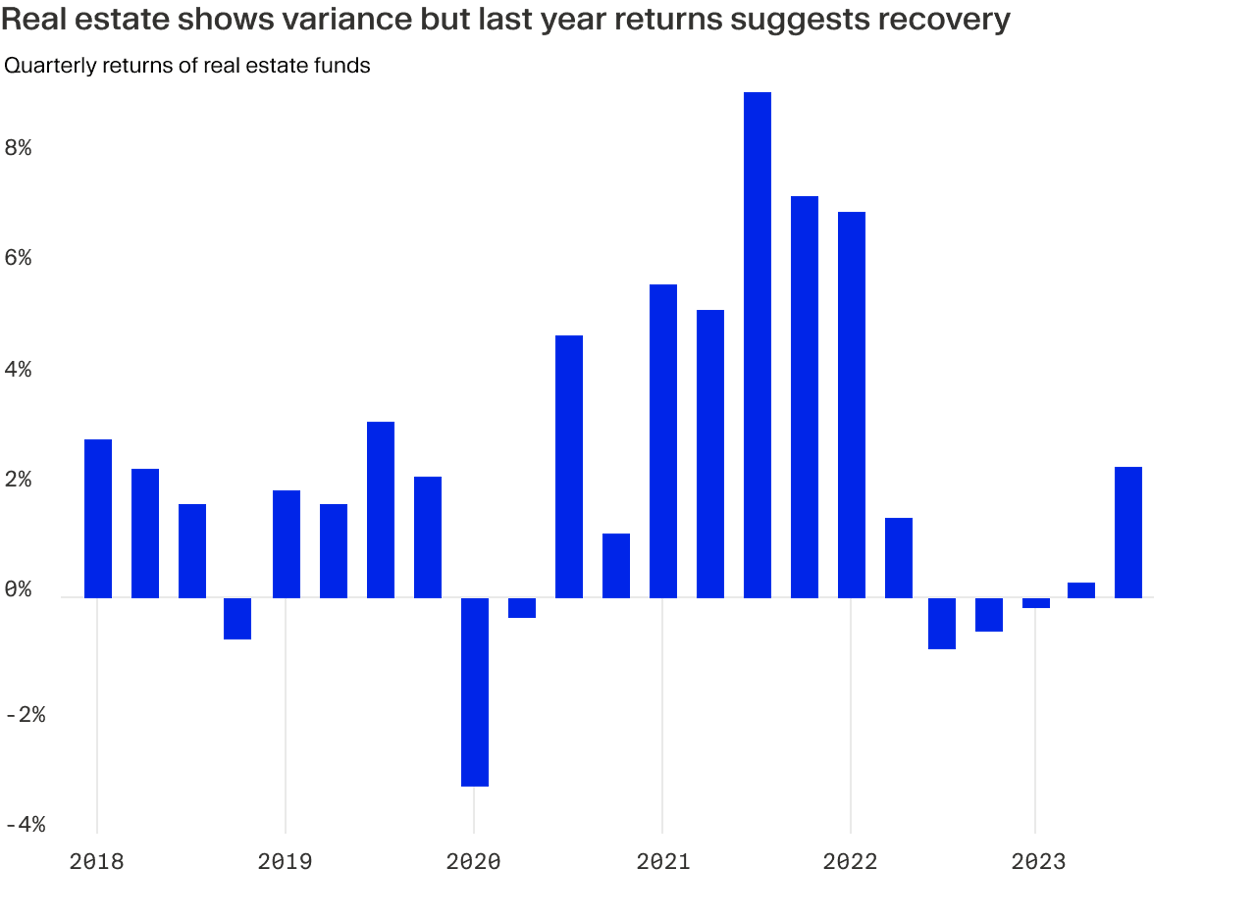

Real estate: increasing property value through active ownership

Real estate investment involves purchasing, managing and selling property to generate income and capital appreciation. It can also mean investing in funds that manage all of this on an investors behalf.

The risk in real estate varies by sector (residential, commercial, industrial) and location. Risk factors include market fluctuations, interest rate changes and specific property risks.

An example of an infrastructure fund is HL Property Fund that invests in bricks and mortar properties, focusing on commercial real estate opportunities in the UK. They will seek to increase the value of its properties through active management, such as working closely with tenants to maintain higher occupancy rates.¹⁷

Real estate investments typically have a medium to long-term horizon, ranging from 5 to 10 years or more.

Final note

We've looked at seven strategies in private markets, each with its own way of creating value, its own risk level, time commitment and potential rate of return.

Each strategy suits different investor goals and risk appetites — it's not about which is best but which best fits your needs.

¹ https://www.hamiltonlane.com/en-us/insight/truths-revealed/private-beats-public ² https://files.pitchbook.com/website/files/pdf/Q2_2023_Global_Fund_Performance.pdf ³ https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-buyout-funds-show-longest-holding-periods-in-2-decades-79033309 ⁴ https://www.wallstreetprep.com/knowledge/growth-equity-guide/ ⁵ https://www.ta.com/about/ ⁶ https://www.summitpartners.com/approach ⁷ https://www.wallstreetprep.com/knowledge/growth-equity-guide/ ⁸ https://baincapitalventures.com/ ⁹ https://www.carlyle.com/our-firm/global-credit ¹⁰ https://www.kkr.com/invest/credit ¹¹ https://www.preqin.com/data/private-debt ¹² https://www.preqin.com/data/private-debt ¹³ https://www.jefferies.com/wp-content/uploads/sites/4/2024/01/Jefferies-Global-Secondary-Market-Review-January-2024.pdf ¹⁴ https://www.bain.com/insights/have-secondaries-reached-a-tipping-point-global-private-equity-report-2024/ ¹⁵ https://www.institutionalinvestor.com/article/2bsjhx58tiizirnnelgcg/innovation/solid-opportunities-in-secondaries ¹⁶ https://eqtgroup.com/ ¹⁷ https://www.hl.co.uk/funds/fund-sectors/property